Flavoured_Milk_Free

The backdrop to the UK flavoured milk market is one of relentless change. The removal of the EU milk quotas, the transition by emerging economies to a Western-style diet, the upcoming introduction of the ‘sugar tax’ and the booming sports nutrition industry are all aspects of change that create both challenges and opportunities for the UK flavoured milk market. HRA Food and Drink has developed this report as a map to guide industry stakeholders. Although volume growth in 2014 was slightly lower than in previous years, the flavoured milk market still has plenty of room for product innovation in the future.

The backdrop to the UK flavoured milk market is one of relentless change. The removal of the EU milk quotas, the transition by emerging economies to a Western-style diet, the upcoming introduction of the ‘sugar tax’ and the booming sports nutrition industry are all aspects of change that create both challenges and opportunities for the UK flavoured milk market.

HRA Food and Drink has developed this report as a map to guide industry stakeholders. Although volume growth in 2014 was slightly lower than in previous years, the flavoured milk market still has plenty of room for product innovation in the future.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

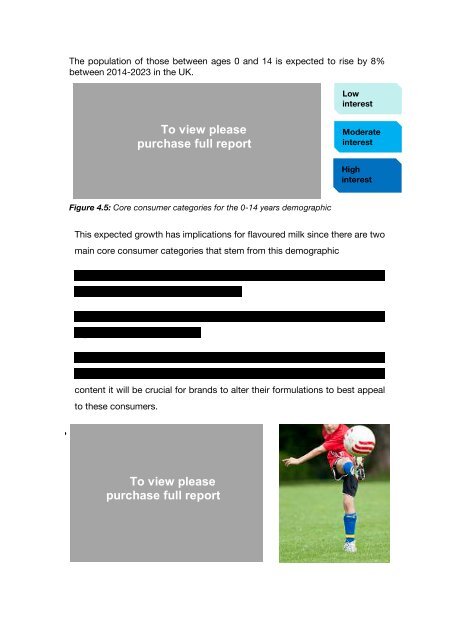

The population of those between ages 0 and 14 is expected to rise by 8%<br />

between 2014-2023 in the UK.<br />

Traditional<br />

Functional<br />

Coffee<br />

Confectionery<br />

Breakfast<br />

Alternative<br />

School<br />

children<br />

To view please<br />

purchase full report<br />

Active<br />

children<br />

Low<br />

interest<br />

Moderate<br />

interest<br />

High<br />

interest<br />

Figure 4.5: Core consumer categories for the 0-14 years demographic<br />

This expected growth has implications for flavoured milk since there are two<br />

main core consumer categories that stem from this demographic<br />

.<br />

• School children (aged 4-14) who may consume flavoured milk in their<br />

lunchbox at school or at home as a treat.<br />

• Active children (aged 4 – 14) with high energy requirements through<br />

regular sport of exercise/clubs.<br />

.<br />

Traditional and confectionery flavoured milks are most relevant to this<br />

consumer segment. However, with parental concerns over high-sugar<br />

content it will be crucial for brands to alter their formulations to best appeal<br />

to these consumers.<br />

• Active children are likely to have requirements<br />

for on-the-go drinks which are filling and<br />

nutritious. These children are typically<br />

To view please<br />

purchase full report<br />

involved in extracurricular activities and may<br />

have higher nutritional requirements than the<br />

average child, meaning they might benefit<br />

from functional and breakfast drinks