2013 CMHA HCVP Admin Plan - Cuyahoga Metropolitan Housing ...

2013 CMHA HCVP Admin Plan - Cuyahoga Metropolitan Housing ...

2013 CMHA HCVP Admin Plan - Cuyahoga Metropolitan Housing ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

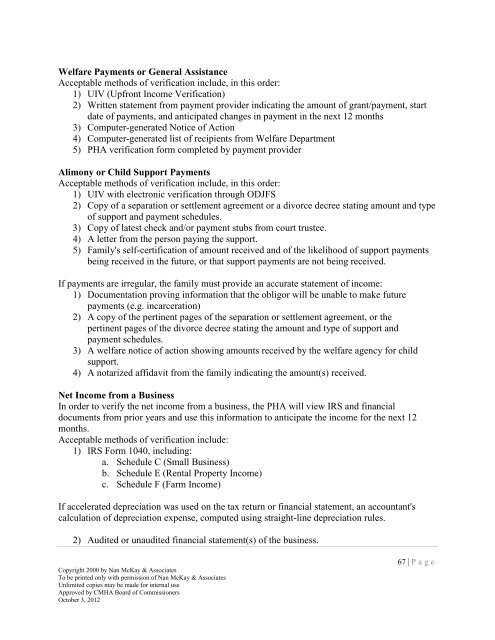

Welfare Payments or General Assistance<br />

Acceptable methods of verification include, in this order:<br />

1) UIV (Upfront Income Verification)<br />

2) Written statement from payment provider indicating the amount of grant/payment, start<br />

date of payments, and anticipated changes in payment in the next 12 months<br />

3) Computer-generated Notice of Action<br />

4) Computer-generated list of recipients from Welfare Department<br />

5) PHA verification form completed by payment provider<br />

Alimony or Child Support Payments<br />

Acceptable methods of verification include, in this order:<br />

1) UIV with electronic verification through ODJFS<br />

2) Copy of a separation or settlement agreement or a divorce decree stating amount and type<br />

of support and payment schedules.<br />

3) Copy of latest check and/or payment stubs from court trustee.<br />

4) A letter from the person paying the support.<br />

5) Family's self-certification of amount received and of the likelihood of support payments<br />

being received in the future, or that support payments are not being received.<br />

If payments are irregular, the family must provide an accurate statement of income:<br />

1) Documentation proving information that the obligor will be unable to make future<br />

payments (e.g. incarceration)<br />

2) A copy of the pertinent pages of the separation or settlement agreement, or the<br />

pertinent pages of the divorce decree stating the amount and type of support and<br />

payment schedules.<br />

3) A welfare notice of action showing amounts received by the welfare agency for child<br />

support.<br />

4) A notarized affidavit from the family indicating the amount(s) received.<br />

Net Income from a Business<br />

In order to verify the net income from a business, the PHA will view IRS and financial<br />

documents from prior years and use this information to anticipate the income for the next 12<br />

months.<br />

Acceptable methods of verification include:<br />

1) IRS Form 1040, including:<br />

a. Schedule C (Small Business)<br />

b. Schedule E (Rental Property Income)<br />

c. Schedule F (Farm Income)<br />

If accelerated depreciation was used on the tax return or financial statement, an accountant's<br />

calculation of depreciation expense, computed using straight-line depreciation rules.<br />

2) Audited or unaudited financial statement(s) of the business.<br />

Copyright 2000 by Nan McKay & Associates<br />

To be printed only with permission of Nan McKay & Associates<br />

Unlimited copies may be made for internal use<br />

Approved by <strong>CMHA</strong> Board of Commissioners<br />

October 3, 2012<br />

67 | P a g e