- Page 1 and 2:

G U I D E T OCRAF TINGTHEPR0FESSION

- Page 3 and 4:

Introduction Chapter 3CRAFTING samp

- Page 5 and 6:

DEFINITION:A resume is a career mar

- Page 7 and 8:

Chapter 1WELCOME sample TOTHE CRAFT

- Page 9 and 10:

LIGHTBULB MOMENT:It’s our goal th

- Page 11 and 12:

WHO NEEDS A RESUME?Everyone. Beyond

- Page 13 and 14:

As you’ll read in later chapters

- Page 15 and 16:

should be the backbone and not the

- Page 17 and 18:

Consider adding resume sections lik

- Page 19 and 20:

WHAT DO PROFESSIONAL RESUME WRITERS

- Page 21 and 22:

Chapter 2sampleSTRATEGY TOOLSFOR TH

- Page 23 and 24:

To help you understand the critical

- Page 25:

evaluating one candidate versus ano

- Page 29 and 30:

Job Information(Repeat this section

- Page 31 and 32:

#2: WRITE TO THE FUTUREYour resume

- Page 33 and 34:

Cell: 309.555.7281KATE JORDANkatejo

- Page 35 and 36:

Cell: 309.555.7281KATE JORDANkatejo

- Page 37 and 38:

#4: THINK STRATEGICALLY ABOUT THE W

- Page 39 and 40:

Now consider the situation of the t

- Page 41 and 42:

If you’re a mid-career profession

- Page 43 and 44:

#8: ADDRESS THE UNIQUE CIRCUMSTANCE

- Page 45 and 46:

The sample resumes in chapters 6 th

- Page 47 and 48:

Chapter 3sampleFORMATTING THEPROFES

- Page 49 and 50:

Format Tool #5Start with a Career S

- Page 51 and 52:

If you live in the location in whic

- Page 53 and 54:

more. It is the format of choice fo

- Page 55 and 56:

Select the categories that coincide

- Page 57 and 58:

DONALD KATZ 2749 Topanga Drive,

- Page 59 and 60:

#4: USE A FUNCTIONAL RESUME FORMAT

- Page 61 and 62:

Celia Navarro 4390 Wells Road, Atla

- Page 63 and 64:

esume and to your employment experi

- Page 65 and 66:

instantly catch your attention. The

- Page 67 and 68:

#6: FOLLOW YOUR SUMMARY WITH YOUR C

- Page 69 and 70:

LIGHTBULB MOMENT:Give your readers

- Page 71 and 72:

Exceptions might include:• You ju

- Page 73 and 74:

Welcome to the heart and soul of th

- Page 75 and 76:

You could say that an education sec

- Page 77 and 78:

On the following few pages is a lis

- Page 79 and 80:

DriveEducateEffectElevateEliminateE

- Page 81 and 82:

PerformPilotPinpointPlanPositionPre

- Page 83 and 84:

#3: PUT RELEVANT INFORMATIONFRONT A

- Page 85 and 86:

Resume Version #1: High-Profile Fie

- Page 87 and 88:

Read the difference in impact of th

- Page 89 and 90:

Dig deep into your performance to c

- Page 91 and 92:

• Academic & Training Credentials

- Page 93 and 94:

eferred to as a “summary,” the

- Page 95 and 96:

Read #6 in this chapter for a more

- Page 97 and 98:

Overview ParagraphOften a title or

- Page 99 and 100:

Career HighlightsDo you want to mak

- Page 101 and 102:

Today’s job search landscape is r

- Page 103 and 104:

Once you’ve written your branding

- Page 105 and 106:

Here’s another copy of that same

- Page 107 and 108:

Here’s a great example:SENIOR VIC

- Page 109 and 110:

#11: SIMPLIFY, STREAMLINE &TIGHTEN

- Page 111 and 112:

4. Polish, finalize, and let it go.

- Page 113 and 114:

Have you ever seen a resume that lo

- Page 115 and 116:

#1: MAKE YOUR RESUME INVITING TO RE

- Page 117 and 118:

