Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

88<br />

Group Financial Statements<br />

Notes<br />

Fair value is primarily measured using the market price-oriented<br />

method. In this method, assets and liabilities are measured at<br />

prices observed in active markets. If measurement using the<br />

market price-oriented method is not feasible, the capitalized<br />

value-oriented method is to be applied. Th is measures fair value<br />

of asset/liabilities as the present value of future net cash fl ows.<br />

Sales proceeds of €-18 million after cash and fi nancial debt<br />

transferred in the transaction were generated from disposals<br />

and other disposals of equity interests.<br />

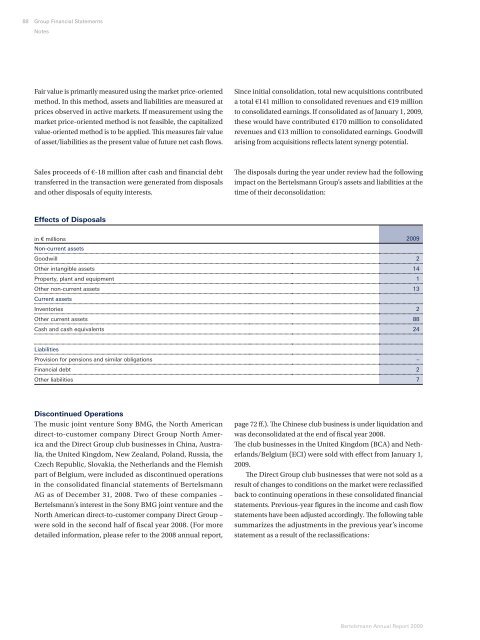

Effects of Disposals<br />

Th e disposals during the year under review had the following<br />

impact on the Bertelsmann Group’s assets and liabilities at the<br />

time of their deconsolidation:<br />

in € millions<br />

Non-current assets<br />

2009<br />

Goodwill 2<br />

Other intangible assets 14<br />

Property, plant and equipment 1<br />

Other non-current assets<br />

Current assets<br />

13<br />

Inventories 2<br />

Other current assets 88<br />

Cash and cash equivalents 24<br />

Liabilities<br />

Provision for pensions and similar obligations –<br />

Financial debt 2<br />

Other liabilities 7<br />

Discontinued Operations<br />

The music joint venture Sony BMG, the North American<br />

direct-to-customer company Direct Group North America<br />

and the Direct Group club businesses in China, Australia,<br />

the United Kingdom, New Zealand, Poland, Russia, the<br />

Czech Republic, Slovakia, the Netherlands and the Flemish<br />

part of Belgium, were included as discontinued operations<br />

in the consolidated financial statements of Bertelsmann<br />

AG as of December 31, 2008. Two of these companies –<br />

Bertelsmann’s interest in the Sony BMG joint venture and the<br />

North American direct-to-customer company Direct Group –<br />

were sold in the second half of fi scal year 2008. (For more<br />

detailed information, please refer to the 2008 annual report,<br />

Since initial consolidation, total new acquisitions contributed<br />

a total €141 million to consolidated revenues and €19 million<br />

to consolidated earnings. If consolidated as of January 1, 2009,<br />

these would have contributed €170 million to consolidated<br />

revenues and €13 million to consolidated earnings. Goodwill<br />

arising from acquisitions refl ects latent synergy potential.<br />

page 72 ff .). Th e Chinese club business is under liquidation and<br />

was deconsolidated at the end of fi scal year 2008.<br />

Th e club businesses in the United Kingdom (BCA) and Netherlands/Belgium<br />

(ECI) were sold with eff ect from January 1,<br />

2009.<br />

Th e Direct Group club businesses that were not sold as a<br />

result of changes to conditions on the market were reclassifi ed<br />

back to continuing operations in these consolidated fi nancial<br />

statements. Previous-year fi gures in the income and cash fl ow<br />

statements have been adjusted accordingly. Th e following table<br />

summarizes the adjustments in the previous year’s income<br />

statement as a result of the reclassifi cations:<br />

Bertelsmann Annual Report 2009