Michelle Beck - Palomar College

Michelle Beck - Palomar College

Michelle Beck - Palomar College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

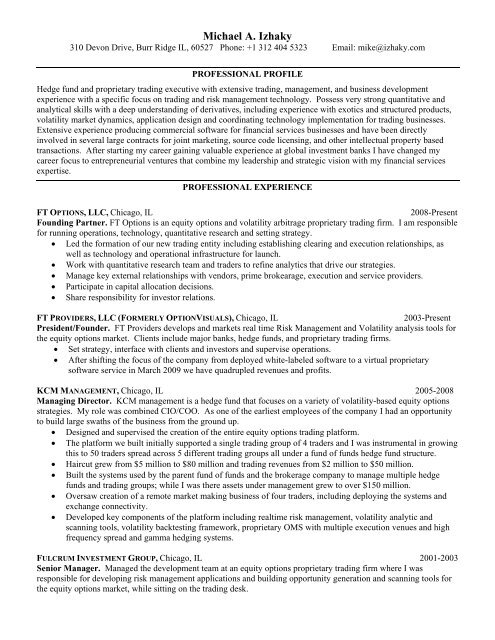

Michael A. Izhaky<br />

310 Devon Drive, Burr Ridge IL, 60527 Phone: +1 312 404 5323 Email: mike@izhaky.com<br />

PROFESSIONAL PROFILE<br />

Hedge fund and proprietary trading executive with extensive trading, management, and business development<br />

experience with a specific focus on trading and risk management technology. Possess very strong quantitative and<br />

analytical skills with a deep understanding of derivatives, including experience with exotics and structured products,<br />

volatility market dynamics, application design and coordinating technology implementation for trading businesses.<br />

Extensive experience producing commercial software for financial services businesses and have been directly<br />

involved in several large contracts for joint marketing, source code licensing, and other intellectual property based<br />

transactions. After starting my career gaining valuable experience at global investment banks I have changed my<br />

career focus to entrepreneurial ventures that combine my leadership and strategic vision with my financial services<br />

expertise.<br />

PROFESSIONAL EXPERIENCE<br />

FT OPTIONS, LLC, Chicago, IL 2008-Present<br />

Founding Partner. FT Options is an equity options and volatility arbitrage proprietary trading firm. I am responsible<br />

for running operations, technology, quantitative research and setting strategy.<br />

• Led the formation of our new trading entity including establishing clearing and execution relationships, as<br />

well as technology and operational infrastructure for launch.<br />

• Work with quantitative research team and traders to refine analytics that drive our strategies.<br />

• Manage key external relationships with vendors, prime brokearage, execution and service providers.<br />

• Participate in capital allocation decisions.<br />

• Share responsibility for investor relations.<br />

FT PROVIDERS, LLC (FORMERLY OPTIONVISUALS), Chicago, IL 2003-Present<br />

President/Founder. FT Providers develops and markets real time Risk Management and Volatility analysis tools for<br />

the equity options market. Clients include major banks, hedge funds, and proprietary trading firms.<br />

• Set strategy, interface with clients and investors and supervise operations.<br />

• After shifting the focus of the company from deployed white-labeled software to a virtual proprietary<br />

software service in March 2009 we have quadrupled revenues and profits.<br />

KCM MANAGEMENT, Chicago, IL 2005-2008<br />

Managing Director. KCM management is a hedge fund that focuses on a variety of volatility-based equity options<br />

strategies. My role was combined CIO/COO. As one of the earliest employees of the company I had an opportunity<br />

to build large swaths of the business from the ground up.<br />

• Designed and supervised the creation of the entire equity options trading platform.<br />

• The platform we built initially supported a single trading group of 4 traders and I was instrumental in growing<br />

this to 50 traders spread across 5 different trading groups all under a fund of funds hedge fund structure.<br />

• Haircut grew from $5 million to $80 million and trading revenues from $2 million to $50 million.<br />

• Built the systems used by the parent fund of funds and the brokerage company to manage multiple hedge<br />

funds and trading groups; while I was there assets under management grew to over $150 million.<br />

• Oversaw creation of a remote market making business of four traders, including deploying the systems and<br />

exchange connectivity.<br />

• Developed key components of the platform including realtime risk management, volatility analytic and<br />

scanning tools, volatility backtesting framework, proprietary OMS with multiple execution venues and high<br />

frequency spread and gamma hedging systems.<br />

FULCRUM INVESTMENT GROUP, Chicago, IL 2001-2003<br />

Senior Manager. Managed the development team at an equity options proprietary trading firm where I was<br />

responsible for developing risk management applications and building opportunity generation and scanning tools for<br />

the equity options market, while sitting on the trading desk.