#2: CHOOSE THE RIGHT FONTFont selec

- Page 119 and 120:

LIGHTBULB MOMENT:Follow TheLadders

- Page 121 and 122:

As you work on your resume design,

- Page 123 and 124:

The plain round bullet is the defau

- Page 125 and 126:

Thomas P. Putnam7943 Winding Way 51

- Page 127 and 128:

Review the sample resumes in chapte

- Page 129 and 130:

space! When you’re trying to comf

- Page 131 and 132:

Here are step-by-step directions fo

- Page 133 and 134:

CYNTHIA ROWLEY89 East 83rd Street,

- Page 135 and 136:

Bar Admissions:New York, Southern D

- Page 137 and 138:

Chapter 6FINANCELADDER:sampleRESUME

- Page 139 and 140:

• When you can’t reveal specifi

- Page 141 and 142:

250 KEYWORDS FORFINANCE RESUMESWhil

- Page 143 and 144: Economic ModelingEconomic PolicyEco

- Page 145 and 146: MacroeconomicsMake/Buy AnalysisMana

- Page 147 and 148: FINANCELADDER:SAMPLE RESUMESOn the

- Page 149 and 150: Midori Fukuoka2939 Lake Mary Drive,

- Page 151 and 152: NEIL RAGHAVAN, CIA, CPA, CA (INDIA)

- Page 153 and 154: ADAM BERG, CFE513 Muir Drive, Carro

- Page 155 and 156: Mary P. Davenport29 Winding Way, Ri

- Page 157 and 158: ROBERT MATTHEWS29 Maple Terrace, We

- Page 159 and 160: Chapter 7HRLADDER: sampleRESUME SAM

- Page 161 and 162: 1. Make the most of metrics. When y

- Page 163 and 164: Behavioral InterviewBenefits Admini

- Page 165 and 166: Human CapitalHuman FactorsHuman Res

- Page 167 and 168: Policies & ProceduresPosition Class

- Page 169 and 170: while the strong content blends job

- Page 171 and 172: Daniel HellmanLearning & Developmen

- Page 173 and 174: TRINA L. MOLINARI513-555-5555 6062

- Page 175 and 176: PATRICIA TAYLOR - PAGE 2 06-

- Page 177 and 178: MELISSA SANDLER, SPHRPage TwoMANPOW

- Page 179 and 180: PROFESSIONAL EXPERIENCE APEX COMP

- Page 181 and 182: LAW:IT’S ALL ABOUT EXPERTISE AND

- Page 183 and 184: 5. Leverage your relationships. Thr

- Page 185 and 186: CourtCourtroom HearingCourtroom Pro

- Page 187 and 188: Legal DocumentationLegal Instrument

- Page 189 and 190: Transactions LawTrialTrial LawTrust

- Page 191 and 192: Donald Mann: Law Firm Managing Part

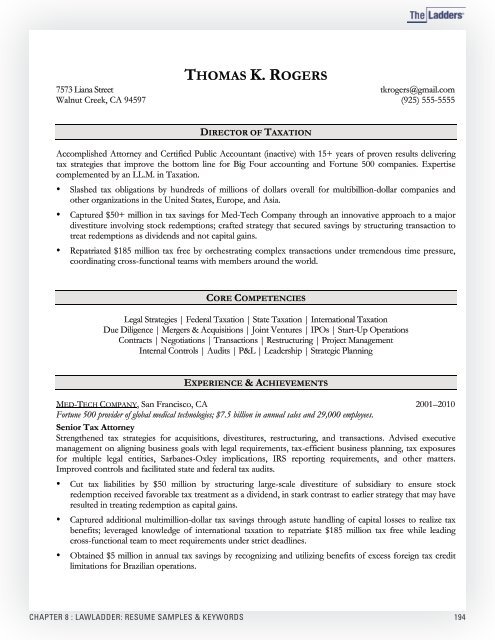

- Page 193: Ellen Reilly, Esq. Phone: (631)

