beyond pt 0 23/1

beyond pt 0 23/1

beyond pt 0 23/1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

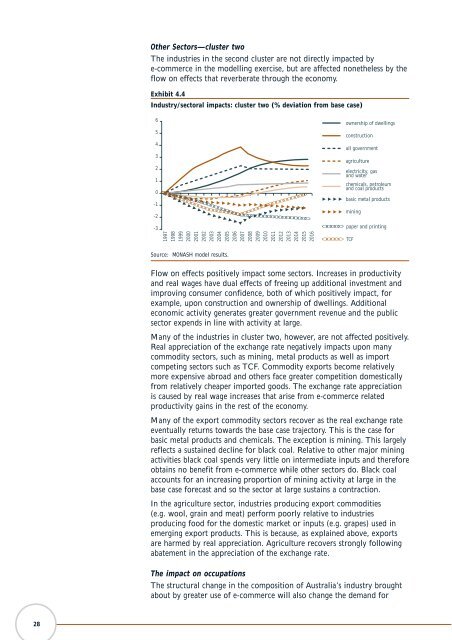

Other Sectors—cluster two<br />

The industries in the second cluster are not directly impacted by<br />

e-commerce in the modelling exercise, but are affected nonetheless by the<br />

flow on effects that reverberate through the economy.<br />

Exhibit 4.4<br />

Industry/sectoral impacts: cluster two (% deviation from base case)<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

ownership of dwellings<br />

construction<br />

all government<br />

agriculture<br />

electricity, gas<br />

and water<br />

chemicals, petroleum<br />

and coal products<br />

basic metal products<br />

mining<br />

-3<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

paper and printing<br />

TCF<br />

Source: MONASH model results.<br />

Flow on effects positively impact some sectors. Increases in productivity<br />

and real wages have dual effects of freeing up additional investment and<br />

improving consumer confidence, both of which positively impact, for<br />

example, upon construction and ownership of dwellings. Additional<br />

economic activity generates greater government revenue and the public<br />

sector expends in line with activity at large.<br />

Many of the industries in cluster two, however, are not affected positively.<br />

Real appreciation of the exchange rate negatively impacts upon many<br />

commodity sectors, such as mining, metal products as well as import<br />

competing sectors such as TCF. Commodity exports become relatively<br />

more expensive abroad and others face greater competition domestically<br />

from relatively cheaper imported goods. The exchange rate appreciation<br />

is caused by real wage increases that arise from e-commerce related<br />

productivity gains in the rest of the economy.<br />

Many of the export commodity sectors recover as the real exchange rate<br />

eventually returns towards the base case trajectory. This is the case for<br />

basic metal products and chemicals. The exce<strong>pt</strong>ion is mining. This largely<br />

reflects a sustained decline for black coal. Relative to other major mining<br />

activities black coal spends very little on intermediate inputs and therefore<br />

obtains no benefit from e-commerce while other sectors do. Black coal<br />

accounts for an increasing proportion of mining activity at large in the<br />

base case forecast and so the sector at large sustains a contraction.<br />

In the agriculture sector, industries producing export commodities<br />

(e.g. wool, grain and meat) perform poorly relative to industries<br />

producing food for the domestic market or inputs (e.g. grapes) used in<br />

emerging export products. This is because, as explained above, exports<br />

are harmed by real appreciation. Agriculture recovers strongly following<br />

abatement in the appreciation of the exchange rate.<br />

The impact on occupations<br />

The structural change in the composition of Australia’s industry brought<br />

about by greater use of e-commerce will also change the demand for<br />

28