Audite¯tais gada pa¯rskats 2008 Nordea 1, SICAV - Nordea Bank ...

Audite¯tais gada pa¯rskats 2008 Nordea 1, SICAV - Nordea Bank ...

Audite¯tais gada pa¯rskats 2008 Nordea 1, SICAV - Nordea Bank ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

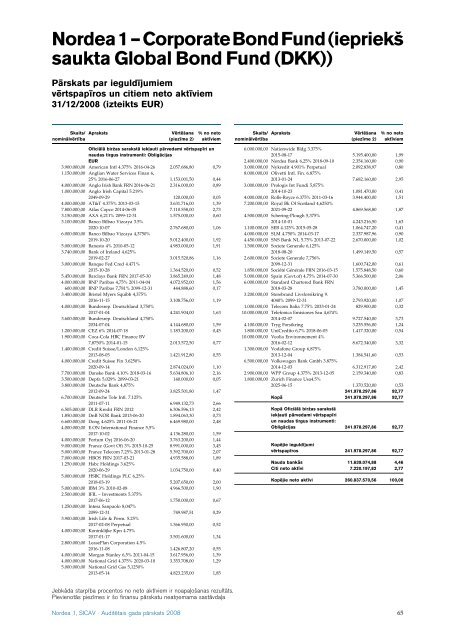

<strong>Nordea</strong>1–CorporateBondFund(iepriekšsaukta Global Bond Fund (DKK))Pārskats par ieguldījumiemvērtspapīros un citiem neto aktīviem31/12/<strong>2008</strong> (izteikts EUR)Skaits/ AprakstsnominālvērtībaVērtēšana(piezīme 2)% no netoaktīviemSkaits/ AprakstsnominālvērtībaVērtēšana(piezīme 2)% no netoaktīviemOficiālā biržas sarakstā iekļauti pārvedami vērtspapīri unnaudas tirgus instrumenti: ObligācijasEUR3.900.000,00 American Intl 4.375% 2016-04-26 2.057.686,80 0,791.150.000,00 Anglian Water Services Finan 6,25% 2016-06-27 1.153.001,50 0,444.000.000,00 Anglo Irish <strong>Bank</strong> FRN 2016-06-21 2.316.000,00 0,891.000.000,00 Anglo Irish Capital 5.219%2049-09-29 120.000,00 0,054.000.000,00 AT&T 4.375% 2013-03-15 3.631.716,00 1,397.800.000,00 Atlas Copco 2014-06-05 7.110.558,00 2,733.150.000,00 AXA 6,211% 2099-12-31 1.575.000,00 0,603.100.000,00 Banco Bilbao Vizcaya 3.5%2020-10-07 2.767.680,00 1,066.000.000,00 Banco Bilbao Vizcaya 4,3750%2019-10-20 5.012.400,00 1,925.000.000,00 Banesto 4% 2010-05-12 4.983.000,00 1,913.740.000,00 <strong>Bank</strong> of Ireland 4.625%2019-02-27 3.015.520,86 1,163.000.000,00 Banque Fed Cred 4.471%2015-10-28 1.364.520,00 0,525.450.000,00 Barclays <strong>Bank</strong> FRN 2017-05-30 3.865.249,00 1,484.000.000,00 BNP Paribas 4,75% 2011-04-04 4.072.952,00 1,56600.000,00 BNP Paribas 7,781% 2099-12-31 444.888,60 0,173.400.000,00 Bristol Myers Squibb 4,375%2016-11-15 3.108.756,00 1,194.000.000,00 Bundesrep. Deutschland 3,750%2017-01-04 4.241.904,00 1,633.600.000,00 Bundesrep. Deutschland 4,750%2034-07-04 4.144.680,00 1,591.200.000,00 CEZ 6% 2014-07-18 1.183.200,00 0,451.900.000,00 Coca-Cola HBC Finance BV7,8750% 2014-01-15 2.013.572,50 0,771.400.000,00 Credit Suisse/London 6,125%2013-08-05 1.421.912,80 0,554.000.000,00 Credit Suisse Fin 3.6250%2020-09-14 2.874.024,00 1,107.700.000,00 Danske <strong>Bank</strong> 4.10% 2018-03-16 5.634.806,10 2,163.500.000,00 Depfa 5,029% 2099-03-21 140.000,00 0,053.800.000,00 Deutsche <strong>Bank</strong> 4,875%2012-09-24 3.825.501,80 1,476.700.000,00 Deutsche Tele Intl. 7.125%2011-07-11 6.949.132,73 2,666.505.000,00 DLR Kredit FRN 2012 6.306.596,13 2,421.850.000,00 DnB NOR <strong>Bank</strong> 2013-06-20 1.894.063,30 0,736.600.000,00 Dong 4.625% 2011-06-21 6.469.980,00 2,484.000.000,00 E.ON International Finance 5,5%2017-10-02 4.136.280,00 1,594.000.000,00 Fortum Oyj 2016-06-20 3.763.200,00 1,449.000.000,00 France (Govt Of) 3% 2015-10-25 8.991.000,00 3,455.000.000,00 France Telecom 7,25% 2013-01-28 5.392.700,00 2,077.000.000,00 HBOS FRN 2017-03-21 4.935.588,00 1,891.250.000,00 Hsbc Holdings 3.625%2020-06-29 