A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

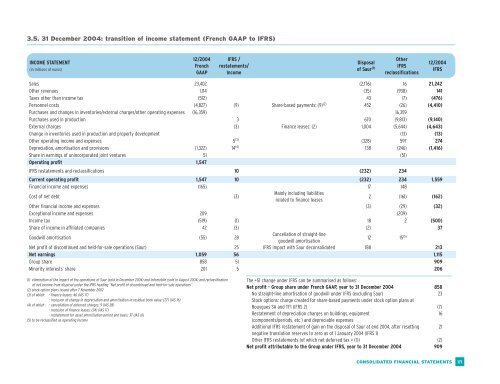

3.5. 31 December 2004: transition of income statement (French GAAP to IFRS)<br />

INCOME STATEMENT<br />

(in millions of euros)<br />

12/2004<br />

French<br />

GAAP<br />

IFRS /<br />

restatements/<br />

Income<br />

Disposal<br />

of Saur (1)<br />

Other<br />

IFRS<br />

reclassifications<br />

12/2004<br />

IFRS<br />

Sales 23,402 (2,176) 16 21,242<br />

Other revenues 1,114 (35) (938) 141<br />

Taxes other than income tax (512) 43 (7) (476)<br />

Personnel costs (4,827) (9) Share-based payments: (9) (2) 452 (26) (4,410)<br />

Purchases and changes in inventories/external charges/other operating expenses (16,359) 16,359<br />

Purchases used in production 3 670 (9,813) (9,140)<br />

External charges (3) Finance leases: (2) 1,004 (5,644) (4,643)<br />

Change in inventories used in production and property development (13) (13)<br />

Other operating income and expenses 5 (3) (328) 597 274<br />

Depreciation, amortisation and provisions (1,322) 14 (4) 138 (246) (1,416)<br />

Share in earnings of unincorporated joint ventures 51 (51)<br />

Operating profit 1,547<br />

IFRS restatements and reclassifications 10 (232) 234<br />

Current operating profit 1,547 10 (232) 234 1,559<br />

Financial income and expenses (165) 17 148<br />

Cost of net debt (3)<br />

Mainly including liabilities<br />

related to finance leases<br />

2 (161) (162)<br />

Other financial income and expenses (3) (29) (32)<br />

Exceptional income and expenses 209 (209)<br />

Income tax (519) (1) 18 2 (500)<br />

Share of income in affiliated companies 42 (3) (2) 37<br />

Goodwill amortisation (55) 28<br />

Cancellation of straight-line<br />

goodwill amortisation<br />

12 15 (5)<br />

Net profit of discontinued and held-for-sale operations (Saur) 25 IFRS impact with Saur deconsolidated 188 213<br />

Net earnings 1,059 56 1,115<br />

Group share 858 51 909<br />

Minority interests’ share 201 5 206<br />

(1) elimination of the impact of the operations of Saur (sold in December 2004) and Infomobile (sold in August 2004) and reclassification<br />

of net income from disposal under the IFRS heading “Net profit of discontinued and held-for-sale operations”.<br />

(2) stock option plans issued after 7 November 2002<br />

(3) of which: - finance leases: 40 (IAS 17)<br />

- inclusion of change in depreciation and amortisation in residual book value: (27) (IAS 16)<br />

(4) of which : - cancellation of deferred charges: 9 (IAS 38)<br />

- inclusion of finance leases: (34) (IAS 17)<br />

- restatement for asset amortisation period and basis: 37 (IAS 16)<br />

(5) to be reclassified as operating income<br />

The +51 change under IFRS can be summarised as follows:<br />

Net profit - Group share under French GAAP, year to 31 December 2004 858<br />

No straight-line amortisation of goodwill under IFRS (excluding Saur) 23<br />

Stock options: charge created for share-based payments under stock option plans at<br />

<strong>Bouygues</strong> SA and TF1 (IFRS 2) (7)<br />

Restatement of depreciation charges on buildings, equipment 16<br />

(components/periods, etc.) and depreciable expenses<br />

Additional IFRS restatement of gain on the disposal of Saur at end 2004, after resetting 21<br />

negative translation reserves to zero as of 1 January 2004 (IFRS 1)<br />

Other IFRS restatements (of which net deferred tax = (1)) (2)<br />

Net profit attributable to the Group under IFRS, year to 31 December 2004 909<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

171