- Page 1 and 2:

ECONOMIC REPORT OF THE PRESIDENT To

- Page 4:

C O N T E N T S ECONOMIC REPORT OF

- Page 8 and 9:

economic report of the president To

- Page 10 and 11:

eforms in history. Banks have sharp

- Page 12:

the annual report of the council of

- Page 16 and 17:

C O N T E N T S CHAPTER 1: EIGHT YE

- Page 18 and 19:

. THE ECONOMIC RATIONALE FOR FEDERA

- Page 20 and 21:

2.4. Government Purchases as Share

- Page 22 and 23:

4.iii. Premium for the Benchmark Pl

- Page 24 and 25:

6.18. Systemic Risk (SRISK) 2005-20

- Page 26 and 27:

C H A P T E R 1 EIGHT YEARS OF RECO

- Page 28 and 29:

Figure 1-1 Actual and Consensus For

- Page 30 and 31:

Figure 1-3 Real Hourly Wage Growth

- Page 32 and 33:

Figure 1-4 Real GDP per Capita: Eur

- Page 34 and 35:

Figure 1-6 Household Net Worth in t

- Page 36 and 37:

Figure 1-8 Global Trade Flows in th

- Page 38 and 39:

Subsequent revisions to fourth-quar

- Page 40 and 41:

Percent 6 Figure 1-9 Fiscal Expansi

- Page 42 and 43:

substantial costs to the Federal Go

- Page 44 and 45:

worked to promote innovation and in

- Page 46 and 47:

expansion, a period of low producti

- Page 48 and 49:

The 2017 Economic Report of the Pre

- Page 50 and 51:

Chapter 4: Reforming the Health Car

- Page 52 and 53:

to the ACA and other factors. The A

- Page 54 and 55:

than 98 percent of Americans should

- Page 56 and 57:

Figure 1-13 Borrowers in Income Dri

- Page 58 and 59:

success of the financial rescue and

- Page 60 and 61:

einforced U.S. leadership in the ru

- Page 62 and 63:

Partnership (OGP), a global partner

- Page 64 and 65:

Figure 1-16 Labor Productivity Grow

- Page 66 and 67:

Labor Force Participation Household

- Page 68 and 69:

number of steps to ensure that econ

- Page 70 and 71:

C H A P T E R 2 THE YEAR IN REVIEW

- Page 72 and 73:

Percent 11 Figure 2-1 Unemployment

- Page 74 and 75:

allowing for additional investments

- Page 76 and 77:

Percentage Point 0.6 0.4 Figure 2-3

- Page 78 and 79:

public, largely highway constructio

- Page 80 and 81:

The size of the Federal Reserve’s

- Page 82 and 83:

Figure 2-5 Private-Sector Payroll E

- Page 84 and 85:

fell 80 percent from September 2014

- Page 86 and 87:

Figure 2-8 Rates of Part-Time Work,

- Page 88 and 89:

Figure 2-v Prime-Age Male Labor For

- Page 90 and 91:

Output Real GDP grew 1.6 percent ov

- Page 92 and 93:

Figure 2-11 Compensation and Consum

- Page 94 and 95:

Table 2-i Optimal Weighting for Hou

- Page 96 and 97:

esults suggest that, to a first app

- Page 98 and 99:

Figure 2-viii Real GDP, Average and

- Page 100 and 101:

Figure 2-13 Consumer Sentiment and

- Page 102 and 103:

Figure 2-xi Household Debt Service,

- Page 104 and 105:

Ratio to Annual DPI 1.10 1.05 Figur

- Page 106 and 107:

Figure 2-17 National House Price In

- Page 108 and 109:

Index 220 Figure 2-19 Housing Affor

- Page 110 and 111:

Figure 2-21 Composition of Growth i

- Page 112 and 113:

Figure 2-23 Capital Services per Un

- Page 114 and 115:

Box 2-7: Explanations for the Recen

- Page 116 and 117:

Figure 2-xv Business Fixed Investme

- Page 118 and 119:

Figure 2-26 Foreign Real GDP and U.

