A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

A N N U A L R E P O R T - Bouygues

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

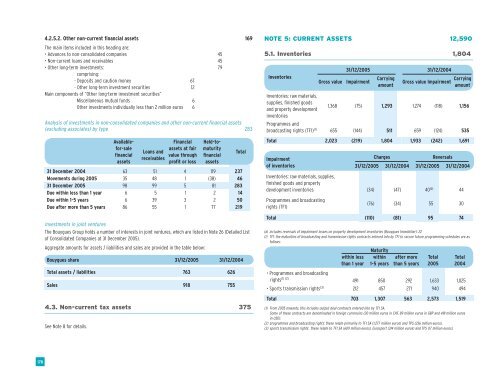

4.2.5.2. Other non-current financial assets 169<br />

The main items included in this heading are:<br />

• Advances to non-consolidated companies 45<br />

• Non-current loans and receivables 45<br />

• Other long-term investments: 79<br />

comprising:<br />

- Deposits and caution money 67<br />

- Other long-term investment securities 12<br />

Main components of “Other long-term investment securities”<br />

Miscellaneous mutual funds 6<br />

Other investments individually less than 2 million euros 6<br />

Analysis of investments in non-consolidated companies and other non-current financial assets<br />

(excluding associates) by type 283<br />

Availablefor-sale<br />

financial<br />

assets<br />

Loans and<br />

receivables<br />

Financial<br />

assets at fair<br />

value through<br />

profit or loss<br />

Held-tomaturity<br />

financial<br />

assets<br />

31 December 2004 63 51 4 119 237<br />

Movements during 2005 35 48 1 (38) 46<br />

31 December 2005 98 99 5 81 283<br />

Due within less than 1 year 6 5 1 2 14<br />

Due within 1-5 years 6 39 3 2 50<br />

Due after more than 5 years 86 55 1 77 219<br />

Investments in joint ventures<br />

The <strong>Bouygues</strong> Group holds a number of interests in joint ventures, which are listed in Note 26 (Detailed List<br />

of Consolidated Companies at 31 December 2005).<br />

Aggregate amounts for assets / liabilities and sales are provided in the table below:<br />

<strong>Bouygues</strong> share 31/12/2005 31/12/2004<br />

Total assets / liabilities 763 626<br />

Sales 918 755<br />

4.3. Non-current tax assets 375<br />

See Note 8 for details.<br />

Total<br />

NOTE 5: CURRENT ASSETS 12,590<br />

5.1. Inventories 1,804<br />

Inventories<br />

Inventories: raw materials,<br />

supplies, finished goods<br />

and property development<br />

inventories<br />

Gross value<br />

31/12/2005 31/12/2004<br />

Impairment<br />

Carrying<br />

amount<br />

Gross value Impairment Carrying<br />

amount<br />

1,368 (75) 1,293 1,274 (118) 1,156<br />

Programmes and<br />

broadcasting rights (TF1) (1) 655 (144) 511 659 (124) 535<br />

Total 2,023 (219) 1,804 1,933 (242) 1,691<br />

Impairment<br />

of inventories<br />

(a) includes reversals of impairment losses on property development inventories (<strong>Bouygues</strong> Immobilier): 22<br />

(1) TF1: the maturities of broadcasting and transmission rights contracts entered into by TF1 to secure future programming schedules are as<br />

follows:<br />

within less<br />

than 1 year<br />

Charges<br />

Maturity<br />

within<br />

1-5 years<br />

after more<br />

than 5 years<br />

Reversals<br />

31/12/2005 31/12/2004 31/12/2005 31/12/2004<br />

Inventories: raw materials, supplies,<br />

finished goods and property<br />

development inventories (34) (47) 40 (a) 44<br />

Programmes and broadcasting<br />

rights (TF1)<br />

(76) (34) 55 30<br />

Total (110) (81) 95 74<br />

Total<br />

2005<br />

Total<br />

2004<br />

• Programmes and broadcasting<br />

rights (1) (2) 491 850 292 1,633 1,025<br />

• Sports transmission rights (3) 212 457 271 940 494<br />

Total 703 1,307 563 2,573 1,519<br />

(1) From 2005 onwards, this includes output deal contracts entered into by TF1 SA.<br />

Some of these contracts are denominated in foreign currencies (30 million euros in CHF, 89 million euros in GBP and 418 million euros<br />

in USD).<br />

(2) programmes and broadcasting rights: these relate primarily to TF1 SA (1,277 million euros) and TPS (236 million euros).<br />

(3) sports transmission rights: these relate to TF1 SA (609 million euros), Eurosport (314 million euros) and TPS (17 million euros).<br />

178