2013 CMHA HCVP Admin Plan - Cuyahoga Metropolitan Housing ...

2013 CMHA HCVP Admin Plan - Cuyahoga Metropolitan Housing ...

2013 CMHA HCVP Admin Plan - Cuyahoga Metropolitan Housing ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

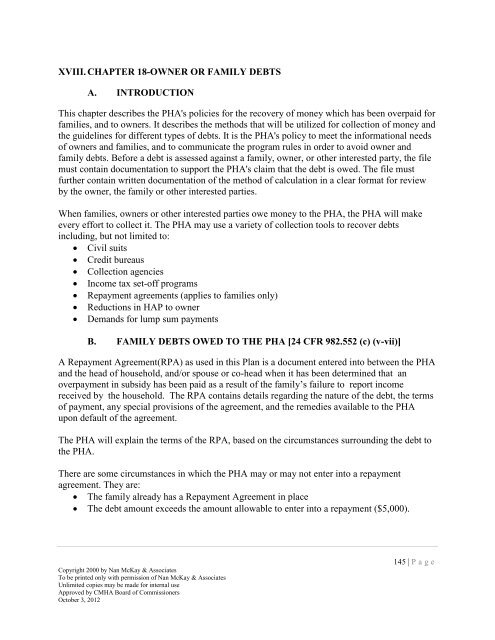

XVIII. CHAPTER 18-OWNER OR FAMILY DEBTS<br />

A. INTRODUCTION<br />

This chapter describes the PHA's policies for the recovery of money which has been overpaid for<br />

families, and to owners. It describes the methods that will be utilized for collection of money and<br />

the guidelines for different types of debts. It is the PHA's policy to meet the informational needs<br />

of owners and families, and to communicate the program rules in order to avoid owner and<br />

family debts. Before a debt is assessed against a family, owner, or other interested party, the file<br />

must contain documentation to support the PHA's claim that the debt is owed. The file must<br />

further contain written documentation of the method of calculation in a clear format for review<br />

by the owner, the family or other interested parties.<br />

When families, owners or other interested parties owe money to the PHA, the PHA will make<br />

every effort to collect it. The PHA may use a variety of collection tools to recover debts<br />

including, but not limited to:<br />

Civil suits<br />

Credit bureaus<br />

Collection agencies<br />

Income tax set-off programs<br />

Repayment agreements (applies to families only)<br />

Reductions in HAP to owner<br />

Demands for lump sum payments<br />

B. FAMILY DEBTS OWED TO THE PHA [24 CFR 982.552 (c) (v-vii)]<br />

A Repayment Agreement(RPA) as used in this <strong>Plan</strong> is a document entered into between the PHA<br />

and the head of household, and/or spouse or co-head when it has been determined that an<br />

overpayment in subsidy has been paid as a result of the family’s failure to report income<br />

received by the household. The RPA contains details regarding the nature of the debt, the terms<br />

of payment, any special provisions of the agreement, and the remedies available to the PHA<br />

upon default of the agreement.<br />

The PHA will explain the terms of the RPA, based on the circumstances surrounding the debt to<br />

the PHA.<br />

There are some circumstances in which the PHA may or may not enter into a repayment<br />

agreement. They are:<br />

The family already has a Repayment Agreement in place<br />

The debt amount exceeds the amount allowable to enter into a repayment ($5,000).<br />

Copyright 2000 by Nan McKay & Associates<br />

To be printed only with permission of Nan McKay & Associates<br />

Unlimited copies may be made for internal use<br />

Approved by <strong>CMHA</strong> Board of Commissioners<br />

October 3, 2012<br />

145 | P a g e