Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

106<br />

Group Financial Statements<br />

Notes<br />

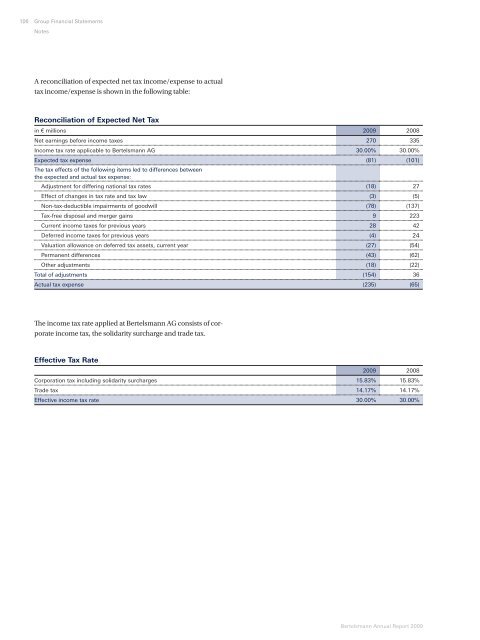

A reconciliation of expected net tax income/expense to actual<br />

tax income/expense is shown in the following table:<br />

Reconciliation of Expected Net Tax<br />

in € millions 2009 2008<br />

Net earnings before income taxes 270 335<br />

Income tax rate applicable to Bertelsmann AG 30.00% 30.00%<br />

Expected tax expense<br />

The tax effects of the following items led to differences between<br />

the expected and actual tax expense:<br />

(81) (101)<br />

Adjustment for differing national tax rates (18) 27<br />

Effect of changes in tax rate and tax law (3) (5)<br />

Non-tax-deductible impairments of goodwill (78) (137)<br />

Tax-free disposal and merger gains 9 223<br />

Current income taxes for previous years 28 42<br />

Deferred income taxes for previous years (4) 24<br />

Valuation allowance on deferred tax assets, current year (27) (54)<br />

Permanent differences (43) (62)<br />

Other adjustments (18) (22)<br />

Total of adjustments (154) 36<br />

Actual tax expense (235) (65)<br />

Th e income tax rate applied at Bertelsmann AG consists of corporate<br />

income tax, the solidarity surcharge and trade tax.<br />

Effective Tax Rate<br />

2009 2008<br />

Corporation tax including solidarity surcharges 15.83% 15.83%<br />

Trade tax 14.17% 14.17%<br />

Effective income tax rate 30.00% 30.00%<br />

Bertelsmann Annual Report 2009