Shopper's Stop Limited - Securities and Exchange Board of India

Shopper's Stop Limited - Securities and Exchange Board of India

Shopper's Stop Limited - Securities and Exchange Board of India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

13. After this issue, the price <strong>of</strong> our Equity Shares may be highly volatile, or an active<br />

trading market for our Equity Shares may not develop<br />

There is no st<strong>and</strong>ard valuation methodology in the retail sector with few listed players in<br />

<strong>India</strong>. There has been no public market for our Equity Shares <strong>and</strong> the prices <strong>of</strong> our Equity<br />

Shares may fluctuate after the issue. There can be no assurance that an active trading<br />

market for our Equity Shares will develop or be sustained after the issue, or that the prices<br />

at which our Equity Shares are initially <strong>of</strong>fered will correspond to the prices at which the<br />

Equity Shares will trade in the market subsequent to this Issue. The valuations in the retail<br />

industry are presently high <strong>and</strong> may not be sustained in future <strong>and</strong> may also not be<br />

reflective <strong>of</strong> the future valuations <strong>of</strong> the industry<br />

Notes:<br />

� Public issue <strong>of</strong> Equity Shares comprising <strong>of</strong> fresh issue <strong>of</strong> 6,946,033 Equity Shares <strong>of</strong><br />

Rs.10/- each at a price <strong>of</strong> Rs. [ ] for cash aggregating Rs. million.( including Net Offer to<br />

the Public <strong>of</strong> 5,555,556 shares)<br />

� The shareholders, at the EGM held on March 31, 2004 approved sub-division <strong>of</strong> Equity<br />

Shares <strong>of</strong> Rs.10/- each into two Equity Shares <strong>of</strong> Rs. 5/- each. Subsequently, shareholders,<br />

at the AGM held on July 30, 2004, approved the consolidation <strong>of</strong> two Equity Shares <strong>of</strong><br />

Rs.5/- each into 1 Equity Share <strong>of</strong> Rs. 10/- each.<br />

� The Book Value per Equity Share <strong>of</strong> Rs. 10/- each was Rs.24.85 <strong>and</strong> Rs 28.70 as at March<br />

31, 2003 <strong>and</strong> March 31, 2004 respectively as per our restated unconsolidated financial<br />

statements under <strong>India</strong>n GAAP.<br />

� The networth <strong>of</strong> our Company was Rs.646 Million <strong>and</strong> Rs.775 Million as on March 31, 2003<br />

<strong>and</strong> March 31, 2004 respectively as per our restated unconsolidated financial statements<br />

under <strong>India</strong>n GAAP.<br />

� Investors are advised to refer to the paragraph on “Basis <strong>of</strong> Issue Price” on page 225 <strong>of</strong> this<br />

draft Red Herring Prospectus.<br />

� Investors may note that in case <strong>of</strong> over-subscription in the Issue, allotment shall be on<br />

proportionate basis to Retail Individual Bidders <strong>and</strong> Non-Institutional Bidders. Please refer<br />

to the paragraph on “Basis <strong>of</strong> Allotment” on page 318 <strong>of</strong> this draft Red Herring Prospectus.<br />

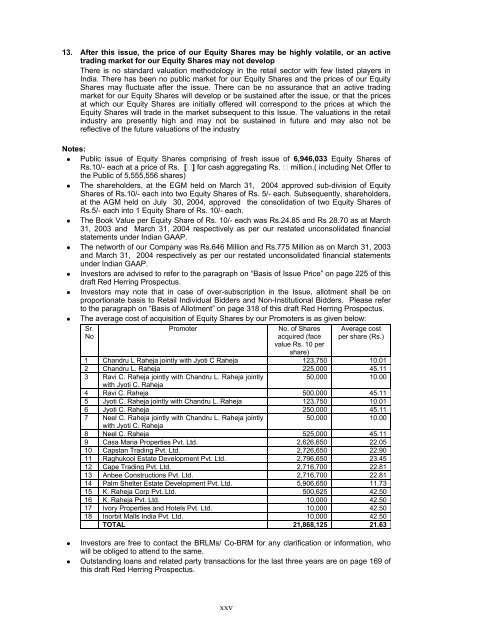

� The average cost <strong>of</strong> acquisition <strong>of</strong> Equity Shares by our Promoters is as given below:<br />

Sr.<br />

No<br />

Promoter No. <strong>of</strong> Shares<br />

acquired (face<br />

value Rs. 10 per<br />

share)<br />

xxv<br />

Average cost<br />

per share (Rs.)<br />

1 Ch<strong>and</strong>ru L Raheja jointly with Jyoti C Raheja 123,750 10.01<br />

2 Ch<strong>and</strong>ru L. Raheja 225,000 45.11<br />

3 Ravi C. Raheja jointly with Ch<strong>and</strong>ru L. Raheja jointly<br />

with Jyoti C. Raheja<br />

50,000 10.00<br />

4 Ravi C. Raheja 500,000 45.11<br />

5 Jyoti C. Raheja jointly with Ch<strong>and</strong>ru L. Raheja 123,750 10.01<br />

6 Jyoti C. Raheja 250,000 45.11<br />

7 Neel C. Raheja jointly with Ch<strong>and</strong>ru L. Raheja jointly<br />

with Jyoti C. Raheja<br />

50,000 10.00<br />

8 Neel C. Raheja 525,000 45.11<br />

9 Casa Maria Properties Pvt. Ltd. 2,626,650 22.05<br />

10 Capstan Trading Pvt. Ltd. 2,726,650 22.90<br />

11 Raghukool Estate Development Pvt. Ltd. 2,796,650 23.45<br />

12 Cape Trading Pvt. Ltd. 2,716,700 22.81<br />

13 Anbee Constructions Pvt. Ltd. 2,716,700 22.81<br />

14 Palm Shelter Estate Development Pvt. Ltd. 5,906,650 11.73<br />

15 K. Raheja Corp Pvt. Ltd. 500,625 42.50<br />

16 K. Raheja Pvt. Ltd. 10,000 42.50<br />

17 Ivory Properties <strong>and</strong> Hotels Pvt. Ltd. 10,000 42.50<br />

18 Inorbit Malls <strong>India</strong> Pvt. Ltd. 10,000 42.50<br />

TOTAL 21,868,125 21.63<br />

� Investors are free to contact the BRLMs/ Co-BRM for any clarification or information, who<br />

will be obliged to attend to the same.<br />

� Outst<strong>and</strong>ing loans <strong>and</strong> related party transactions for the last three years are on page 169 <strong>of</strong><br />

this draft Red Herring Prospectus.