PARVEST - BNP Paribas Investment Partners

PARVEST - BNP Paribas Investment Partners

PARVEST - BNP Paribas Investment Partners

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

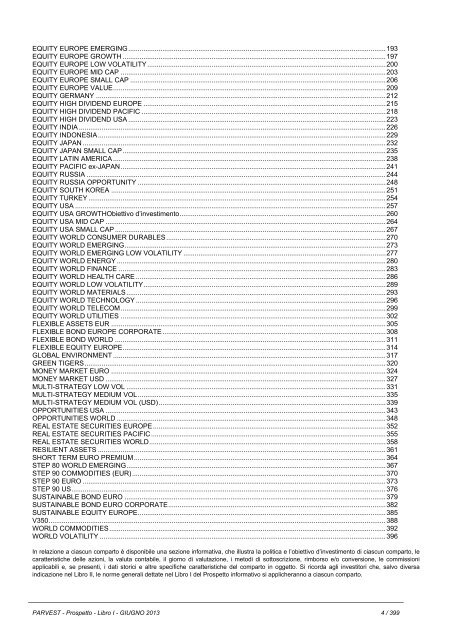

EQUITY EUROPE EMERGING........................................................................................................................................193EQUITY EUROPE GROWTH ...........................................................................................................................................197EQUITY EUROPE LOW VOLATILITY..............................................................................................................................200EQUITY EUROPE MID CAP ............................................................................................................................................203EQUITY EUROPE SMALL CAP .......................................................................................................................................206EQUITY EUROPE VALUE................................................................................................................................................209EQUITY GERMANY ......................................................................................................................................................... 212EQUITY HIGH DIVIDEND EUROPE ................................................................................................................................215EQUITY HIGH DIVIDEND PACIFIC .................................................................................................................................218EQUITY HIGH DIVIDEND USA ........................................................................................................................................223EQUITY INDIA .................................................................................................................................................................. 226EQUITY INDONESIA........................................................................................................................................................ 229EQUITY JAPAN ................................................................................................................................................................ 232EQUITY JAPAN SMALL CAP...........................................................................................................................................235EQUITY LATIN AMERICA ................................................................................................................................................238EQUITY PACIFIC ex-JAPAN............................................................................................................................................241EQUITY RUSSIA .............................................................................................................................................................. 244EQUITY RUSSIA OPPORTUNITY ...................................................................................................................................248EQUITY SOUTH KOREA .................................................................................................................................................251EQUITY TURKEY ............................................................................................................................................................. 254EQUITY USA .................................................................................................................................................................... 257EQUITY USA GROWTHObiettivo d’investimento.............................................................................................................260EQUITY USA MID CAP ....................................................................................................................................................264EQUITY USA SMALL CAP ...............................................................................................................................................267EQUITY WORLD CONSUMER DURABLES....................................................................................................................270EQUITY WORLD EMERGING..........................................................................................................................................273EQUITY WORLD EMERGING LOW VOLATILITY ...........................................................................................................277EQUITY WORLD ENERGY ..............................................................................................................................................280EQUITY WORLD FINANCE .............................................................................................................................................283EQUITY WORLD HEALTH CARE ....................................................................................................................................286EQUITY WORLD LOW VOLATILITY................................................................................................................................289EQUITY WORLD MATERIALS.........................................................................................................................................293EQUITY WORLD TECHNOLOGY ....................................................................................................................................296EQUITY WORLD TELECOM............................................................................................................................................299EQUITY WORLD UTILITIES ............................................................................................................................................302FLEXIBLE ASSETS EUR .................................................................................................................................................305FLEXIBLE BOND EUROPE CORPORATE......................................................................................................................308FLEXIBLE BOND WORLD ...............................................................................................................................................311FLEXIBLE EQUITY EUROPE...........................................................................................................................................314GLOBAL ENVIRONMENT ................................................................................................................................................317GREEN TIGERS............................................................................................................................................................... 320MONEY MARKET EURO .................................................................................................................................................324MONEY MARKET USD ....................................................................................................................................................327MULTI-STRATEGY LOW VOL .........................................................................................................................................331MULTI-STRATEGY MEDIUM VOL...................................................................................................................................335MULTI-STRATEGY MEDIUM VOL (USD)........................................................................................................................339OPPORTUNITIES USA ....................................................................................................................................................343OPPORTUNITIES WORLD ..............................................................................................................................................348REAL ESTATE SECURITIES EUROPE...........................................................................................................................352REAL ESTATE SECURITIES PACIFIC............................................................................................................................355REAL ESTATE SECURITIES WORLD.............................................................................................................................358RESILIENT ASSETS ........................................................................................................................................................ 361SHORT TERM EURO PREMIUM.....................................................................................................................................364STEP 80 WORLD EMERGING.........................................................................................................................................367STEP 90 COMMODITIES (EUR)......................................................................................................................................370STEP 90 EURO ................................................................................................................................................................ 373STEP 90 US...................................................................................................................................................................... 376SUSTAINABLE BOND EURO ..........................................................................................................................................379SUSTAINABLE BOND EURO CORPORATE...................................................................................................................382SUSTAINABLE EQUITY EUROPE...................................................................................................................................385V350.................................................................................................................................................................................. 388WORLD COMMODITIES..................................................................................................................................................392WORLD VOLATILITY ....................................................................................................................................................... 396In relazione a ciascun comparto è disponibile una sezione informativa, che illustra la politica e l’obiettivo d’investimento di ciascun comparto, lecaratteristiche delle azioni, la valuta contabile, il giorno di valutazione, i metodi di sottoscrizione, rimborso e/o conversione, le commissioniapplicabili e, se presenti, i dati storici e altre specifiche caratteristiche del comparto in oggetto. Si ricorda agli investitori che, salvo diversaindicazione nel Libro II, le norme generali dettate nel Libro I del Prospetto informativo si applicheranno a ciascun comparto.<strong>PARVEST</strong> - Prospetto - Libro I - GIUGNO 2013 4 / 399