Michelle Beck - Palomar College

Michelle Beck - Palomar College

Michelle Beck - Palomar College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

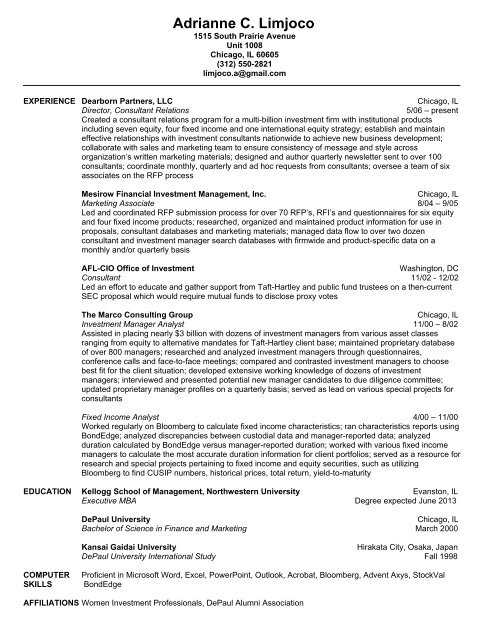

Adrianne C. Limjoco<br />

1515 South Prairie Avenue<br />

Unit 1008<br />

Chicago, IL 60605<br />

(312) 550-2821<br />

limjoco.a@gmail.com<br />

EXPERIENCE Dearborn Partners, LLC Chicago, IL<br />

Director, Consultant Relations 5/06 – present<br />

Created a consultant relations program for a multi-billion investment firm with institutional products<br />

including seven equity, four fixed income and one international equity strategy; establish and maintain<br />

effective relationships with investment consultants nationwide to achieve new business development;<br />

collaborate with sales and marketing team to ensure consistency of message and style across<br />

organization’s written marketing materials; designed and author quarterly newsletter sent to over 100<br />

consultants; coordinate monthly, quarterly and ad hoc requests from consultants; oversee a team of six<br />

associates on the RFP process<br />

Mesirow Financial Investment Management, Inc. Chicago, IL<br />

Marketing Associate 8/04 – 9/05<br />

Led and coordinated RFP submission process for over 70 RFP’s, RFI’s and questionnaires for six equity<br />

and four fixed income products; researched, organized and maintained product information for use in<br />

proposals, consultant databases and marketing materials; managed data flow to over two dozen<br />

consultant and investment manager search databases with firmwide and product-specific data on a<br />

monthly and/or quarterly basis<br />

AFL-CIO Office of Investment Washington, DC<br />

Consultant 11/02 - 12/02<br />

Led an effort to educate and gather support from Taft-Hartley and public fund trustees on a then-current<br />

SEC proposal which would require mutual funds to disclose proxy votes<br />

The Marco Consulting Group Chicago, IL<br />

Investment Manager Analyst 11/00 – 8/02<br />

Assisted in placing nearly $3 billion with dozens of investment managers from various asset classes<br />

ranging from equity to alternative mandates for Taft-Hartley client base; maintained proprietary database<br />

of over 800 managers; researched and analyzed investment managers through questionnaires,<br />

conference calls and face-to-face meetings; compared and contrasted investment managers to choose<br />

best fit for the client situation; developed extensive working knowledge of dozens of investment<br />

managers; interviewed and presented potential new manager candidates to due diligence committee;<br />

updated proprietary manager profiles on a quarterly basis; served as lead on various special projects for<br />

consultants<br />

Fixed Income Analyst 4/00 – 11/00<br />

Worked regularly on Bloomberg to calculate fixed income characteristics; ran characteristics reports using<br />

BondEdge; analyzed discrepancies between custodial data and manager-reported data; analyzed<br />

duration calculated by BondEdge versus manager-reported duration; worked with various fixed income<br />

managers to calculate the most accurate duration information for client portfolios; served as a resource for<br />

research and special projects pertaining to fixed income and equity securities, such as utilizing<br />

Bloomberg to find CUSIP numbers, historical prices, total return, yield-to-maturity<br />

EDUCATION Kellogg School of Management, Northwestern University Evanston, IL<br />

Executive MBA Degree expected June 2013<br />

DePaul University Chicago, IL<br />

Bachelor of Science in Finance and Marketing March 2000<br />

Kansai Gaidai University Hirakata City, Osaka, Japan<br />

DePaul University International Study Fall 1998<br />

COMPUTER Proficient in Microsoft Word, Excel, PowerPoint, Outlook, Acrobat, Bloomberg, Advent Axys, StockVal<br />

SKILLS BondEdge<br />

AFFILIATIONS Women Investment Professionals, DePaul Alumni Association