Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company | Group Management | Group Financial | Corporate Governance | Report of the | Boards/Mandates Additional Information<br />

Report Statements Supervisory<br />

Board<br />

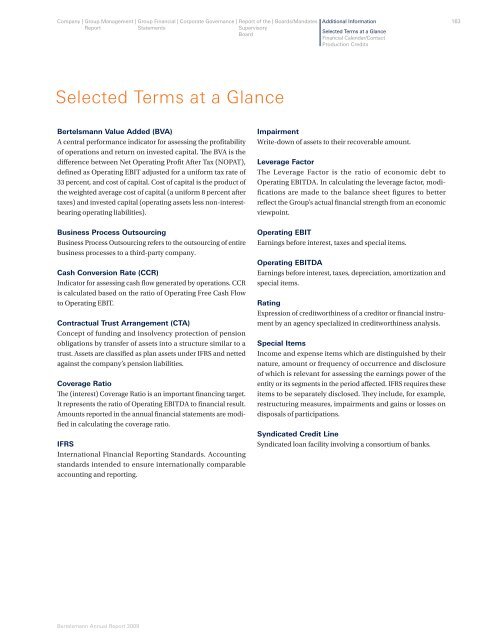

Selected Terms at a Glance<br />

Bertelsmann Value Added (BVA)<br />

A central performance indicator for assessing the profi tability<br />

of operations and return on invested capital. Th e BVA is the<br />

diff erence between Net Operating Profi t After Tax (NOPAT),<br />

defi ned as Operating EBIT adjusted for a uniform tax rate of<br />

33 percent, and cost of capital. Cost of capital is the product of<br />

the weighted average cost of capital (a uniform 8 percent after<br />

taxes) and invested capital (operating assets less non-interestbearing<br />

operating liabilities).<br />

Business Process Outsourcing<br />

Business Process Outsourcing refers to the outsourcing of entire<br />

business processes to a third-party company.<br />

Cash Conversion Rate (CCR)<br />

Indicator for assessing cash fl ow generated by operations. CCR<br />

is calculated based on the ratio of Operating Free Cash Flow<br />

to Operating EBIT.<br />

Contractual Trust Arrangement (CTA)<br />

Concept of funding and insolvency protection of pension<br />

obligations by transfer of assets into a structure similar to a<br />

trust. Assets are classifi ed as plan assets under IFRS and netted<br />

against the company’s pension liabilities.<br />

Coverage Ratio<br />

Th e (interest) Coverage Ratio is an important fi nancing target.<br />

It represents the ratio of Operating EBITDA to fi nancial result.<br />

Amounts reported in the annual fi nancial statements are modifi<br />

ed in calculating the coverage ratio.<br />

IFRS<br />

International Financial Reporting Standards. Accounting<br />

standards intended to ensure internationally comparable<br />

accounting and reporting.<br />

Bertelsmann Annual Report 2009<br />

Selected Terms at a Glance<br />

Financial Calendar/Contact<br />

Production Credits<br />

Impairment<br />

Write-down of assets to their recoverable amount.<br />

Leverage Factor<br />

The Leverage Factor is the ratio of economic debt to<br />

Operating EBITDA. In calculating the leverage factor, modifications<br />

are made to the balance sheet figures to better<br />

refl ect the Group’s actual fi nancial strength from an economic<br />

viewpoint.<br />

Operating EBIT<br />

Earnings before interest, taxes and special items.<br />

Operating EBITDA<br />

Earnings before interest, taxes, depreciation, amortization and<br />

special items.<br />

Rating<br />

Expression of creditworthiness of a creditor or fi nancial instrument<br />

by an agency specialized in creditworthiness analysis.<br />

Special Items<br />

Income and expense items which are distinguished by their<br />

nature, amount or frequency of occurrence and disclosure<br />

of which is relevant for assessing the earnings power of the<br />

entity or its segments in the period aff ected. IFRS requires these<br />

items to be separately disclosed. Th ey include, for example,<br />

restructuring measures, impairments and gains or losses on<br />

disposals of participations.<br />

Syndicated Credit Line<br />

Syndicated loan facility involving a consortium of banks.<br />

163