Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Company | Group Management Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

Income Statement<br />

Statement of Comprehensive Income<br />

Balance Sheet<br />

Cash Flow Statement<br />

Statement of Changes in Equity<br />

Notes<br />

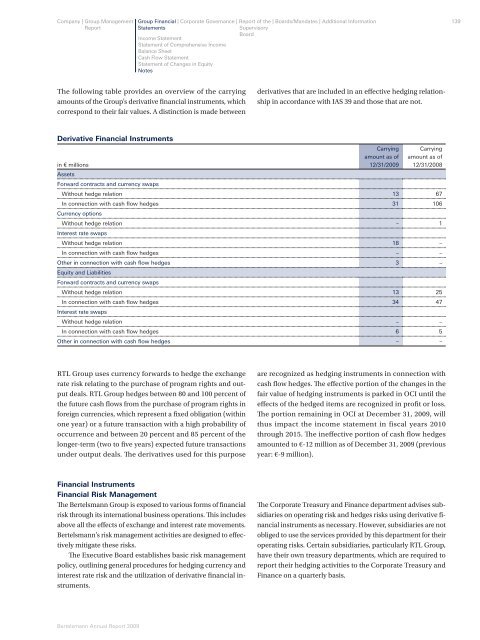

The following table provides an overview of the carrying<br />

amounts of the Group’s derivative fi nancial instruments, which<br />

correspond to their fair values. A distinction is made between<br />

Financial Instruments<br />

Financial Risk Management<br />

Th e Bertelsmann Group is exposed to various forms of fi nancial<br />

risk through its international business operations. Th is includes<br />

above all the eff ects of exchange and interest rate movements.<br />

Bertelsmann’s risk management activities are designed to eff ectively<br />

mitigate these risks.<br />

Th e Executive Board establishes basic risk management<br />

policy, outlining general procedures for hedging currency and<br />

interest rate risk and the utilization of derivative fi nancial instruments.<br />

Bertelsmann Annual Report 2009<br />

derivatives that are included in an eff ective hedging relationship<br />

in accordance with IAS 39 and those that are not.<br />

Derivative Financial Instruments<br />

Carrying Carrying<br />

amount as of amount as of<br />

in € millions<br />

Assets<br />

Forward contracts and currency swaps<br />

12/31/2009 12/31/2008<br />

Without hedge relation 13 67<br />

In connection with cash fl ow hedges<br />

Currency options<br />

31 106<br />

Without hedge relation<br />

Interest rate swaps<br />

– 1<br />

Without hedge relation 18 –<br />

In connection with cash fl ow hedges – –<br />

Other in connection with cash fl ow hedges<br />

Equity and Liabilities<br />

Forward contracts and currency swaps<br />

3 –<br />

Without hedge relation 13 25<br />

In connection with cash fl ow hedges<br />

Interest rate swaps<br />

34 47<br />

Without hedge relation – –<br />

In connection with cash fl ow hedges 6 5<br />

Other in connection with cash fl ow hedges – –<br />

RTL Group uses currency forwards to hedge the exchange<br />

rate risk relating to the purchase of program rights and output<br />

deals. RTL Group hedges between 80 and 100 percent of<br />

the future cash fl ows from the purchase of program rights in<br />

foreign currencies, which represent a fi xed obligation (within<br />

one year) or a future transaction with a high probability of<br />

occurrence and between 20 percent and 85 percent of the<br />

longer-term (two to fi ve years) expected future transactions<br />

under output deals. Th e derivatives used for this purpose<br />

are recognized as hedging instruments in connection with<br />

cash fl ow hedges. Th e eff ective portion of the changes in the<br />

fair value of hedging instruments is parked in OCI until the<br />

eff ects of the hedged items are recognized in profi t or loss.<br />

Th e portion remaining in OCI at December 31, 2009, will<br />

thus impact the income statement in fiscal years 2010<br />

through 2015. Th e ineff ective portion of cash fl ow hedges<br />

amounted to €-12 million as of December 31, 2009 (previous<br />

year: €-9 million).<br />

Th e Corporate Treasury and Finance department advises subsidiaries<br />

on operating risk and hedges risks using derivative fi -<br />

nancial instruments as necessary. However, subsidiaries are not<br />

obliged to use the services provided by this department for their<br />

operating risks. Certain subsidiaries, particularly RTL Group,<br />

have their own treasury departments, which are required to<br />

report their hedging activities to the Corporate Treasury and<br />

Finance on a quarterly basis.<br />

139