beyond pt 0 23/1

beyond pt 0 23/1

beyond pt 0 23/1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

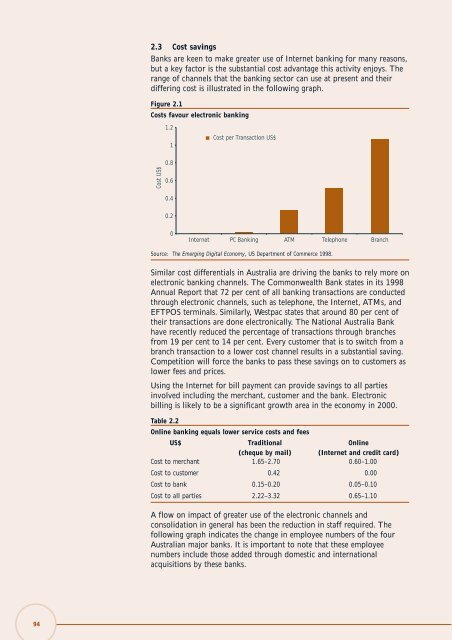

2.3 Cost savings<br />

Banks are keen to make greater use of Internet banking for many reasons,<br />

but a key factor is the substantial cost advantage this activity enjoys. The<br />

range of channels that the banking sector can use at present and their<br />

differing cost is illustrated in the following graph.<br />

Figure 2.1<br />

Costs favour electronic banking<br />

1.2<br />

1<br />

Cost per Transaction US$<br />

Cost US$<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0<br />

Internet PC Banking ATM Telephone Branch<br />

Source: The Emerging Digital Economy, US Department of Commerce 1998.<br />

Similar cost differentials in Australia are driving the banks to rely more on<br />

electronic banking channels. The Commonwealth Bank states in its 1998<br />

Annual Report that 72 per cent of all banking transactions are conducted<br />

through electronic channels, such as telephone, the Internet, ATMs, and<br />

EFTPOS terminals. Similarly, Westpac states that around 80 per cent of<br />

their transactions are done electronically. The National Australia Bank<br />

have recently reduced the percentage of transactions through branches<br />

from 19 per cent to 14 per cent. Every customer that is to switch from a<br />

branch transaction to a lower cost channel results in a substantial saving.<br />

Competition will force the banks to pass these savings on to customers as<br />

lower fees and prices.<br />

Using the Internet for bill payment can provide savings to all parties<br />

involved including the merchant, customer and the bank. Electronic<br />

billing is likely to be a significant growth area in the economy in 2000.<br />

Table 2.2<br />

Online banking equals lower service costs and fees<br />

US$ Traditional Online<br />

(cheque by mail) (Internet and credit card)<br />

Cost to merchant 1.65–2.70 0.60–1.00<br />

Cost to customer 0.42 0.00<br />

Cost to bank 0.15–0.20 0.05–0.10<br />

Cost to all parties 2.22–3.32 0.65–1.10<br />

A flow on impact of greater use of the electronic channels and<br />

consolidation in general has been the reduction in staff required. The<br />

following graph indicates the change in employee numbers of the four<br />

Australian major banks. It is important to note that these employee<br />

numbers include those added through domestic and international<br />

acquisitions by these banks.<br />

94