Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

144<br />

Group Financial Statements<br />

Notes<br />

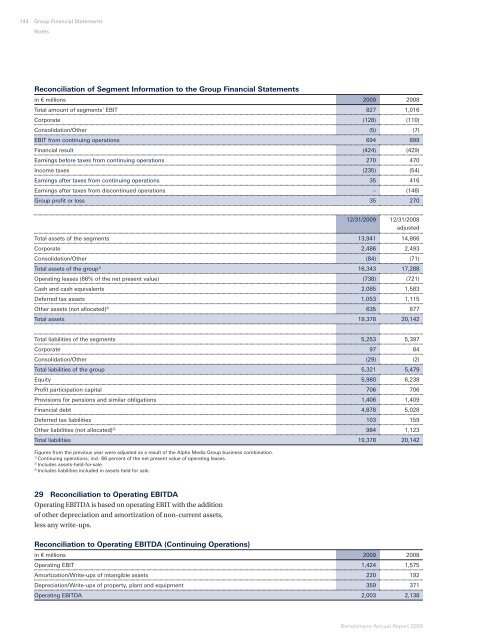

Reconciliation of Segment Information to the Group Financial Statements<br />

in € millions 2009 2008<br />

Total amount of segments' EBIT 827 1,016<br />

Corporate (128) (110)<br />

Consolidation/Other (5) (7)<br />

EBIT from continuing operations 694 899<br />

Financial result (424) (429)<br />

Earnings before taxes from continuing operations 270 470<br />

Income taxes (235) (54)<br />

Earnings after taxes from continuing operations 35 416<br />

Earnings after taxes from discontinued operations – (146)<br />

Group profi t or loss 35 270<br />

12/31/2009 12/31/2008<br />

adjusted<br />

Total assets of the segments 13,941 14,866<br />

Corporate 2,486 2,493<br />

Consolidation/Other (84) (71)<br />

Total assets of the group1) 16,343 17,288<br />

Operating leases (66% of the net present value) (738) (721)<br />

Cash and cash equivalents 2,085 1,583<br />

Deferred tax assets 1,053 1,115<br />

Other assets (not allocated) 2) 635 877<br />

Total assets 19,378 20,142<br />

Total liabilities of the segments 5,253 5,397<br />

Corporate 97 84<br />

Consolidation/Other (29) (2)<br />

Total liabilities of the group 5,321 5,479<br />

Equity 5,980 6,238<br />

Profi t participation capital 706 706<br />

Provisions for pensions and similar obligations 1,406 1,409<br />

Financial debt 4,878 5,028<br />

Deferred tax liabilities 103 159<br />

Other liabilities (not allocated) 3) 984 1,123<br />

Total liabilities 19,378 20,142<br />

Figures from the previous year were adjusted as a result of the Alpha Media Group business combination.<br />

1) Continuing operations; incl. 66 percent of the net present value of operating leases.<br />

2) Includes assets-held-for-sale.<br />

3) Includes liabilities included in assets held for sale.<br />

29 Reconciliation to Operating EBITDA<br />

Operating EBITDA is based on operating EBIT with the addition<br />

of other depreciation and amortization of non-current assets,<br />

less any write-ups.<br />

Reconciliation to Operating EBITDA (Continuing Operations)<br />

in € millions 2009 2008<br />

Operating EBIT 1,424 1,575<br />

Amortization/Write-ups of intangible assets 220 192<br />

Depreciation/Write-ups of property, plant and equipment 359 371<br />

Operating EBITDA 2,003 2,138<br />

Bertelsmann Annual Report 2009