Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Company | Group Management | Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

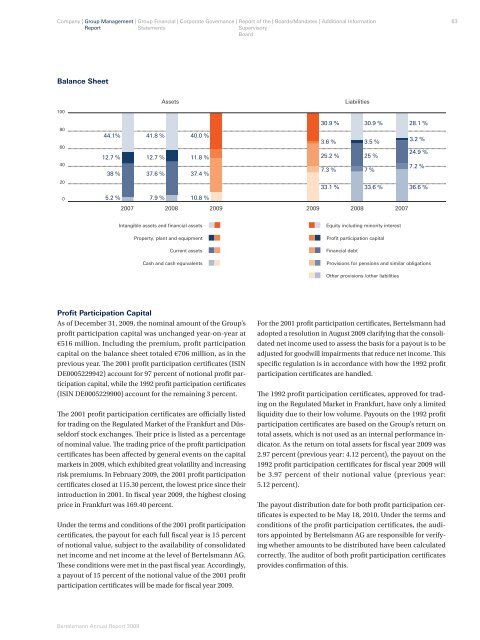

Balance Sheet<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

44.1%<br />

12.7 %<br />

38 %<br />

5.2 %<br />

Profi t Participation Capital<br />

As of December 31, 2009, the nominal amount of the Group’s<br />

profi t participation capital was unchanged year-on-year at<br />

€516 million. Including the premium, profi t participation<br />

capital on the balance sheet totaled €706 million, as in the<br />

previous year. Th e 2001 profi t participation certifi cates (ISIN<br />

DE0005229942) account for 97 percent of notional profi t participation<br />

capital, while the 1992 profi t participation certifi cates<br />

(ISIN DE0005229900) account for the remaining 3 percent.<br />

Th e 2001 profi t participation certifi cates are offi cially listed<br />

for trading on the Regulated Market of the Frankfurt and Düsseldorf<br />

stock exchanges. Th eir price is listed as a percentage<br />

of nominal value. Th e trading price of the profi t participation<br />

certifi cates has been aff ected by general events on the capital<br />

markets in 2009, which exhibited great volatility and increasing<br />

risk premiums. In February 2009, the 2001 profi t participation<br />

certifi cates closed at 115.30 percent, the lowest price since their<br />

introduction in 2001. In fi scal year 2009, the highest closing<br />

price in Frankfurt was 169.40 percent.<br />

Under the terms and conditions of the 2001 profi t participation<br />

certifi cates, the payout for each full fi scal year is 15 percent<br />

of notional value, subject to the availability of consolidated<br />

net income and net income at the level of Bertelsmann AG.<br />

Th ese conditions were met in the past fi scal year. Accordingly,<br />

a payout of 15 percent of the notional value of the 2001 profi t<br />

participation certifi cates will be made for fi scal year 2009.<br />

Bertelsmann Annual Report 2009<br />

41.8 %<br />

12.7 %<br />

37.6 %<br />

7.9 %<br />

2007 2008<br />

40.0 %<br />

11.8 %<br />

37.4 %<br />

10.8 %<br />

Intangible assets and financial assets<br />

Assets Liabilities<br />

Property, plant and equipment<br />

Current assets<br />

Cash and cash equivalents<br />

2009<br />

30.9 %<br />

3.6 %<br />

25.2 %<br />

7.3 %<br />

33.1 %<br />

30.9 %<br />

3.5 %<br />

25 %<br />

7 %<br />

33.6 %<br />

2009 2008<br />

2007<br />

Equity including minority interest<br />

Profit participation capital<br />

Financial debt<br />

28.1 %<br />

24.9 %<br />

7.2 %<br />

36.6 %<br />

Provisions for pensions and similar obligations<br />

Other provisions /other liabilities<br />

3.2 %<br />

For the 2001 profi t participation certifi cates, Bertelsmann had<br />

adopted a resolution in August 2009 clarifying that the consolidated<br />

net income used to assess the basis for a payout is to be<br />

adjusted for goodwill impairments that reduce net income. Th is<br />

specifi c regulation is in accordance with how the 1992 profi t<br />

participation certifi cates are handled.<br />

Th e 1992 profi t participation certifi cates, approved for trading<br />

on the Regulated Market in Frankfurt, have only a limited<br />

liquidity due to their low volume. Payouts on the 1992 profi t<br />

participation certifi cates are based on the Group’s return on<br />

total assets, which is not used as an internal performance indicator.<br />

As the return on total assets for fi scal year 2009 was<br />

2.97 percent (previous year: 4.12 percent), the payout on the<br />

1992 profi t participation certifi cates for fi scal year 2009 will<br />

be 3.97 percent of their notional value (previous year:<br />

5.12 percent).<br />

Th e payout distribution date for both profi t participation certifi<br />

cates is expected to be May 18, 2010. Under the terms and<br />

conditions of the profi t participation certifi cates, the auditors<br />

appointed by Bertelsmann AG are responsible for verifying<br />

whether amounts to be distributed have been calculated<br />

correctly. Th e auditor of both profi t participation certifi cates<br />

provides confi rmation of this.<br />

63