Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

126<br />

Group Financial Statements<br />

Notes<br />

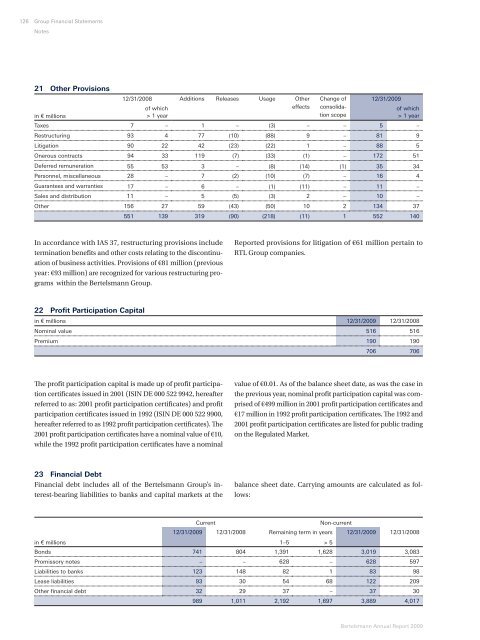

21 Other Provisions<br />

12/31/2008 Additions Releases Usage Other Change of 12/31/2009<br />

of which<br />

effects consolida-<br />

of which<br />

in € millions<br />

> 1 year<br />

tion scope<br />

> 1 year<br />

Taxes 7 – 1 – (3) – – 5 –<br />

Restructuring 93 4 77 (10) (88) 9 – 81 9<br />

Litigation 90 22 42 (23) (22) 1 – 88 5<br />

Onerous contracts 94 33 119 (7) (33) (1) – 172 51<br />

Deferred remuneration 55 53 3 – (8) (14) (1) 35 34<br />

Personnel, miscellaneous 28 – 7 (2) (10) (7) – 16 4<br />

Guarantees and warranties 17 – 6 – (1) (11) – 11 –<br />

Sales and distribution 11 – 5 (5) (3) 2 – 10 –<br />

Other 156 27 59 (43) (50) 10 2 134 37<br />

551 139 319 (90) (218) (11) 1 552 140<br />

In accordance with IAS 37, restructuring provisions include<br />

termination benefi ts and other costs relating to the discontinuation<br />

of business activities. Provisions of €81 million (previous<br />

year: €93 million) are recognized for various restructuring programs<br />

within the Bertelsmann Group.<br />

Reported provisions for litigation of €61 million pertain to<br />

RTL Group companies.<br />

22 Profi t Participation Capital<br />

in € millions 12/31/2009 12/31/2008<br />

Nominal value 516 516<br />

Premium 190 190<br />

706 706<br />

Th e profi t participation capital is made up of profi t participation<br />

certifi cates issued in 2001 (ISIN DE 000 522 9942, hereafter<br />

referred to as: 2001 profi t participation certifi cates) and profi t<br />

participation certifi cates issued in 1992 (ISIN DE 000 522 9900,<br />

hereafter referred to as 1992 profi t participation certifi cates). Th e<br />

2001 profi t participation certifi cates have a nominal value of €10,<br />

while the 1992 profi t participation certifi cates have a nominal<br />

23 Financial Debt<br />

Financial debt includes all of the Bertelsmann Group’s interest-bearing<br />

liabilities to banks and capital markets at the<br />

value of €0.01. As of the balance sheet date, as was the case in<br />

the previous year, nominal profi t participation capital was comprised<br />

of €499 million in 2001 profi t participation certifi cates and<br />

€17 million in 1992 profi t participation certifi cates. Th e 1992 and<br />

2001 profi t participation certifi cates are listed for public trading<br />

on the Regulated Market.<br />

balance sheet date. Carrying amounts are calculated as follows:<br />

Current Non-current<br />

12/31/2009 12/31/2008 Remaining term in years 12/31/2009 12/31/2008<br />

in € millions 1–5 > 5<br />

Bonds 741 804 1,391 1,628 3,019 3,083<br />

Promissory notes – – 628 – 628 597<br />

Liabilities to banks 123 148 82 1 83 98<br />

Lease liabilities 93 30 54 68 122 209<br />

Other fi nancial debt 32 29 37 – 37 30<br />

989 1,011 2,192 1,697 3,889 4,017<br />

Bertelsmann Annual Report 2009