- Page 120 and 121:

somewhat generalizable (Box 2-8), b

- Page 122 and 123:

prices weakened and the global econ

- Page 124 and 125:

inadequate demand has contributed t

- Page 126 and 127:

Figure 2-31 Nominal Wage Inflation

- Page 128 and 129:

Figure 2-33 Real Hourly Wage Growth

- Page 130 and 131:

Index 6 Figure 2-36 Financial Condi

- Page 132 and 133:

Percent 4.0 Figure 2-38 Nominal Lon

- Page 134 and 135:

Dollars per Barrel 80 Figure 2-40 B

- Page 136 and 137:

Figure 2-41 IMF World Real GDP Grow

- Page 138 and 139:

against the Mexican peso, the Chine

- Page 140 and 141:

United Kingdom It has been a turbul

- Page 142 and 143:

for example, Japan has grown almost

- Page 144 and 145:

Figure 2-45 Credit to Nonfinancial

- Page 146 and 147:

Meanwhile, core inflation (excludin

- Page 148 and 149: kept rates low across a wide range

- Page 150 and 151: Investments in surface transportati

- Page 152 and 153: Table 2-2 Supply-Side Components of

- Page 154: Conclusion The economy continued to

- Page 157 and 158: not increased from 1973 to 2013, in

- Page 159 and 160: developments; individual behavior;

