beyond pt 0 23/1

beyond pt 0 23/1

beyond pt 0 23/1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Appendix C<br />

MONASH base case forecasts<br />

This Appendix explains the detailed assum<strong>pt</strong>ions that underpin the base<br />

case forecasts. That is, the view of the economy as it would be without<br />

greater use of e-commerce.<br />

C.1 MONASH methodology<br />

As indicated in Exhibit C.1, the model incorporates the views of specialist<br />

organisations into the base case simulation. For this study the modellers<br />

have used:<br />

• Macroeconomic forecasts from the Treasury and Access Economics. <strong>23</strong><br />

• Forecasts for the quantities and prices of agricultural and mineral<br />

exports from the Australian Bureau of Agricultural and Resource<br />

Economics (ABARE), 24 and forecasts of inbound tourism numbers<br />

from the Tourism Forecasting Council (TFC). 25<br />

• Forecasts of changes in industry production technologies (i.e., in inputoutput<br />

coefficients) and in household preferences from the Centre of<br />

Policy Studies (CoPS).<br />

• Results from Dixon and Rimmer (1999) 26 on the effects of the GST.<br />

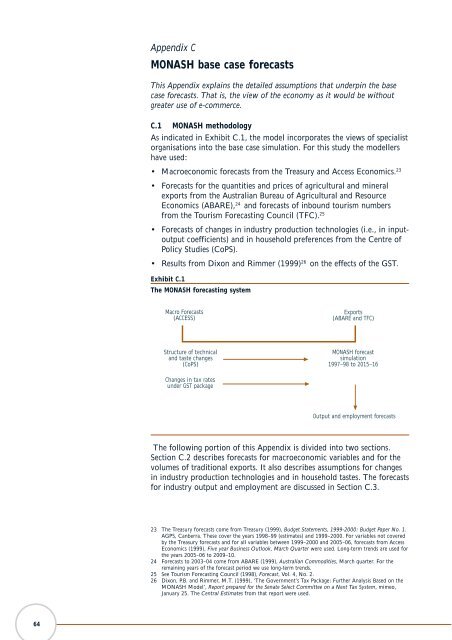

Exhibit C.1<br />

The MONASH forecasting system<br />

Macro Forecasts<br />

(ACCESS)<br />

Exports<br />

(ABARE and TFC)<br />

Structure of technical<br />

and taste changes<br />

(CoPS)<br />

MONASH forecast<br />

simulation<br />

1997–98 to 2015–16<br />

Changes in tax rates<br />

under GST package<br />

Output and employment forecasts<br />

The following portion of this Appendix is divided into two sections.<br />

Section C.2 describes forecasts for macroeconomic variables and for the<br />

volumes of traditional exports. It also describes assum<strong>pt</strong>ions for changes<br />

in industry production technologies and in household tastes. The forecasts<br />

for industry output and employment are discussed in Section C.3.<br />

<strong>23</strong> The Treasury forecasts come from Treasury (1999), Budget Statements, 1999-2000: Budget Paper No. 1.<br />

AGPS, Canberra. These cover the years 1998–99 (estimates) and 1999–2000. For variables not covered<br />

by the Treasury forecasts and for all variables between 1999–2000 and 2005–06, forecasts from Access<br />

Economics (1999), Five year Business Outlook, March Quarter were used. Long-term trends are used for<br />

the years 2005–06 to 2009–10.<br />

24 Forecasts to 2003–04 come from ABARE (1999), Australian Commodities, March quarter. For the<br />

remaining years of the forecast period we use long-term trends.<br />

25 See Tourism Forecasting Council (1998), Forecast, Vol. 4, No. 2.<br />

26 Dixon, P.B. and Rimmer, M.T. (1999), ‘The Government’s Tax Package: Further Analysis Based on the<br />

MONASH Model’, Report prepared for the Senate Select Committee on a Next Tax System, mimeo,<br />

January 25. The Central Estimates from that report were used.<br />

64