Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company | Group Management | Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

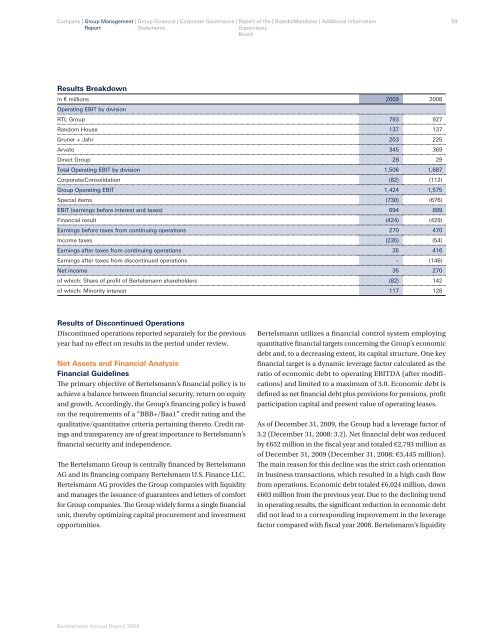

Results Breakdown<br />

in € millions<br />

Operating EBIT by division<br />

2009 2008<br />

RTL Group 793 927<br />

Random House 137 137<br />

Gruner + Jahr 203 225<br />

Arvato 345 369<br />

Direct Group 28 29<br />

Total Operating EBIT by division 1,506 1,687<br />

Corporate/Consolidation (82) (112)<br />

Group Operating EBIT 1,424 1,575<br />

Special items (730) (676)<br />

EBIT (earnings before interest and taxes) 694 899<br />

Financial result (424) (429)<br />

Earnings before taxes from continuing operations 270 470<br />

Income taxes (235) (54)<br />

Earnings after taxes from continuing operations 35 416<br />

Earnings after taxes from discontinued operations – (146)<br />

Net income 35 270<br />

of which: Share of profi t of Bertelsmann shareholders (82) 142<br />

of which: Minority interest 117 128<br />

Results of Discontinued Operations<br />

Discontinued operations reported separately for the previous<br />

year had no eff ect on results in the period under review.<br />

Net Assets and Financial Analysis<br />

Financial Guidelines<br />

Th e primary objective of Bertelsmann’s fi nancial policy is to<br />

achieve a balance between fi nancial security, return on equity<br />

and growth. Accordingly, the Group’s fi nancing policy is based<br />

on the requirements of a “BBB+/Baa1” credit rating and the<br />

qualitative/quantitative criteria pertaining thereto. Credit ratings<br />

and transparency are of great importance to Bertelsmann’s<br />

fi nancial security and independence.<br />

Th e Bertelsmann Group is centrally fi nanced by Bertelsmann<br />

AG and its fi nancing company Bertelsmann U.S. Finance LLC.<br />

Bertelsmann AG provides the Group companies with liquidity<br />

and manages the issuance of guarantees and letters of comfort<br />

for Group companies. Th e Group widely forms a single fi nancial<br />

unit, thereby optimizing capital procurement and investment<br />

opportunities.<br />

Bertelsmann Annual Report 2009<br />

Bertelsmann utilizes a fi nancial control system employing<br />

quantitative fi nancial targets concerning the Group’s economic<br />

debt and, to a decreasing extent, its capital structure. One key<br />

fi nancial target is a dynamic leverage factor calculated as the<br />

ratio of economic debt to operating EBITDA (after modifi -<br />

cations) and limited to a maximum of 3.0. Economic debt is<br />

defi ned as net fi nancial debt plus provisions for pensions, profi t<br />

participation capital and present value of operating leases.<br />

As of December 31, 2009, the Group had a leverage factor of<br />

3.2 (December 31, 2008: 3.2). Net fi nancial debt was reduced<br />

by €652 million in the fi scal year and totaled €2,793 million as<br />

of December 31, 2009 (December 31, 2008: €3,445 million).<br />

Th e main reason for this decline was the strict cash orientation<br />

in business transactions, which resulted in a high cash fl ow<br />

from operations. Economic debt totaled €6,024 million, down<br />

€603 million from the previous year. Due to the declining trend<br />

in operating results, the signifi cant reduction in economic debt<br />

did not lead to a corresponding improvement in the leverage<br />

factor compared with fi scal year 2008. Bertelsmann’s liquidity<br />

59