Michelle Beck - Palomar College

Michelle Beck - Palomar College

Michelle Beck - Palomar College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

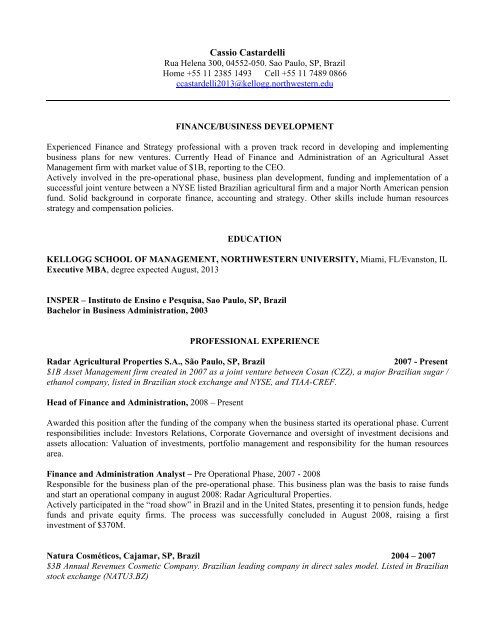

Cassio Castardelli<br />

Rua Helena 300, 04552-050. Sao Paulo, SP, Brazil<br />

Home +55 11 2385 1493 Cell +55 11 7489 0866<br />

ccastardelli2013@kellogg.northwestern.edu<br />

FINANCE/BUSINESS DEVELOPMENT<br />

Experienced Finance and Strategy professional with a proven track record in developing and implementing<br />

business plans for new ventures. Currently Head of Finance and Administration of an Agricultural Asset<br />

Management firm with market value of $1B, reporting to the CEO.<br />

Actively involved in the pre-operational phase, business plan development, funding and implementation of a<br />

successful joint venture between a NYSE listed Brazilian agricultural firm and a major North American pension<br />

fund. Solid background in corporate finance, accounting and strategy. Other skills include human resources<br />

strategy and compensation policies.<br />

EDUCATION<br />

KELLOGG SCHOOL OF MANAGEMENT, NORTHWESTERN UNIVERSITY, Miami, FL/Evanston, IL<br />

Executive MBA, degree expected August, 2013<br />

INSPER – Instituto de Ensino e Pesquisa, Sao Paulo, SP, Brazil<br />

Bachelor in Business Administration, 2003<br />

PROFESSIONAL EXPERIENCE<br />

Radar Agricultural Properties S.A., São Paulo, SP, Brazil 2007 - Present<br />

$1B Asset Management firm created in 2007 as a joint venture between Cosan (CZZ), a major Brazilian sugar /<br />

ethanol company, listed in Brazilian stock exchange and NYSE, and TIAA-CREF.<br />

Head of Finance and Administration, 2008 – Present<br />

Awarded this position after the funding of the company when the business started its operational phase. Current<br />

responsibilities include: Investors Relations, Corporate Governance and oversight of investment decisions and<br />

assets allocation: Valuation of investments, portfolio management and responsibility for the human resources<br />

area.<br />

Finance and Administration Analyst – Pre Operational Phase, 2007 - 2008<br />

Responsible for the business plan of the pre-operational phase. This business plan was the basis to raise funds<br />

and start an operational company in august 2008: Radar Agricultural Properties.<br />

Actively participated in the “road show” in Brazil and in the United States, presenting it to pension funds, hedge<br />

funds and private equity firms. The process was successfully concluded in August 2008, raising a first<br />

investment of $370M.<br />

Natura Cosméticos, Cajamar, SP, Brazil 2004 – 2007<br />

$3B Annual Revenues Cosmetic Company. Brazilian leading company in direct sales model. Listed in Brazilian<br />

stock exchange (NATU3.BZ)