You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

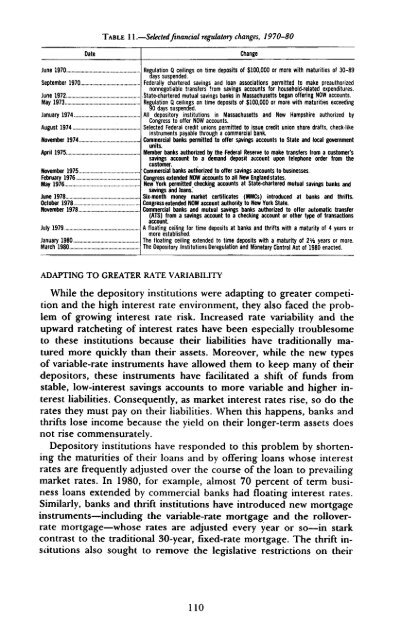

TABLE 11.—Selected financial regulatory changes, 1970-80DateChangeJune 1970September 1970June 1972May 1973January 1974August 1974November 1974April 1975November 1975.. . . .,February 1976May 1976June 1978October 1978November 1978July 1979January 1980March 1980Regulation Q ceilings on time deposits <strong>of</strong> $100,000 or more with maturities <strong>of</strong> 30-89days suspended.Federally chartered savings and loan associations permitted to make preauttiorizednonnegotiable transfers from savings accounts for household-related expenditures.State-chartered mutual savings banks in Massachusetts began <strong>of</strong>fering NOW accounts.Regulation Q ceilings on time deposits <strong>of</strong> $100,000 or more with maturities exceeding90 days suspended.All depository institutions in Massachusetts and New Hampshire authorized byCongress to <strong>of</strong>fer NOW accounts.Selected Federal credit unions permitted to issue credit union share drafts, check-likeinstruments payable through a commercial bank.Commercial banks permitted to <strong>of</strong>fer savings accounts to State and local governmentunits.Member banks authorized by <strong>the</strong> Federal Reserve to make transfers from a customer'ssavings account to a demand deposit account upon telephone order from <strong>the</strong>customer.Commerciat banks authorized to <strong>of</strong>fer savings accounts to businesses.Congress extended NOW accounts to all New England states.New York permitted checking accounts at State-chartered mutual savings banks andsavings and loans.'Six-month money market certificates (MMCs) introduced at banks and thrifts.Congress extended NOW account authority to New York State.Commercial banks and mutual savings banks authorized to <strong>of</strong>fer automatic transfer(ATS) from a savings account to a checking account or o<strong>the</strong>r type <strong>of</strong> transactionsaccount.A floating ceiling for time deposits at banks and thrifts with a maturity <strong>of</strong> 4 years ormore established.The floating ceiling extended to time deposits with a maturity <strong>of</strong> 2Vz years or more.The Depository Institutions Deregulation and Monetary Control Act <strong>of</strong> 1980 enacted.ADAPTING TO GREATER RATE VARIABILITYWhile <strong>the</strong> depository institutions were adapting to greater competitionand <strong>the</strong> high interest rate environment, <strong>the</strong>y also faced <strong>the</strong> problem<strong>of</strong> growing interest rate risk. Increased rate variability and <strong>the</strong>upward ratcheting <strong>of</strong> interest rates have been especially troublesometo <strong>the</strong>se institutions because <strong>the</strong>ir liabilities have traditionally maturedmore quickly than <strong>the</strong>ir assets. Moreover, while <strong>the</strong> new types<strong>of</strong> variable-rate instruments have allowed <strong>the</strong>m to keep many <strong>of</strong> <strong>the</strong>irdepositors, <strong>the</strong>se instruments have facilitated a shift <strong>of</strong> funds fromstable, low-interest savings accounts to more variable and higher interestliabilities. Consequently, as market interest rates rise, so do <strong>the</strong>rates <strong>the</strong>y must pay on <strong>the</strong>ir liabilities. When this happens, banks andthrifts lose income because <strong>the</strong> yield on <strong>the</strong>ir longer-term assets doesnot rise commensurately.Depository institutions have responded to this problem by shortening<strong>the</strong> maturities <strong>of</strong> <strong>the</strong>ir loans and by <strong>of</strong>fering loans whose interestrates are frequently adjusted over <strong>the</strong> course <strong>of</strong> <strong>the</strong> loan to prevailingmarket rates. In 1980, for example, almost 70 percent <strong>of</strong> term businessloans extended by commercial banks had floating interest rates.Similarly, banks and thrift institutions have introduced new mortgageinstruments—including <strong>the</strong> variable-rate mortgage and <strong>the</strong> rolloverratemortgage—whose rates are adjusted every year or so—in starkcontrast to <strong>the</strong> traditional 30-year, fixed-rate mortgage. The thrift institutionsalso sought to remove <strong>the</strong> legislative restrictions on <strong>the</strong>ir110