- Page 161 and 162: action affecting income inequality

- Page 163 and 164: have occurred. In doing so, these p

- Page 165 and 166: Percent 24 21 18 15 12 9 6 African

- Page 167 and 168: without the policy response.5 These

- Page 169 and 170: Box 3-2: Income Inequality and the

- Page 171 and 172: unable to obtain insurance at any p

- Page 173 and 174: Figure 3-7B Percent 50 Uninsured Ra

- Page 175 and 176: and have not expanded Medicaid foun

- Page 177 and 178: Box 3-3: Safety Net Policies as Ins

- Page 179 and 180: Millions of People 18 Figure 3-8 Im

- Page 181 and 182: Figure 3-9 Effective Tax Rates for

- Page 183 and 184: Box 3-4: Additional Actions to Make

- Page 185 and 186: $294 million in newly appropriated

- Page 187 and 188: 15 10 5 0 -5 -10 -15 Figure 3-12 Pe

- Page 189 and 190: Administration with those of previo

- Page 191 and 192: as a share of potential GDP by Pres

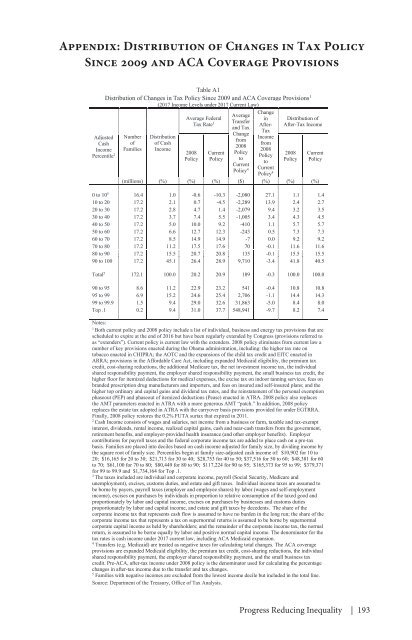

- Page 193 and 194: Figure 3-17 Changes in the Distribu

- Page 195 and 196: 30 25 20 15 10 5 0 Single Source: C

- Page 197: ate on capital gains and dividends

- Page 201 and 202: health insurance coverage by signin

- Page 203 and 204: The six years since the ACA became

- Page 205 and 206: Medicare and Medicaid were created

- Page 207 and 208: Share of Income Required to Purchas

- Page 209 and 210: But these efforts left significant

- Page 211 and 212: percent were denied coverage, charg

- Page 213 and 214: Box 4-1: Public Health Benefits of

- Page 215 and 216: Figure 4-6 Health Insurance Coverag

- Page 217 and 218: (Marketplaces), web-based markets t

- Page 219 and 220: Decline in Uninsured Rate, 2013-201

- Page 221 and 222: silver (or “benchmark”) plan in

- Page 223 and 224: health status of individual market

- Page 225 and 226: Figure 4-iv Change in Benchmark Pre

- Page 227 and 228: illustrated in Figure 4-10 (KFF/HRE

- Page 229 and 230: chapter reviews this evidence base,

- Page 231 and 232: Share of Population Not Receiving N

- Page 233 and 234: for confidence that expanded insura

- Page 235 and 236: as the proportional reduction in th

- Page 237 and 238: that the introduction of Medicare l

- Page 239 and 240: statistical area (MSA), and rural a

- Page 241 and 242: 0.8 0.6 0.4 0.2 0.0 -0.2 -0.4 -0.6

- Page 243 and 244: currently employed. 15 Contrary to

- Page 245 and 246: Figure 4-20 Change in Average Weekl

- Page 247 and 248: Figure 4-21 Employment Outcomes for

- Page 249 and 250:

Figure 4-22 Health Care Spending as

- Page 251 and 252:

suggesting that the additional spen

- Page 253 and 254:

Government, which pays for the majo

- Page 255 and 256:

large health benefits. When decidin

- Page 257 and 258:

and any other services associated w

- Page 259 and 260:

Figure 4-25 Medicare Beneficiaries

- Page 261 and 262:

is far below the overall return to

- Page 263 and 264:

provide excessively costly and inef

- Page 265 and 266:

Percent 100 Figure 4-27 Percent of

- Page 267 and 268:

Aggregate spending refers to the to

- Page 269 and 270:

3 Figure 4-29 Trends in Real Health

- Page 271 and 272:

Panel A: Private Insurance Average

- Page 273 and 274:

Figure 4-33 Nominal Per Enrollee He

- Page 275 and 276:

Indeed, Holahan and McMorrow (2015)

- Page 277 and 278:

illustrated in Figure 4-3. As a res

- Page 279 and 280:

Figure 4-36 Unemployment Rate, 2006

- Page 281 and 282:

Average Age 40 Figure 4-37 Average

- Page 283 and 284:

Percent 25 Figure 4-39 Out-of-Pocke

- Page 285 and 286:

suggests that changes in the health

- Page 287 and 288:

egan restraining health care spendi

- Page 289 and 290:

payments made to providers. These p

- Page 291 and 292:

Declines in the Rate of Hospital-Ac

- Page 293 and 294:

Figure 4-43 Medicare 30-Day, All-Co

- Page 295 and 296:

Figure 4-44 Projected National Heal

- Page 297 and 298:

Figure 4-45 Average Nominal Premium

- Page 299 and 300:

2016 Part D premium was $34.10 per

- Page 301 and 302:

Figure 4-47 Deficit Reduction Due t

- Page 303 and 304:

The reforms included in the ACA and

- Page 305 and 306:

Earnings Ratio 1.8 1.7 1.6 1.5 1.4

- Page 307 and 308:

Individual Returns to Higher Educat

- Page 309 and 310:

Rate 100 90 80 70 60 50 40 30 20 10

- Page 311 and 312:

alone would supply an inefficiently

- Page 313 and 314:

The economics literature provides s

- Page 315 and 316:

students who overestimate costs are

- Page 317 and 318:

permanent in 2015; the refundable p

- Page 319 and 320:

Figure 5-6 Annual Percent Change in

- Page 321 and 322:

Figure 5-8 Growth in the Cost of At

- Page 323 and 324:

Figure 5-9 Promise Programs Across

- Page 325 and 326:

Box 5-3: Expansions of Early Educat

- Page 327 and 328:

The evidence suggests that, on aver

- Page 329 and 330:

Rate 16 Figure 5-12 Cohort Default

- Page 331 and 332:

Figure 5-13 Repayment Distribution

- Page 333 and 334:

Figure 5-14 Borrowers in Income Dri

- Page 335 and 336:

efore entering income-driven repaym

- Page 337 and 338:

crucial role in encouraging student

- Page 339 and 340:

College rankings like Forbes, Money

- Page 341 and 342:

Box 5-4: Improving Information to D

- Page 343 and 344:

Figure 5-21 FAFSA Tax Filing Status

- Page 345 and 346:

Staiger 2014), and feedback from ev

- Page 347 and 348:

Box 5-6: The Rise of the For-Profit

- Page 349 and 350:

Figure 5-22 Relationship Between Un

- Page 351 and 352:

tactics (consistent with a 2010 Gov

- Page 353 and 354:

Better information and regulation o

- Page 355 and 356:

hold more capital and have better a

- Page 357 and 358:

and other non-cash payment methods

- Page 359 and 360:

Box 6-1: Financialization of the U.

