Sustainable Building Technical Manual - Etn-presco.net

Sustainable Building Technical Manual - Etn-presco.net

Sustainable Building Technical Manual - Etn-presco.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

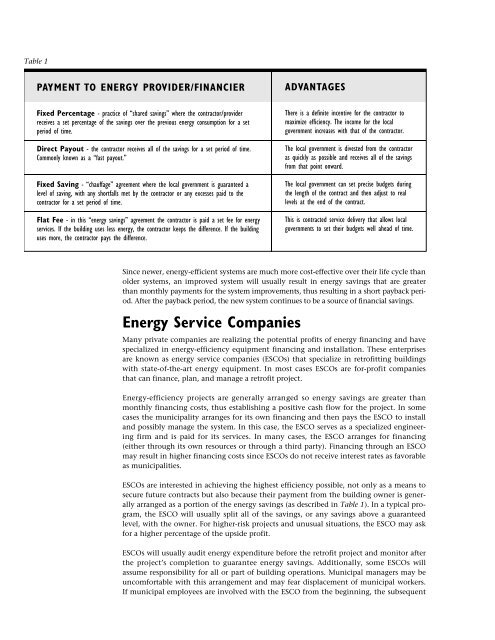

Table 1PAYMENT TO ENERGY PROV I D E R / F I N A N C I E RA DVA N TA G E SFixed Percentage - practice of “shared savings” where the contractor/providerreceives a set percentage of the savings over the previous energy consumption for a setperiod of time.Direct Payout - the contractor receives all of the savings for a set period of time.Commonly known as a “fast payout.”Fixed Saving - “chauffage” agreement where the local government is guaranteed alevel of saving, with any shortfalls met by the contractor or any excesses paid to thecontractor for a set period of time.Flat Fee - in this “energy savings” agreement the contractor is paid a set fee for energyservices. If the building uses less energy, the contractor keeps the difference. If the buildinguses more, the contractor pays the difference.There is a definite incentive for the contractor tomaximize efficiency. The income for the localgovernment increases with that of the contractor.The local government is divested from the contractoras quickly as possible and receives all of the savingsfrom that point onward.The local government can set precise budgets duringthe length of the contract and then adjust to reallevels at the end of the contract.This is contracted service delivery that allows localgovernments to set their budgets well ahead of time.Since newer, energy-efficient systems are much more cost-effective over their life cycle thanolder systems, an improved system will usually result in energy savings that are greaterthan monthly payments for the system improvements, thus resulting in a short payback period.After the payback period, the new system continues to be a source of financial savings.Energy Service CompaniesMany private companies are realizing the potential profits of energy financing and havespecialized in energy-efficiency equipment financing and installation. These enterprisesare known as energy service companies (ESCOs) that specialize in retrofitting buildingswith state-of-the-art energy equipment. In most cases ESCOs are for-profit companiesthat can finance, plan, and manage a retrofit project.Energy-efficiency projects are generally arranged so energy savings are greater thanmonthly financing costs, thus establishing a positive cash flow for the project. In somecases the municipality arranges for its own financing and then pays the ESCO to installand possibly manage the system. In this case, the ESCO serves as a specialized engineeringfirm and is paid for its services. In many cases, the ESCO arranges for financing(either through its own resources or through a third party). Financing through an ESCOmay result in higher financing costs since ESCOs do not receive interest rates as favorableas municipalities.ESCOs are interested in achieving the highest efficiency possible, not only as a means tosecure future contracts but also because their payment from the building owner is generallyarranged as a portion of the energy savings (as described in Table 1). In a typical program,the ESCO will usually split all of the savings, or any savings above a guaranteedlevel, with the owner. For higher-risk projects and unusual situations, the ESCO may askfor a higher percentage of the upside profit.ESCOs will usually audit energy expenditure before the retrofit project and monitor afterthe project’s completion to guarantee energy savings. Additionally, some ESCOs willassume responsibility for all or part of building operations. Municipal managers may beuncomfortable with this arrangement and may fear displacement of municipal workers.If municipal employees are involved with the ESCO from the beginning, the subsequent