- Page 1 and 2: 2011-2013 Building Futures Since 18

- Page 3 and 4: Accreditation Cazenovia College is

- Page 5 and 6: Contact Information Mailing Address

- Page 7 and 8: About Cazenovia College History Caz

- Page 9 and 10: also include electronic sharing of

- Page 11 and 12: Student Development and Services Fa

- Page 13 and 14: Fitness and Wellness Center The Fit

- Page 15 and 16: Student Leadership and Engagement P

- Page 17 and 18: Admissions Choosing the right colle

- Page 19 and 20: Transfer students may benefit from

- Page 21 and 22: Jefferson Community College Bachelo

- Page 23 and 24: 2. Provide all appropriate academic

- Page 25 and 26: Support for the Cazenovia College f

- Page 27 and 28: Any returning student who wishes to

- Page 29 and 30: If a student does not complete the

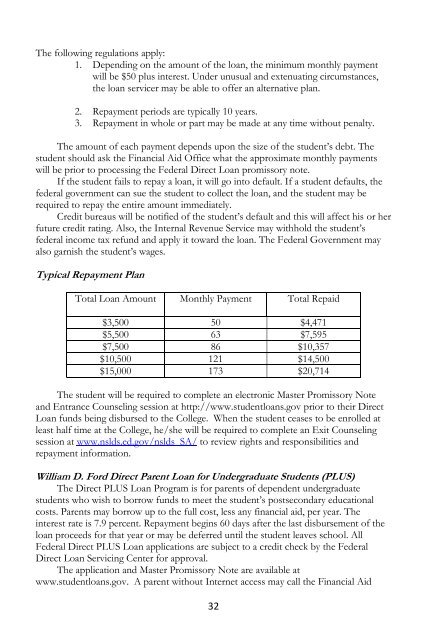

- Page 31: Application is made by filing a spe

- Page 35 and 36: Student Responsibilities and Rights

- Page 37 and 38: Cazenovia College Auxiliary Scholar

- Page 39 and 40: Counseling and Mental Health Progra

- Page 41 and 42: Elsbeth W. and Charles B. Morgan Sc

- Page 43 and 44: Katharine and Charles Sigety Award:

- Page 45 and 46: Financial Services As part of the E

- Page 47 and 48: Blue Meal Plan - $4,800.00 Includes

- Page 49 and 50: Medical insurance coverage is manda

- Page 51 and 52: 50

- Page 53 and 54: Cazenovia College also participates

- Page 55 and 56: the registrar and the director of t

- Page 57 and 58: Study Abroad Cazenovia College has

- Page 59 and 60: Students who expect to complete a b

- Page 61 and 62: of the Registrar. If the student fa

- Page 63 and 64: credits. If a full-time student is

- Page 65 and 66: for excessive absence; and students

- Page 67 and 68: Students are inducted to Psi Chi in

- Page 69 and 70: Change in Major A student may chang

- Page 71 and 72: approval, in writing, from the vice

- Page 73 and 74: Written Communication: To produce w

- Page 75 and 76: EN 342 Studies in Children‘s Lite

- Page 77 and 78: Academic Program Summary Inventory

- Page 79 and 80: Associate in Science Business Manag

- Page 81 and 82: Business Bachelor of Science The Ba

- Page 83 and 84:

Communication Studies Bachelor of A

- Page 85 and 86:

Criminal Justice and Homeland Secur

- Page 87 and 88:

English Bachelor of Arts The Englis

- Page 89 and 90:

Environmental Studies: Environmenta

- Page 91 and 92:

Fashion Design Bachelor of Fine Art

- Page 93 and 94:

Human Services: Alcohol/Substance A

- Page 95 and 96:

Human Services: Children and Youth

- Page 97 and 98:

Human Services: Counseling and Ment

- Page 99 and 100:

Human Services: Generalist concentr

- Page 101 and 102:

Inclusive Early Childhood Education

- Page 103 and 104:

ED 181 Teaching Practicum I (60 hrs

- Page 105 and 106:

Examinations in order to be recomme

- Page 107 and 108:

Interior Design Bachelor of Fine Ar

- Page 109 and 110:

International Studies Bachelor of A

- Page 111 and 112:

Liberal Studies Bachelor of Arts Th

- Page 113 and 114:

Liberal Studies Bachelor of Science

- Page 115 and 116:

Management: Accounting concentratio

- Page 117 and 118:

Management: Business Management con

- Page 119 and 120:

Management: Equine Business Managem

- Page 121 and 122:

EQ 220 Equine Nutrition (4) EQ 321

- Page 123 and 124:

PROGRAM COURSES Art & Sciences Cour

- Page 125 and 126:

BU ___ Electives (3) HC 110 Introdu

- Page 127 and 128:

BU 110 Principles of Management (3)

- Page 129 and 130:

SB 323 Abnormal Psychology (3) SB 3

- Page 131 and 132:

HG 358 History of Mexico SB 329 Wom

- Page 133 and 134:

Two of the following ten courses in

- Page 135 and 136:

TOTAL GENERAL EDUCATION CREDITS - 3

- Page 137 and 138:

SA 162 Photography II (3) SA 168 Ti

- Page 139 and 140:

GENERAL EDUCATION COURSES Courses (

- Page 141 and 142:

Visual Communications: Graphic Desi

- Page 143 and 144:

ELECTIVES Open Electives Courses (C

- Page 145 and 146:

studio labs. GENERAL EDUCATION COUR

- Page 147 and 148:

Visual Communications: Web and Inte

- Page 149 and 150:

ELECTIVES Open Electives Courses (C

- Page 151 and 152:

widely acknowledged by local indust

- Page 153 and 154:

Certificate Programs Equine Reprodu

- Page 155 and 156:

Minors Minors are an excellent opti

- Page 157 and 158:

VC 221 VC 375 History of Visual Com

- Page 159 and 160:

Choice of one of the courses listed

- Page 161 and 162:

BU 205 Consumer Awareness BU 348 Ma

- Page 163 and 164:

CM 410 CM 420 EN 312 Advocacy and P

- Page 165 and 166:

Minor in Sport Studies In an effort

- Page 167 and 168:

FA 473 FA 485 EN 216 EN 3/4 Researc

- Page 169 and 170:

Accounting AC 110 Fundamentals of A

- Page 171 and 172:

Business BU 105 American Business 3

- Page 173 and 174:

establishing customer satisfaction.

- Page 175 and 176:

BU 353 Internet and Other Business

- Page 177 and 178:

BU 473 Business Research Methods 3

- Page 179 and 180:

and state laws. Prerequisite: CJ 15

- Page 181 and 182:

findings to an audience comprised o

- Page 183 and 184:

private worlds. Students will revie

- Page 185 and 186:

CM 481 Communication Internship 3 c

- Page 187 and 188:

ED 320 Emergent Literacy 3 credits

- Page 189 and 190:

technological and content area lite

- Page 191 and 192:

narratives, students will examine r

- Page 193 and 194:

EN 216 Shakespeare and His Rivals 3

- Page 195 and 196:

works and the culture that produced

- Page 197 and 198:

part of each student‘s skills ass

- Page 199 and 200:

to 1 credit hour. (Offered every se

- Page 201 and 202:

exposure to all phases of breeding

- Page 203 and 204:

multi-faceted nature of the theatre

- Page 205 and 206:

junior year, Studio Art and Photogr

- Page 207 and 208:

Fashion Design/Merchandising FD des

- Page 209 and 210:

asic programs. Students will use bo

- Page 211 and 212:

The internship provides an opportun

- Page 213 and 214:

student fashion show. Students will

- Page 215 and 216:

monetary and fiscal policy, and the

- Page 217 and 218:

HG 261 Comparative Political Ideolo

- Page 219 and 220:

Human Services HS 110 Introduction

- Page 221 and 222:

management, family work, community

- Page 223 and 224:

HS 475 Program Planning and Evaluat

- Page 225 and 226:

HU 365 Ethics 3 credits (AS) Studen

- Page 227 and 228:

use AutoCAD as a design and present

- Page 229 and 230:

projects emphasize creative problem

- Page 231 and 232:

own and to learn about the similari

- Page 233 and 234:

SA 131 Design and Color Theory 3 cr

- Page 235 and 236:

site and materials. The course inve

- Page 237 and 238:

trial. The methodologies used to te

- Page 239 and 240:

Student must pass with a "C" or bet

- Page 241 and 242:

delinquency, crime, criminal justic

- Page 243 and 244:

machine interactions and effective

- Page 245 and 246:

instrumental conditioning, stimulus

- Page 247 and 248:

SB 234 Social Psychology, and HU 36

- Page 249 and 250:

to the operations and properties of

- Page 251 and 252:

digestive, integumentary, special s

- Page 253 and 254:

attempt to address and resolve thes

- Page 255 and 256:

devoted to individual research and

- Page 257 and 258:

and are a fundamental keystone of t

- Page 259 and 260:

covered, including legal issues, co

- Page 261 and 262:

VC 484 Visual Communications Intern

- Page 264 and 265:

Board of Trustees 2011-2012 Officer

- Page 266 and 267:

Administration and Staff (year of i

- Page 268 and 269:

Sarah Diederich, B.S. Executive Adm

- Page 270 and 271:

Todd H. Spangler, Ph.D. Director of

- Page 272 and 273:

Christine A. Geyer Assistant Profes

- Page 274 and 275:

Laurie G. Selleck Professor, Visual

- Page 276 and 277:

Faculty Emeriti John Aistars Profes

- Page 278 and 279:

Index Academic Advisers ...........

- Page 280 and 281:

Applying for New Students .........

- Page 282:

Fitness and Wellness Center .......

- Page 285 and 286:

284

- Page 287 and 288:

Academic Calendar 2012-2013 July 7

- Page 289 and 290:

288