Michelle Beck - Palomar College

Michelle Beck - Palomar College

Michelle Beck - Palomar College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SUMMARY<br />

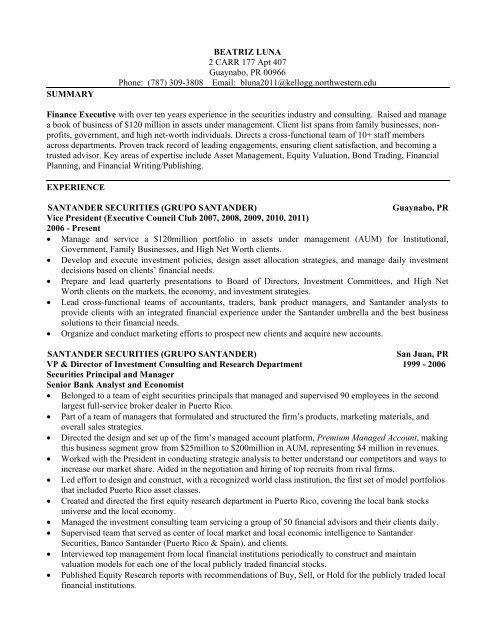

BEATRIZ LUNA<br />

2 CARR 177 Apt 407<br />

Guaynabo, PR 00966<br />

Phone: (787) 309-3808 Email: bluna2011@kellogg.northwestern.edu<br />

Finance Executive with over ten years experience in the securities industry and consulting. Raised and manage<br />

a book of business of $120 million in assets under management. Client list spans from family businesses, nonprofits,<br />

government, and high net-worth individuals. Directs a cross-functional team of 10+ staff members<br />

across departments. Proven track record of leading engagements, ensuring client satisfaction, and becoming a<br />

trusted advisor. Key areas of expertise include Asset Management, Equity Valuation, Bond Trading, Financial<br />

Planning, and Financial Writing/Publishing.<br />

EXPERIENCE<br />

SANTANDER SECURITIES (GRUPO SANTANDER) Guaynabo, PR<br />

Vice President (Executive Council Club 2007, 2008, 2009, 2010, 2011)<br />

2006 - Present<br />

• Manage and service a $120million portfolio in assets under management (AUM) for Institutional,<br />

Government, Family Businesses, and High Net Worth clients.<br />

• Develop and execute investment policies, design asset allocation strategies, and manage daily investment<br />

decisions based on clients’ financial needs.<br />

• Prepare and lead quarterly presentations to Board of Directors, Investment Committees, and High Net<br />

Worth clients on the markets, the economy, and investment strategies.<br />

• Lead cross-functional teams of accountants, traders, bank product managers, and Santander analysts to<br />

provide clients with an integrated financial experience under the Santander umbrella and the best business<br />

solutions to their financial needs.<br />

• Organize and conduct marketing efforts to prospect new clients and acquire new accounts.<br />

SANTANDER SECURITIES (GRUPO SANTANDER) San Juan, PR<br />

VP & Director of Investment Consulting and Research Department 1999 - 2006<br />

Securities Principal and Manager<br />

Senior Bank Analyst and Economist<br />

• Belonged to a team of eight securities principals that managed and supervised 90 employees in the second<br />

largest full-service broker dealer in Puerto Rico.<br />

• Part of a team of managers that formulated and structured the firm’s products, marketing materials, and<br />

overall sales strategies.<br />

• Directed the design and set up of the firm’s managed account platform, Premium Managed Account, making<br />

this business segment grow from $25million to $200million in AUM, representing $4 million in revenues.<br />

• Worked with the President in conducting strategic analysis to better understand our competitors and ways to<br />

increase our market share. Aided in the negotiation and hiring of top recruits from rival firms.<br />

• Led effort to design and construct, with a recognized world class institution, the first set of model portfolios<br />

that included Puerto Rico asset classes.<br />

• Created and directed the first equity research department in Puerto Rico, covering the local bank stocks<br />

universe and the local economy.<br />

• Managed the investment consulting team servicing a group of 50 financial advisors and their clients daily.<br />

• Supervised team that served as center of local market and local economic intelligence to Santander<br />

Securities, Banco Santander (Puerto Rico & Spain), and clients.<br />

• Interviewed top management from local financial institutions periodically to construct and maintain<br />

valuation models for each one of the local publicly traded financial stocks.<br />

• Published Equity Research reports with recommendations of Buy, Sell, or Hold for the publicly traded local<br />

financial institutions.