Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Company | Group Management Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

Income Statement<br />

Statement of Comprehensive Income<br />

Balance Sheet<br />

Cash Flow Statement<br />

Statement of Changes in Equity<br />

Notes<br />

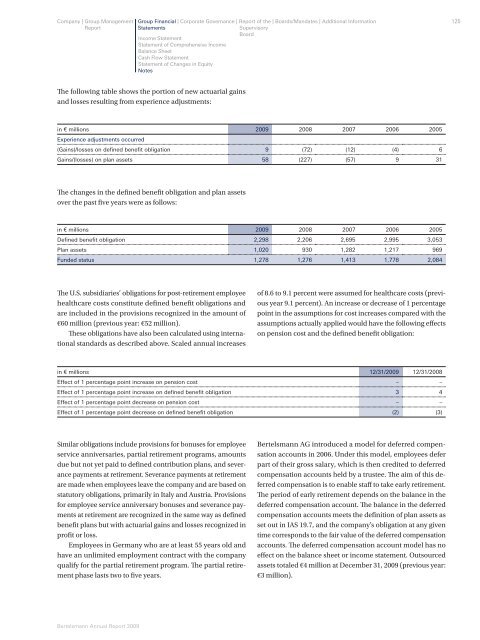

Th e following table shows the portion of new actuarial gains<br />

and losses resulting from experience adjustments:<br />

in € millions<br />

Experience adjustments occurred<br />

2009 2008 2007 2006 2005<br />

(Gains)/losses on defi ned benefi t obligation 9 (72) (12) (4) 6<br />

Gains/(losses) on plan assets 58 (227) (57) 9 31<br />

Th e changes in the defi ned benefi t obligation and plan assets<br />

over the past fi ve years were as follows:<br />

in € millions 2009 2008 2007 2006 2005<br />

Defi ned benefi t obligation 2,298 2,206 2,695 2,995 3,053<br />

Plan assets 1,020 930 1,282 1,217 969<br />

Funded status 1,278 1,276 1,413 1,778 2,084<br />

Th e U.S. subsidiaries’ obligations for post-retirement employee<br />

healthcare costs constitute defi ned benefi t obligations and<br />

are included in the provisions recognized in the amount of<br />

€60 million (previous year: €52 million).<br />

Th ese obligations have also been calculated using international<br />

standards as described above. Scaled annual increases<br />

Bertelsmann Annual Report 2009<br />

of 8.6 to 9.1 percent were assumed for healthcare costs (previous<br />

year 9.1 percent). An increase or decrease of 1 percentage<br />

point in the assumptions for cost increases compared with the<br />

assumptions actually applied would have the following eff ects<br />

on pension cost and the defi ned benefi t obligation:<br />

in € millions 12/31/2009 12/31/2008<br />

Effect of 1 percentage point increase on pension cost – –<br />

Effect of 1 percentage point increase on defi ned benefi t obligation 3 4<br />

Effect of 1 percentage point decrease on pension cost – –<br />

Effect of 1 percentage point decrease on defi ned benefi t obligation (2) (3)<br />

Similar obligations include provisions for bonuses for employee<br />

service anniversaries, partial retirement programs, amounts<br />

due but not yet paid to defi ned contribution plans, and severance<br />

payments at retirement. Severance payments at retirement<br />

are made when employees leave the company and are based on<br />

statutory obligations, primarily in Italy and Austria. Provisions<br />

for employee service anniversary bonuses and severance payments<br />

at retirement are recognized in the same way as defi ned<br />

benefi t plans but with actuarial gains and losses recognized in<br />

profi t or loss.<br />

Employees in Germany who are at least 55 years old and<br />

have an unlimited employment contract with the company<br />

qualify for the partial retirement program. Th e partial retirement<br />

phase lasts two to fi ve years.<br />

Bertelsmann AG introduced a model for deferred compensation<br />

accounts in 2006. Under this model, employees defer<br />

part of their gross salary, which is then credited to deferred<br />

compensation accounts held by a trustee. Th e aim of this deferred<br />

compensation is to enable staff to take early retirement.<br />

Th e period of early retirement depends on the balance in the<br />

deferred compensation account. Th e balance in the deferred<br />

compensation accounts meets the defi nition of plan assets as<br />

set out in IAS 19.7, and the company’s obligation at any given<br />

time corresponds to the fair value of the deferred compensation<br />

accounts. Th e deferred compensation account model has no<br />

eff ect on the balance sheet or income statement. Outsourced<br />

assets totaled €4 million at December 31, 2009 (previous year:<br />

€3 million).<br />

125