A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Bouygues</strong> Telecom<br />

Tons directs<br />

Logotype BT Quadri<br />

Cyan Magenta Jaune -<br />

027_bt_logo_quadri.ai<br />

Couleurs autorisées à l'impression : 3<br />

- - - -<br />

Technique d'impression<br />

Tons à composer<br />

24/10/05<br />

Document<br />

C 100 + J 25 M 70 + J 100 C 100 + M70 -<br />

- - - -<br />

Ce fichier est un document d'exécution et non un document de gravure prêt à flasher (sauf<br />

indications contraires). La préparation technique reste à la charge du photograveur. La<br />

sortie laser papier de ce fichier ne constitue en aucun cas la cible couleur de référence à<br />

obtenir lors de l'impression. Les images intégrées au document sont des imports de<br />

placement uniquement (sauf indications contraires). L'incorporation des illustratrions et<br />

Ektas originaux ou des imports haute définition fournis sera réalisée lors de la gravure.<br />

28, rue Broca 75005 Paris France<br />

Paris Venise Design préconise le nombre et l'utilisation en tons directs ou à composer des www.interbrand.fr<br />

couleurs de ce document mais leur validation reste à la charge de l'annonceur et de ses<br />

tél +33 (0)1 40 53 85 85 fax +33 (0)1 40 53 85 84<br />

photograveurs/imprimeurs.<br />

0cm 1 2 3 4 5<br />

ION SERVICES<br />

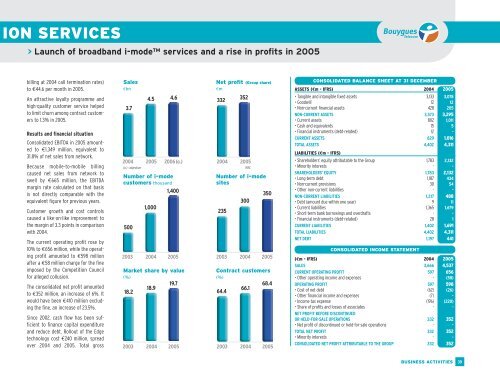

> Launch of broadband i-mode services and a rise in profits in 2005<br />

billing at 2004 call termination rates)<br />

to €44.6 per month in 2005.<br />

An attractive loyalty programme and<br />

high-quality customer service helped<br />

to limit churn among contract customers<br />

to 1.3% in 2005.<br />

Results and financial situation<br />

Consolidated EBITDA in 2005 amounted<br />

to €1,349 million, equivalent to<br />

31.8% of net sales from network.<br />

Because mobile-to-mobile billing<br />

caused net sales from network to<br />

swell by €665 million, the EBITDA<br />

margin rate calculated on that basis<br />

is not directly comparable with the<br />

equivalent figure for previous years.<br />

Customer growth and cost controls<br />

caused a like-on-like improvement to<br />

the margin of 3.3 points in comparison<br />

with 2004.<br />

The current operating profit rose by<br />

10% to €656 million, while the operating<br />

profit amounted to €598 million<br />

after a €58 million charge for the fine<br />

imposed by the Competition Council<br />

for alleged collusion.<br />

The consolidated net profit amounted<br />

to €352 million, an increase of 6%. It<br />

would have been €410 million excluding<br />

the fine, an increase of 23.5%.<br />

Since 2002, cash flow has been sufficient<br />

to finance capital expenditure<br />

and reduce debt. Rollout of the Edge<br />

technology cost €240 million, spread<br />

over 2004 and 2005. Total gross<br />

Sales<br />

€bn<br />

3.7<br />

4.5 4.6<br />

Number of i-mode<br />

customers thousand<br />

1,400<br />

Net profit (Group share)<br />

€m<br />

332<br />

352<br />

2004 2005 2006 (o.) 2004 2005<br />

(o.) : objective<br />

500<br />

1,000<br />

Number of i-mode<br />

sites<br />

235<br />

2003 2004 2005 2003 2004 2005<br />

Market share by value<br />

(%)<br />

19.7<br />

18.9<br />

18.2<br />

300<br />

350<br />

Contract customers<br />

(%)<br />

68.4<br />

66.1<br />

64.4<br />

2003 2004 2005 2003 2004 2005<br />

IFRS<br />

CONSOLIDATED BALANCE SHEET AT 31 DECEMBER<br />

ASSETS (€m - IFRS) 2004 2005<br />

Interbrand ParisVenise<br />

• Tangible and intangible fixed assets 3,133 3,078<br />

• Goodwill 12 12<br />

• Non-current financial assets 428 205<br />

NON-CURRENT ASSETS 3,573 3,295<br />

• Current assets 802 1,011<br />

• Cash and equivalents 15 5<br />

• Financial instruments (debt-related) 12 -<br />

CURRENT ASSETS 829 1,016<br />

TOTAL ASSETS 4,402 4,311<br />

LIABILITIES (€m - IFRS)<br />

• Shareholders’ equity attributable to the Group 1,783 2,132<br />

• Minority interests - -<br />

SHAREHOLDERS’ EQUITY 1,783 2,132<br />

• Long-term debt 1,187 434<br />

• Non-current provisions 30 54<br />

• Other non-current liabilities - -<br />

NON-CURRENT LIABILITIES 1,217 488<br />

• Debt (amount due within one year) 9 11<br />

• Current liabilities 1,365 1,679<br />

• Short-term bank borrowings and overdrafts - -<br />

• Financial instruments (debt-related) 28 1<br />

CURRENT LIABILITIES 1,402 1,691<br />

TOTAL LIABILITIES 4,402 4,311<br />

NET DEBT 1,197 441<br />

CONSOLIDATED INCOME STATEMENT<br />

(€m - IFRS) 2004 2005<br />

SALES 3,666 4,537<br />

CURRENT OPERATING PROFIT 597 656<br />

• Other operating income and expenses - (58)<br />

OPERATING PROFIT 597 598<br />

• Cost of net debt (62) (26)<br />

• Other financial income and expenses (7) -<br />

• Income tax expense (196) (220)<br />

• Share of profits and losses of associates - -<br />

NET PROFIT BEFORE DISCONTINUED<br />

OR HELD-FOR-SALE OPERATIONS 332 352<br />

• Net profit of discontinued or held-for-sale operations - -<br />

TOTAL NET PROFIT 332 352<br />

• Minority interests - -<br />

CONSOLIDATED NET PROFIT ATTRIBUTABLE TO THE GROUP 332 352<br />

BUSINESS ACTIVITIES<br />

39