Michelle Beck - Palomar College

Michelle Beck - Palomar College

Michelle Beck - Palomar College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

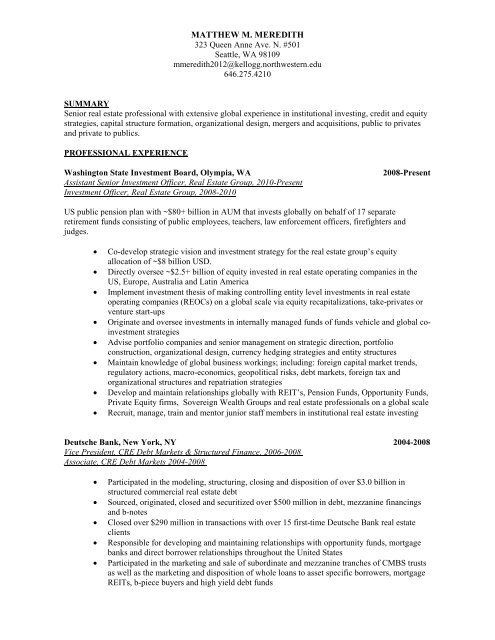

MATTHEW M. MEREDITH<br />

323 Queen Anne Ave. N. #501<br />

Seattle, WA 98109<br />

mmeredith2012@kellogg.northwestern.edu<br />

646.275.4210<br />

SUMMARY<br />

Senior real estate professional with extensive global experience in institutional investing, credit and equity<br />

strategies, capital structure formation, organizational design, mergers and acquisitions, public to privates<br />

and private to publics.<br />

PROFESSIONAL EXPERIENCE<br />

Washington State Investment Board, Olympia, WA 2008-Present<br />

Assistant Senior Investment Officer, Real Estate Group, 2010-Present<br />

Investment Officer, Real Estate Group, 2008-2010<br />

US public pension plan with ~$80+ billion in AUM that invests globally on behalf of 17 separate<br />

retirement funds consisting of public employees, teachers, law enforcement officers, firefighters and<br />

judges.<br />

• Co-develop strategic vision and investment strategy for the real estate group’s equity<br />

allocation of ~$8 billion USD.<br />

• Directly oversee ~$2.5+ billion of equity invested in real estate operating companies in the<br />

US, Europe, Australia and Latin America<br />

• Implement investment thesis of making controlling entity level investments in real estate<br />

operating companies (REOCs) on a global scale via equity recapitalizations, take-privates or<br />

venture start-ups<br />

• Originate and oversee investments in internally managed funds of funds vehicle and global coinvestment<br />

strategies<br />

• Advise portfolio companies and senior management on strategic direction, portfolio<br />

construction, organizational design, currency hedging strategies and entity structures<br />

• Maintain knowledge of global business workings; including: foreign capital market trends,<br />

regulatory actions, macro-economics, geopolitical risks, debt markets, foreign tax and<br />

organizational structures and repatriation strategies<br />

• Develop and maintain relationships globally with REIT’s, Pension Funds, Opportunity Funds,<br />

Private Equity firms, Sovereign Wealth Groups and real estate professionals on a global scale<br />

• Recruit, manage, train and mentor junior staff members in institutional real estate investing<br />

Deutsche Bank, New York, NY 2004-2008<br />

Vice President, CRE Debt Markets & Structured Finance, 2006-2008<br />

Associate, CRE Debt Markets 2004-2008<br />

• Participated in the modeling, structuring, closing and disposition of over $3.0 billion in<br />

structured commercial real estate debt<br />

• Sourced, originated, closed and securitized over $500 million in debt, mezzanine financings<br />

and b-notes<br />

• Closed over $290 million in transactions with over 15 first-time Deutsche Bank real estate<br />

clients<br />

• Responsible for developing and maintaining relationships with opportunity funds, mortgage<br />

banks and direct borrower relationships throughout the United States<br />

• Participated in the marketing and sale of subordinate and mezzanine tranches of CMBS trusts<br />

as well as the marketing and disposition of whole loans to asset specific borrowers, mortgage<br />

REITs, b-piece buyers and high yield debt funds