Michelle Beck - Palomar College

Michelle Beck - Palomar College

Michelle Beck - Palomar College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

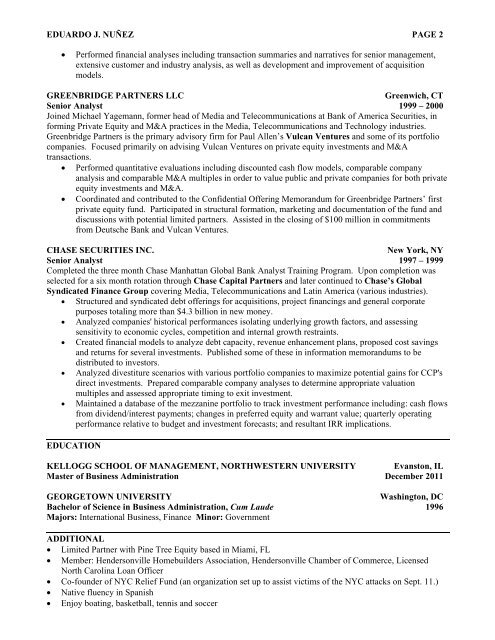

EDUARDO J. NUÑEZ PAGE 2<br />

• Performed financial analyses including transaction summaries and narratives for senior management,<br />

extensive customer and industry analysis, as well as development and improvement of acquisition<br />

models.<br />

GREENBRIDGE PARTNERS LLC Greenwich, CT<br />

Senior Analyst 1999 – 2000<br />

Joined Michael Yagemann, former head of Media and Telecommunications at Bank of America Securities, in<br />

forming Private Equity and M&A practices in the Media, Telecommunications and Technology industries.<br />

Greenbridge Partners is the primary advisory firm for Paul Allen’s Vulcan Ventures and some of its portfolio<br />

companies. Focused primarily on advising Vulcan Ventures on private equity investments and M&A<br />

transactions.<br />

• Performed quantitative evaluations including discounted cash flow models, comparable company<br />

analysis and comparable M&A multiples in order to value public and private companies for both private<br />

equity investments and M&A.<br />

• Coordinated and contributed to the Confidential Offering Memorandum for Greenbridge Partners’ first<br />

private equity fund. Participated in structural formation, marketing and documentation of the fund and<br />

discussions with potential limited partners. Assisted in the closing of $100 million in commitments<br />

from Deutsche Bank and Vulcan Ventures.<br />

CHASE SECURITIES INC. New York, NY<br />

Senior Analyst 1997 – 1999<br />

Completed the three month Chase Manhattan Global Bank Analyst Training Program. Upon completion was<br />

selected for a six month rotation through Chase Capital Partners and later continued to Chase’s Global<br />

Syndicated Finance Group covering Media, Telecommunications and Latin America (various industries).<br />

• Structured and syndicated debt offerings for acquisitions, project financings and general corporate<br />

purposes totaling more than $4.3 billion in new money.<br />

• Analyzed companies' historical performances isolating underlying growth factors, and assessing<br />

sensitivity to economic cycles, competition and internal growth restraints.<br />

• Created financial models to analyze debt capacity, revenue enhancement plans, proposed cost savings<br />

and returns for several investments. Published some of these in information memorandums to be<br />

distributed to investors.<br />

• Analyzed divestiture scenarios with various portfolio companies to maximize potential gains for CCP's<br />

direct investments. Prepared comparable company analyses to determine appropriate valuation<br />

multiples and assessed appropriate timing to exit investment.<br />

• Maintained a database of the mezzanine portfolio to track investment performance including: cash flows<br />

from dividend/interest payments; changes in preferred equity and warrant value; quarterly operating<br />

performance relative to budget and investment forecasts; and resultant IRR implications.<br />

EDUCATION<br />

KELLOGG SCHOOL OF MANAGEMENT, NORTHWESTERN UNIVERSITY Evanston, IL<br />

Master of Business Administration December 2011<br />

GEORGETOWN UNIVERSITY Washington, DC<br />

Bachelor of Science in Business Administration, Cum Laude 1996<br />

Majors: International Business, Finance Minor: Government<br />

ADDITIONAL<br />

• Limited Partner with Pine Tree Equity based in Miami, FL<br />

• Member: Hendersonville Homebuilders Association, Hendersonville Chamber of Commerce, Licensed<br />

North Carolina Loan Officer<br />

• Co-founder of NYC Relief Fund (an organization set up to assist victims of the NYC attacks on Sept. 11.)<br />

• Native fluency in Spanish<br />

• Enjoy boating, basketball, tennis and soccer