1.034.750,00 0,405.000.000,00 HSBC Holdings PLC 6,25%2018-03-19 5.207.650,00 2,005.000.000,00 IBM 3% 2010-02-08 4.966.500,00 1,902.500.000,00 IFIL – Investments 5.375%2017-06-12 1.750.000,00 0,671.250.000,00 Intesa Sanpaolo 8,047%2099-12-31 749.987,51 0,293.900.000,00 Irish Life & Perm. 5.25%2017-02-08 Perpetual 1.366.950,00 0,524.000.000,00 Koninklijke Kpn 4.75%2017-01-17 3.501.600,00 1,342.800.000,00 LeasePlan Corporation 4.5%2016-11-08 1.426.807,20 0,554.000.000,00 Morgan Stanley 6,5% 2011-04-15 3.617.956,00 1,394.000.000,00 National Grid 4.375% 2020-03-10 3.353.708,00 1,295.000.000,00 National Grid Gas 5,1250%2013-05-14 4.823.235,00 1,856.000.000,00 Nationwide Bldg 3.375%2015-08-17 5.195.400,00 1,992.400.000,00 <strong>Nordea</strong> <strong>Bank</strong> 6,25% 2018-09-10 2.354.160,00 0,903.000.000,00 Nykredit 4.901% Perpetual 2.092.838,97 0,808.000.000,00 Olivetti Intl. Fin. 6.875%2013-01-24 7.682.160,00 2,953.000.000,00 Prologis Int Fundi 5,875%2014-10-23 1.081.470,00 0,414.000.000,00 Rolls-Royce 6.375% 2011-03-16 3.944.400,00 1,517.200.000,00 Royal Bk Of Scotland 4,6250%2021-09-22 4.869.568,80 1,874.500.000,00 Schering-Plough 5,375%2014-10-01 4.243.216,50 1,631.100.000,00 SEB 4.125% 2015-05-28 1.064.747,20 0,414.000.000,00 SLM 4.750% 2014-03-17 2.337.987,96 0,904.450.000,00 SNS <strong>Bank</strong> NL 5.75% 2013-07-22 2.670.000,00 1,021.500.000,00 Societe Generale 6,125%2018-08-20 1.499.149,50 0,572.600.000,00 Societe Generale 7,756%2099-12-31 1.600.742,00 0,611.850.000,00 Société Générale FRN 2016-03-15 1.575.848,50 0,605.000.000,00 Spain (Govt.of) 4.75% 2014-07-30 5.366.500,00 2,066.000.000,00 Standard Chartered <strong>Bank</strong> FRN2018-03-28 3.780.000,00 1,453.200.000,00 Storebrand Livsforsikring 9.4040% 2099-12-31 2.793.920,00 1,071.000.000,00 Telecom Italia 7.75% 2033-01-24 829.900,00 0,3210.000.000,00 Telefonica Emisiones Sau 4,674%2014-02-07 9.727.540,00 3,734.100.000,00 Tryg Forsikring 3.235.556,00 1,241.800.000,00 UniCredito 6,7% 2018-06-05 1.417.320,00 0,5410.000.000,00 Veolia Environnement 4%2016-02-12 8.672.340,00 3,321.300.000,00 Vodafone Group 6,875%2013-12-04 1.384.541,60 0,536.500.000,00 Volkswagen <strong>Bank</strong> Gmbh 3.875%2014-12-03 6.312.917,00 2,422.900.000,00 WPP Group 4.375% 2013-12-05 2.159.340,00 0,831.800.000,00 Zurich Finance Usa4.5%2025-06-15 1.370.520,00 0,53241.978.297,86 92,77Kopā 241.978.297,86 92,77Kopā Oficiālā biržas sarakstāiekļauti pārvedami vērtspapīriun naudas tirgus instrumenti:Obligācijas 241.978.297,86 92,77Kopējie ieguldījumivērtspapīros 241.978.297,86 92,77Nauda bankās 11.639.074,88 4,46Citi neto aktīvi 7.220.197,82 2,77Kopējie neto aktīvi 260.837.570,56 100,00Jebkāda starpība procentos no neto aktīviem ir noapaļošanas rezultāts.Pievienotās piezīmes ir šo finansu pārskatu neatņemama sastāvdaļa<strong>Nordea</strong> 1, <strong>SICAV</strong> ˙ Auditētais <strong>gada</strong> pārskats <strong>2008</strong> 65