- Page 361 and 362:

accounted for half of the industry

- Page 363 and 364:

Figure 6-iii Families with Direct o

- Page 365 and 366:

are due in part to information asym

- Page 367 and 368:

Figure 6-1 Household Net Worth in t

- Page 369 and 370:

Figure 6-3 Subprime Mortgage Origin

- Page 371 and 372:

Figure 6-6 Growth of Shadow Banking

- Page 373 and 374:

these financial institutions and th

- Page 375 and 376:

Box 6-2: A Cross-Country Comparison

- Page 377 and 378:

to the larger financial system as s

- Page 379 and 380:

y scoring banks based on their perc

- Page 381 and 382:

Figure 6-8 Tier 1 Common Equity Rat

- Page 383 and 384:

Figure 6-9 Liquidity Ratio for Larg

- Page 385 and 386:

Figure 6-11 Losses for Large U.S. B

- Page 387 and 388:

Figure 6-viii Average Loan Growth o

- Page 389 and 390:

deposits—from 1.15 percent to 1.3

- Page 391 and 392:

U.S. financial stability, subjectin

- Page 393 and 394:

systemic footprint. In April 2015,

- Page 395 and 396:

market fund boards new tools - liqu

- Page 397 and 398:

Figure 6-18 shows that the SRISK me

- Page 399 and 400:

Box 6-4: Have We Ended “Too-Big-T

- Page 401 and 402:

Scholars using each of these method

- Page 403 and 404:

Overall, the funding advantage of g

- Page 405 and 406:

Basis Points (bps) 500 Figure 6-19

- Page 407 and 408:

Figure 6-20 Global OTC Derivatives

- Page 409 and 410:

Figure 6-21 Interest Rate Derivativ

- Page 411 and 412:

to a shareholder advisory vote on e

- Page 413 and 414:

Additional Investor Protections The

- Page 415 and 416:

Figure 6-xii U.S. Retirement Assets

- Page 417 and 418:

ule does not ban such “conflicted

- Page 419 and 420:

Figure 6-22 International Financial

- Page 421 and 422:

tors,” tasked the SEC with ensuri

- Page 423 and 424:

Figure 6-25 Fixed Income Implied Vo

- Page 425 and 426:

peak above 200 in the fall of 2008

- Page 428 and 429:

C H A P T E R 7 ADDRESSING CLIMATE

- Page 430 and 431:

generation from natural gas and ren

- Page 432 and 433:

Figure 7-1 Billion-Dollar Event Typ

- Page 434 and 435:

will strain Federal fire suppressio

- Page 436 and 437:

climate sensitivity.6 With the poss

- Page 438 and 439:

Figure 7-2 Greenhouse Gas Emissions

- Page 440 and 441:

modernization, advanced vehicles an

- Page 442 and 443:

2,200 Figure 7-3 Clean Power Plan P

- Page 444 and 445:

Box 7-1: Quantifying the Benefits o

- Page 446 and 447:

uilding use, and 30 percent of indu

- Page 448 and 449:

Box 7-2: Investing in Clean Energy

- Page 450 and 451:

advanced vehicle technologies (CEA

- Page 452 and 453:

adaptation plans, establishing a st

- Page 454 and 455:

of climate change—a critical comp

- Page 456 and 457:

Index, 2000=1 1.3 1.2 Figure 7-5 GD

- Page 458 and 459:

Figure 7-9 Energy Intensity Project

- Page 460 and 461:

Petroleum consumption was 2 percent

- Page 462 and 463:

Index, 2003=1 1.1 Figure 7-14a Ener

- Page 464 and 465:

Figure 7-15a Carbon Intensity Proje

- Page 466 and 467:

Figure 7-18 Monthly Share of Non-Hy

- Page 468 and 469:

Figure 7-20 U.S. Non-Hydro Renewabl

- Page 470 and 471:

in the United States where new wind

- Page 472 and 473:

Figure 7-24 Growth Rates of GDP, En

- Page 474 and 475:

