G20 china_web

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Growing the global economy<br />

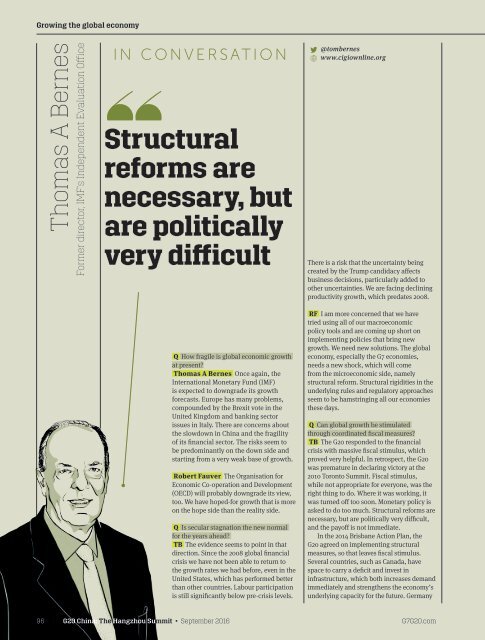

Thomas A Bernes<br />

Former director, IMF's Independent Evaluation Office<br />

IN CONVERSATION<br />

Structural<br />

reforms are<br />

necessary, but<br />

are politically<br />

very difficult<br />

Q How fragile is global economic growth<br />

at present?<br />

Thomas A Bernes Once again, the<br />

International Monetary Fund (IMF)<br />

is expected to downgrade its growth<br />

forecasts. Europe has many problems,<br />

compounded by the Brexit vote in the<br />

United Kingdom and banking sector<br />

issues in Italy. There are concerns about<br />

the slowdown in China and the fragility<br />

of its financial sector. The risks seem to<br />

be predominantly on the down side and<br />

starting from a very weak base of growth.<br />

Robert Fauver The Organisation for<br />

Economic Co-operation and Development<br />

(OECD) will probably downgrade its view,<br />

too. We have hoped-for growth that is more<br />

on the hope side than the reality side.<br />

Q Is secular stagnation the new normal<br />

for the years ahead?<br />

TB The evidence seems to point in that<br />

direction. Since the 2008 global financial<br />

crisis we have not been able to return to<br />

the growth rates we had before, even in the<br />

United States, which has performed better<br />

than other countries. Labour participation<br />

is still significantly below pre-crisis levels.<br />

@tombernes<br />

www.cigiownline.org<br />

There is a risk that the uncertainty being<br />

created by the Trump candidacy affects<br />

business decisions, particularly added to<br />

other uncertainties. We are facing declining<br />

productivity growth, which predates 2008.<br />

RF I am more concerned that we have<br />

tried using all of our macroeconomic<br />

policy tools and are coming up short on<br />

implementing policies that bring new<br />

growth. We need new solutions. The global<br />

economy, especially the G7 economies,<br />

needs a new shock, which will come<br />

from the microeconomic side, namely<br />

structural reform. Structural rigidities in the<br />

underlying rules and regulatory approaches<br />

seem to be hamstringing all our economies<br />

these days.<br />

Q Can global growth be stimulated<br />

through coordinated fiscal measures?<br />

TB The <strong>G20</strong> responded to the financial<br />

crisis with massive fiscal stimulus, which<br />

proved very helpful. In retrospect, the <strong>G20</strong><br />

was premature in declaring victory at the<br />

2010 Toronto Summit. Fiscal stimulus,<br />

while not appropriate for everyone, was the<br />

right thing to do. Where it was working, it<br />

was turned off too soon. Monetary policy is<br />

asked to do too much. Structural reforms are<br />

necessary, but are politically very difficult,<br />

and the payoff is not immediate.<br />

In the 2014 Brisbane Action Plan, the<br />

<strong>G20</strong> agreed on implementing structural<br />

measures, so that leaves fiscal stimulus.<br />

Several countries, such as Canada, have<br />

space to carry a deficit and invest in<br />

infrastructure, which both increases demand<br />

immediately and strengthens the economy’s<br />

underlying capacity for the future. Germany<br />

96 <strong>G20</strong> China: The Hangzhou Summit • September 2016 G7<strong>G20</strong>.com