Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

134<br />

Group Financial Statements<br />

Notes<br />

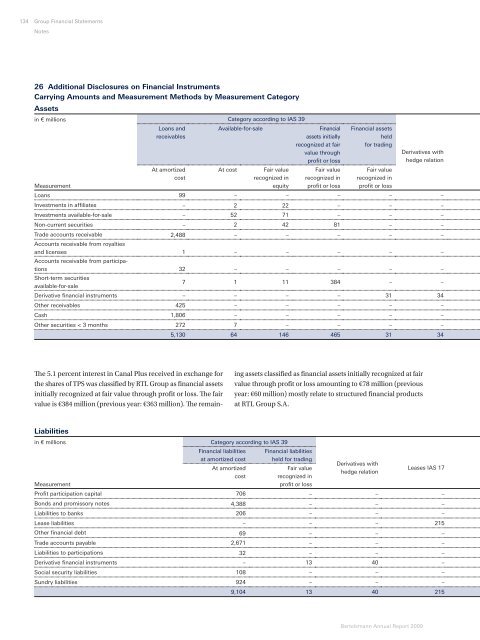

26 Additional Disclosures on Financial Instruments<br />

Carrying Amounts and Measurement Methods by Measurement Category<br />

Assets<br />

in € millions Category according to IAS 39<br />

Loans and<br />

receivables<br />

Available-for-sale Financial<br />

assets initially<br />

recognized at fair<br />

value through<br />

profit or loss<br />

Financial assets<br />

held<br />

for trading<br />

Derivatives with<br />

hedge relation<br />

At amortized<br />

At cost Fair value Fair value Fair value<br />

cost<br />

recognized in recognized in recognized in<br />

Measurement<br />

equity profi t or loss profi t or loss<br />

Loans 99 – – – – –<br />

Investments in affi liates – 2 22 – – –<br />

Investments available-for-sale – 52 71 – – –<br />

Non-current securities – 2 42 81 – –<br />

Trade accounts receivable<br />

Accounts receivable from royalties<br />

2,488 – – – – –<br />

and licenses<br />

Accounts receivable from participa-<br />

1 – – – – –<br />

tions 32 – – – – –<br />

Short-term securities<br />

available-for-sale<br />

7 1 11 384 – –<br />

Derivative fi nancial instruments – – – – 31 34<br />

Other receivables 425 – – – – –<br />

Cash 1,806 – – – – –<br />

Other securities < 3 months 272 7 – – – –<br />

5,130 64 146 465 31 34<br />

Th e 5.1 percent interest in Canal Plus received in exchange for<br />

the shares of TPS was classifi ed by RTL Group as fi nancial assets<br />

initially recognized at fair value through profi t or loss. Th e fair<br />

value is €384 million (previous year: €363 million). Th e remain-<br />

ing assets classifi ed as fi nancial assets initially recognized at fair<br />

value through profi t or loss amounting to €78 million (previous<br />

year: €60 million) mostly relate to structured fi nancial products<br />

at RTL Group S.A.<br />

Liabilities<br />

in € millions Category according to IAS 39<br />

Financial liabilities Financial liabilities<br />

at amortized cost<br />

At amortized<br />

cost<br />

held for trading<br />

Fair value<br />

recognized in<br />

Derivatives with<br />

hedge relation<br />

Leases IAS 17<br />

Measurement<br />

profi t or loss<br />

Profi t participation capital 706 – – –<br />

Bonds and promissory notes 4,388 – – –<br />

Liabilities to banks 206 – – –<br />

Lease liabilities – – – 215<br />

Other fi nancial debt 69 – – –<br />

Trade accounts payable 2,671 – – –<br />

Liabilities to participations 32 – – –<br />

Derivative fi nancial instruments – 13 40 –<br />

Social security liabilities 108 – – –<br />

Sundry liabilities 924 – – –<br />

9,104 13 40 215<br />

Bertelsmann Annual Report 2009