Figure 7-25 Decomposition of Total

- Page 476 and 477:

Lower carbon intensity also played

- Page 478 and 479:

Figure 7-27 U.S. Net Emissions base

- Page 480 and 481:

Obama and President Xi made a surpr

- Page 482 and 483:

years, accelerate cost reductions f

- Page 484 and 485:

to increase transparency from Burea

- Page 486 and 487:

As penetration of variable energy r

- Page 488 and 489:

accomplishments in the clean energy

- Page 490 and 491:

REFERENCES Chapter 1 Blinder, Alan

- Page 492 and 493:

IMF Country Report 16/220. Washingt

- Page 494 and 495:

of Governors of the Federal Reserve

- Page 496 and 497:

Chapter 3 Aguiar, Mark, and Mark Bi

- Page 498 and 499:

Dahl, Gordon B., and Lance Lochner.

- Page 500 and 501:

Care Act Implementation; Problems R

- Page 502 and 503:

Baicker, Katherine, et al. 2013.

- Page 504 and 505:

Claxton, Gary, Larry Levitt, and Mi

- Page 506 and 507:

Cutler, David M., Mark McClellan, a

- Page 508 and 509:

NBER Working Paper 21352. Cambridge

- Page 510 and 511:

Health Care Payment Learning & Acti

- Page 512 and 513:

Lee, David, and Frank Levy. 2012.

- Page 514 and 515:

accountable-care-organizations-in-2

- Page 516 and 517:

Shekelle, Paul G. 2015. “Electron

- Page 518 and 519:

White, Chapin, and Vivian Yaling Wu

- Page 520 and 521:

Baum, Sandy, Jennifer Ma, and Kathl

- Page 522 and 523:

______. 2014b. “Measuring the Imp

- Page 524 and 525:

Darolia, Rajeev, et al. 2015. “Do

- Page 526 and 527:

Fain, Paul. 2014. “Benefits of Fr

- Page 528 and 529:

Horn, Laura, Xianlei Chen, and Chri

- Page 530 and 531:

Lavecchia, Adam, Heidi Liu, and Phi

- Page 532 and 533:

Nord, Mark, and Mark Prell. 2011.

- Page 534 and 535:

Sun, Stephen, and Constantine Yanne

- Page 536 and 537:

Berk, Jonathan B., and Richard C. G

- Page 538 and 539:

Statistics and Monetary Affairs. (h

- Page 540 and 541:

Bodnar, Paul, and Dave Turk. 2015.

- Page 542 and 543:

______. 2016f. “Workplace Chargin

- Page 544 and 545:

Farmer, E.D., V.G. Newman, and Pete

- Page 546 and 547:

Lenton, Timothy M., et al. 2008.

- Page 548:

Walsh, Bryan. 2010. “Why the Clim

- Page 552 and 553:

letter of transmittal Council of Ec

- Page 554:

Council Members and Their Dates of

- Page 557 and 558:

University of California, Berkeley

- Page 559 and 560:

that some criminal justice policies

- Page 561 and 562:

The Staff of the Council of Economi

- Page 563 and 564:

Interns Student interns provide inv

- Page 566 and 567:

C O N T E N T S GDP, INCOME, PRICES

- Page 568 and 569:

General Notes Detail in these table

- Page 570 and 571:

Table B-1. Percent changes in real

- Page 572 and 573:

Table B-2. Gross domestic product,

- Page 574 and 575:

Table B-4. Growth rates in real gro

- Page 576 and 577:

Year or quarter Total Table B-6. Co

- Page 578 and 579:

Table B-8. New private housing unit

- Page 580 and 581:

Table B-10. Changes in consumer pri

- Page 582 and 583:

Table B-11. Civilian labor force, 1

- Page 584 and 585:

Year or month Table B-13. Unemploym

- Page 586 and 587:

Table B-14. Employees on nonagricul

- Page 588 and 589:

Year or quarter Table B-16. Product

- Page 590 and 591:

Table B-18. Federal receipts, outla

- Page 592 and 593:

Table B-20. Federal receipts, outla

- Page 594 and 595:

Table B-22. State and local governm

- Page 596 and 597:

End of month Table B-24. Estimated

- Page 598 and 599:

Table B-25. Bond yields and interes