2003-2005 - Special Collections - University of Baltimore

2003-2005 - Special Collections - University of Baltimore

2003-2005 - Special Collections - University of Baltimore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

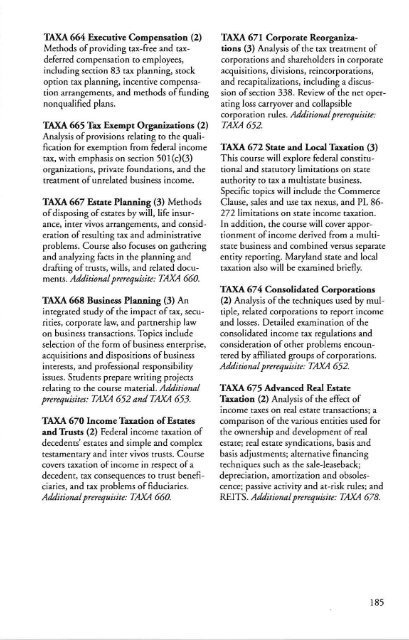

TAXA 664 Executive Compensation (2)<br />

Methods <strong>of</strong> providing tax-free and taxdeferred<br />

compensation to employees,<br />

including section 83 tax planning, stock<br />

option tax planning, incentive compensation<br />

arrangements, and methods <strong>of</strong> funding<br />

nonqualified plans.<br />

TAXA 665 Tax Exempt Organizations (2)<br />

Analysis <strong>of</strong> provisions relating to the qualification<br />

for exemption from federal income<br />

tax, with emphasis on section 501 (c)(3)<br />

organizations, private foundations, and the<br />

treatment <strong>of</strong> unrelated business income.<br />

TAXA 667 Estate Planning (3) Methods<br />

<strong>of</strong>disposing <strong>of</strong> estates by will, life insurance,<br />

inter vivos arrangements, and consideration<br />

<strong>of</strong> resulting tax and administrative<br />

problems. Course also focuses on gathering<br />

and analyzing facts in the planning and<br />

draning <strong>of</strong> trusts, wills, and related documents.<br />

Additionalprerequisite: TAXA 660.<br />

TAXA 668 Business Planning (3) An<br />

integrated study <strong>of</strong> the impact <strong>of</strong> tax, securities,<br />

corporate law, and partnership law<br />

on business transactions. Topics include<br />

selection <strong>of</strong> the form <strong>of</strong> business enterprise,<br />

acquisitions and dispositions <strong>of</strong> business<br />

interests, and pr<strong>of</strong>essional responsibility<br />

issues. Students prepare writing projects<br />

relating to the course material. Additional<br />

prerequisites: TAXA 652 and TAXA 653.<br />

TAXA 670 Income Taxation <strong>of</strong>Estates<br />

and Trusts (2) Federal income taxation <strong>of</strong><br />

decedents' estates and simple and complex<br />

testamentary and inter vivos trusts. Course<br />

covers taxation <strong>of</strong> income in respect <strong>of</strong> a<br />

decedent, tax consequences ro trust beneficiaries,<br />

and tax problems <strong>of</strong> fiduciaries.<br />

Additionalprerequisite: TAXA 660.<br />

TAXA 671 Corporate Reorganizations<br />

(3) Analysis <strong>of</strong> the tax treatment <strong>of</strong><br />

corporations and shareholders in corporate<br />

acquisitions, divisions, reincorporations,<br />

and recapitalizations, including a discussion<br />

<strong>of</strong>section 338. Review <strong>of</strong> the net operating<br />

loss carryover and collapsible<br />

corporation rules. Additionalprerequisite:<br />

TAXA 652.<br />

TAXA 672 State and Local Taxation (3)<br />

This course will explore federal constitutional<br />

and statutory limitations on state<br />

authority to tax a mulristate business.<br />

Specific topics will include the Commerce<br />

Clause, sales and use tax nexus, and PL 86<br />

272 limitations on state income taxation.<br />

In addition, the course will cover apportionment<br />

<strong>of</strong> income derived from a multistate<br />

business and combined versus separate<br />

entity reporting. Maryland state and local<br />

taxation also will be examined briefly.<br />

TAXA 674 Consolidated Corporations<br />

(2) Analysis <strong>of</strong> the techniques used by multiple,<br />

related corporations to report income<br />

and losses. Detailed examination <strong>of</strong> the<br />

consolidated income tax regulations and<br />

consideration <strong>of</strong> other problems encountered<br />

by affiliated groups <strong>of</strong>corporations.<br />

Additionalprerequisite: TAXA 652.<br />

TAXA 675 Advanced Real Estate<br />

Taxation (2) Analysis <strong>of</strong> the effect <strong>of</strong><br />

income taxes on real estate transactions; a<br />

comparison <strong>of</strong> the various entities used for<br />

the ownership and development <strong>of</strong> real<br />

estate; real estate syndications, basis and<br />

basis adjustments; alternative financing<br />

techniques such as the sale-leaseback;<br />

depreciation, amortization and obsolescence;<br />

passive activity and at-risk rules; and<br />

REITS. Additionalprerequisite: TAXA 678.<br />

185