Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company | Group Management Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

Income Statement<br />

Statement of Comprehensive Income<br />

Balance Sheet<br />

Cash Flow Statement<br />

Statement of Changes in Equity<br />

Notes<br />

Th e non-current fi nancial debt recognized by the Group includes<br />

transaction costs and is adjusted over time. Foreigncurrency<br />

liabilities are translated at the exchange rate at the<br />

balance sheet date. Th e Bertelsmann Group has access to<br />

variable-rate and fi xed-rate funds through various contractual<br />

arrangements. Financial debt is generally unsecured and<br />

all has the same priority.<br />

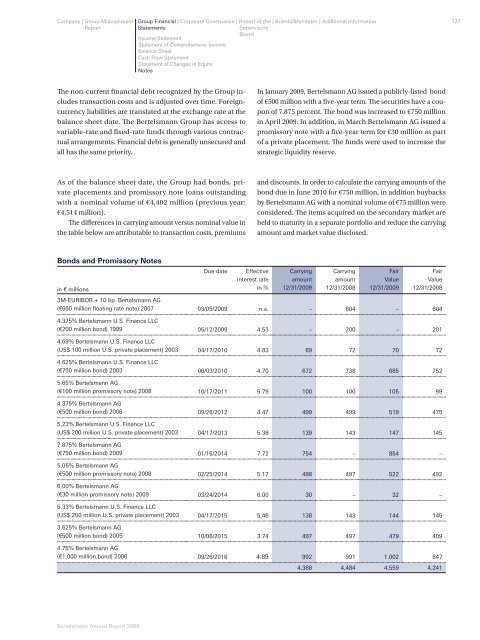

As of the balance sheet date, the Group had bonds, private<br />

placements and promissory note loans outstanding<br />

with a nominal volume of €4,402 million (previous year:<br />

€4,514 million).<br />

Th e diff erences in carrying amount versus nominal value in<br />

the table below are attributable to transaction costs, premiums<br />

Bonds and Promissory Notes<br />

in € millions<br />

Bertelsmann Annual Report 2009<br />

Due date Effective<br />

interest rate<br />

in %<br />

In January 2009, Bertelsmann AG issued a publicly-listed bond<br />

of €500 million with a fi ve-year term. Th e securities have a coupon<br />

of 7.875 percent. Th e bond was increased to €750 million<br />

in April 2009. In addition, in March Bertelsmann AG issued a<br />

promissory note with a fi ve-year term for €30 million as part<br />

of a private placement. Th e funds were used to increase the<br />

strategic liquidity reserve.<br />

and discounts. In order to calculate the carrying amounts of the<br />

bond due in June 2010 for €750 million, in addition buybacks<br />

by Bertelsmann AG with a nominal volume of €75 million were<br />

considered. Th e items acquired on the secondary market are<br />

held to maturity in a separate portfolio and reduce the carrying<br />

amount and market value disclosed.<br />

Carrying<br />

amount<br />

12/31/2009<br />

Carrying<br />

amount<br />

12/31/2008<br />

Fair<br />

Value<br />

12/31/2009<br />

Fair<br />

Value<br />

12/31/2008<br />

3M-EURIBOR + 10 bp. Bertelsmann AG<br />

(€650 million fl oating rate note) 2007 03/05/2009 n.a. – 604 – 604<br />

4.375% Bertelsmann U.S. Finance LLC<br />

(€200 million bond) 1999 05/12/2009 4.53 – 200 – 201<br />

4.69% Bertelsmann U.S. Finance LLC<br />

(US$ 100 million U.S. private placement) 2003 04/17/2010 4.83 69 72 70 72<br />

4.625% Bertelsmann U.S. Finance LLC<br />

(€750 million bond) 2003 06/03/2010 4.70 672 738 685 752<br />

5.65% Bertelsmann AG<br />

(€100 million promissory note) 2008 10/17/2011 5.79 100 100 105 99<br />

4.375% Bertelsmann AG<br />

(€500 million bond) 2006 09/26/2012 4.47 499 499 519 475<br />

5.23% Bertelsmann U.S. Finance LLC<br />

(US$ 200 million U.S. private placement) 2003 04/17/2013 5.38 139 143 147 145<br />

7.875% Bertelsmann AG<br />

(€750 million bond) 2009 01/16/2014 7.72 754 – 854 –<br />

5.05% Bertelsmann AG<br />

(€500 million promissory note) 2008 02/25/2014 5.17 498 497 522 492<br />

6.00% Bertelsmann AG<br />

(€30 million promissory note) 2009 03/24/2014 6.00 30 – 32 –<br />

5.33% Bertelsmann U.S. Finance LLC<br />

(US$ 200 million U.S. private placement) 2003 04/17/2015 5.46 138 143 144 145<br />

3.625% Bertelsmann AG<br />

(€500 million bond) 2005 10/06/2015 3.74 497 497 479 409<br />

4.75% Bertelsmann AG<br />

(€1,000 million bond) 2006 09/26/2016 4.89 992 991 1.002 847<br />

4,388 4,484 4,559 4,241<br />

127