Flavoured_Milk_Free

The backdrop to the UK flavoured milk market is one of relentless change. The removal of the EU milk quotas, the transition by emerging economies to a Western-style diet, the upcoming introduction of the ‘sugar tax’ and the booming sports nutrition industry are all aspects of change that create both challenges and opportunities for the UK flavoured milk market. HRA Food and Drink has developed this report as a map to guide industry stakeholders. Although volume growth in 2014 was slightly lower than in previous years, the flavoured milk market still has plenty of room for product innovation in the future.

The backdrop to the UK flavoured milk market is one of relentless change. The removal of the EU milk quotas, the transition by emerging economies to a Western-style diet, the upcoming introduction of the ‘sugar tax’ and the booming sports nutrition industry are all aspects of change that create both challenges and opportunities for the UK flavoured milk market.

HRA Food and Drink has developed this report as a map to guide industry stakeholders. Although volume growth in 2014 was slightly lower than in previous years, the flavoured milk market still has plenty of room for product innovation in the future.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

UK FLAVOURED MILK MARKET 2017 & BEYOND<br />

• In this group demand for traditional and confectionery flavoured milk<br />

decreases, as tastes become more sophisticated. Consumers with young<br />

families may be more price conscious, decreasing spending on on-the-go<br />

treats.<br />

• This consumer group will contain a high proportion of ‘gatekeepers’ and<br />

so will be an important target for flavoured milk brands aimed at children.<br />

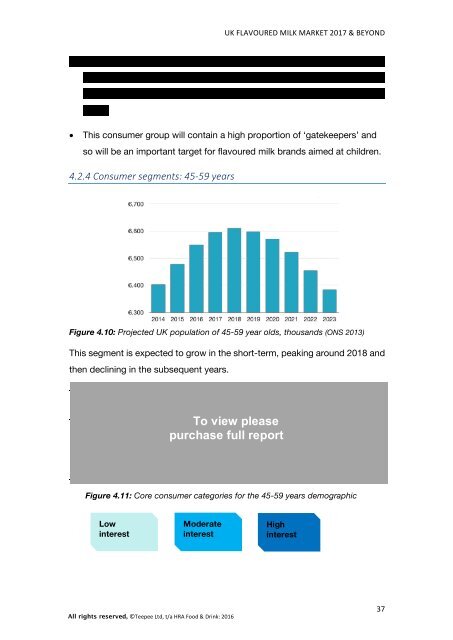

4.2.4 Consumer segments: 45-59 years<br />

Figure 4.10: Projected UK population of 45-59 year olds, thousands (ONS 2013)<br />

This segment is expected to grow in the short-term, peaking around 2018 and<br />

then declining in the subsequent years.<br />

Traditional<br />

Functional<br />

Coffee<br />

Confectionery<br />

Breakfast<br />

Alternative<br />

Endurance<br />

Athletes<br />

Weight<br />

conscious<br />

consumers<br />

On-the-go<br />

professionals<br />

To view please<br />

purchase full report<br />

Vegans<br />

Casual<br />

Gym<br />

Goers<br />

Figure 4.11: Core consumer categories for the 45-59 years demographic<br />

Low<br />

interest<br />

Moderate<br />

interest<br />

High<br />

interest<br />

All rights reserved, ©Teepee Ltd, t/a HRA Food & Drink: 2016<br />

to 2017<br />

37