- Page 197 and 198: RACHEL SPEARS, ESQ. - PAGE TWOM: 51

- Page 199 and 200: 732.555.5555 MARK P. WINFIELD ¥ PA

- Page 201 and 202: DONALD MANN JR.630.555.1012 ¥ mann

- Page 203 and 204: MARKETING:IT’S ALL ABOUT IDENTIFY

- Page 205 and 206: and media to web-based platforms an

- Page 207 and 208: Customer FeedbackCustomer Focus Gro

- Page 209 and 210: Marketing ManagementMarketing Plan

- Page 211 and 212: Strategic RelationshipManagementSur

- Page 213 and 214: Luisa Valdez: Chief Marketing Offic

- Page 215 and 216: CHRISTINE WONG - PAGE TWO555-5555 |

- Page 217 and 218: CARL DAVIDSON PAGE TWO(212) 555-12

- Page 219 and 220: LUIS TAVARES • Page 2 of 2

- Page 221 and 222: Debra Axminster ¥ Page Two310.555.

- Page 223 and 224: § Achieved 23% increase in linear-

- Page 225 and 226: OPERATIONS:IT’S ALL ABOUT PERFORM

- Page 227 and 228: 4. Paint the big picture. Particula

- Page 229 and 230: E-CommerceEarnings Before Interest

- Page 231 and 232: MentorMergerMetricsMulti-ChannelMul

- Page 233 and 234: StrategySystems DesignSystems Devel

- Page 235 and 236: Richard Lee: Senior Operations Exec

- Page 237 and 238: ALLEN RICHMOND § Page 2 allen.rich

- Page 239 and 240: EVELYN LANDTedLand@sc.rr.comPage 2

- Page 241 and 242: Samuel Phipps ¥ Page TwoCell: 813.

- Page 243 and 244: RICHARD W. LEE — Page 2 of 2 ¥ (

- Page 245 and 246:

Brianna H. Jensen Cell: (862) 555-5

- Page 247 and 248:

SALES:IT’S ALL ABOUT CAPTURING CL

- Page 249 and 250:

250 KEYWORDS FORSALES RESUMESWhile

- Page 251 and 252:

Distributor SalesDistrict SalesDist

- Page 253 and 254:

Product LicensingProduct LifecycleP

- Page 255 and 256:

SALESLADDER:SAMPLE RESUMESOn the fo

- Page 257 and 258:

Carlos Rodriguez1 Leon Drive ♦ We

- Page 259 and 260:

DONALD MYERS745 Aztec Ave. Austin,

- Page 261 and 262:

Winona Majors6807 Hardy Drive ¥ Pi

- Page 263 and 264:

Mark HedbergCharlotte, NC mhedberg@

- Page 265 and 266:

Phaedra Markopolisphaedra@gmail.com

- Page 267 and 268:

Chapter 12TECHNOLOGYLADDER:sampleRE

- Page 269 and 270:

leadership, and business accomplish

- Page 271 and 272:

Budget ManagementBudgetingCamera-Ba

- Page 273 and 274:

Human-Computer InterfaceImageImage

- Page 275 and 276:

Real-Time DataReal-Time Motion Capt

- Page 277 and 278:

proficiencies positioned at the end

- Page 279 and 280:

SANDRA JONES sjones@gmail.com •

- Page 281 and 282:

► Wade Shaw570-555-5555 ► wshaw

- Page 283 and 284:

Valerie Michaelsvmichaels@gmail.com

- Page 285 and 286:

Richard Sanchez10958 Viejo Street,

- Page 287 and 288:

JANELLE THOMPKINSjthompkins@gmail.c

- Page 289 and 290:

Chapter 13sample USING THEPROFESSIO

- Page 291 and 292:

#1: UPDATE YOUR RESUME EVERY SIX MO

- Page 293 and 294:

If you have important new informati

- Page 295 and 296:

strategically about how to position

- Page 297 and 298:

as they relate to specific skill ar

- Page 299 and 300:

#5: BUILD SKILLS FOR THE FUTUREJob

- Page 301 and 302:

THELADDERS RESUME WRITERSEvery resu