Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Company | Group Management Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

Income Statement<br />

Statement of Comprehensive Income<br />

Balance Sheet<br />

Cash Flow Statement<br />

Statement of Changes in Equity<br />

Notes<br />

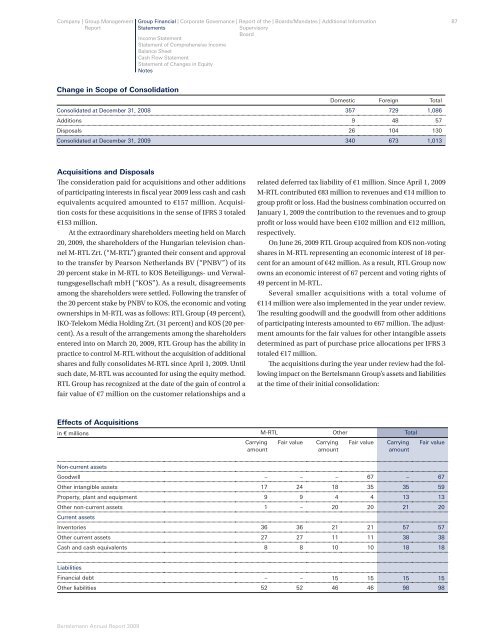

Change in Scope of Consolidation<br />

Domestic Foreign Total<br />

Consolidated at December 31, 2008 357 729 1,086<br />

Additions 9 48 57<br />

Disposals 26 104 130<br />

Consolidated at December 31, 2009 340 673 1,013<br />

Acquisitions and Disposals<br />

Th e consideration paid for acquisitions and other additions<br />

of participating interests in fi scal year 2009 less cash and cash<br />

equivalents acquired amounted to €157 million. Acquisition<br />

costs for these acquisitions in the sense of IFRS 3 totaled<br />

€153 million.<br />

At the extraordinary shareholders meeting held on March<br />

20, 2009, the shareholders of the Hungarian television channel<br />

M-RTL Zrt. (“M-RTL”) granted their consent and approval<br />

to the transfer by Pearson Netherlands BV (“PNBV”) of its<br />

20 percent stake in M-RTL to KOS Beteiligungs- und Verwaltungsgesellschaft<br />

mbH (“KOS”). As a result, disagreements<br />

among the shareholders were settled. Following the transfer of<br />

the 20 percent stake by PNBV to KOS, the economic and voting<br />

ownerships in M-RTL was as follows: RTL Group (49 percent),<br />

IKO-Telekom Média Holding Zrt. (31 percent) and KOS (20 percent).<br />

As a result of the arrangements among the shareholders<br />

entered into on March 20, 2009, RTL Group has the ability in<br />

practice to control M-RTL without the acquisition of additional<br />

shares and fully consolidates M-RTL since April 1, 2009. Until<br />

such date, M-RTL was accounted for using the equity method.<br />

RTL Group has recognized at the date of the gain of control a<br />

fair value of €7 million on the customer relationships and a<br />

Effects of Acquisitions<br />

in € millions M-RTL Other Total<br />

Carrying Fair value Carrying Fair value Carrying Fair value<br />

amount<br />

amount<br />

amount<br />

Non-current assets<br />

Goodwill – – – 67 – 67<br />

Other intangible assets 17 24 18 35 35 59<br />

Property, plant and equipment 9 9 4 4 13 13<br />

Other non-current assets<br />

Current assets<br />

1 – 20 20 21 20<br />

Inventories 36 36 21 21 57 57<br />

Other current assets 27 27 11 11 38 38<br />

Cash and cash equivalents 8 8 10 10 18 18<br />

Liabilities<br />

Financial debt – – 15 15 15 15<br />

Other liabilities 52 52 46 46 98 98<br />

Bertelsmann Annual Report 2009<br />

related deferred tax liability of €1 million. Since April 1, 2009<br />

M-RTL contributed €83 million to revenues and €14 million to<br />

group profi t or loss. Had the business combination occurred on<br />

January 1, 2009 the contribution to the revenues and to group<br />

profi t or loss would have been €102 million and €12 million,<br />

respectively.<br />

On June 26, 2009 RTL Group acquired from KOS non-voting<br />

shares in M-RTL representing an economic interest of 18 percent<br />

for an amount of €42 million. As a result, RTL Group now<br />

owns an economic interest of 67 percent and voting rights of<br />

49 percent in M-RTL.<br />

Several smaller acquisitions with a total volume of<br />

€114 million were also implemented in the year under review.<br />

Th e resulting goodwill and the goodwill from other additions<br />

of participating interests amounted to €67 million. Th e adjustment<br />

amounts for the fair values for other intangible assets<br />

determined as part of purchase price allocations per IFRS 3<br />

totaled €17 million.<br />

Th e acquisitions during the year under review had the following<br />

impact on the Bertelsmann Group’s assets and liabilities<br />

at the time of their initial consolidation:<br />

87