Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

122<br />

Group Financial Statements<br />

Notes<br />

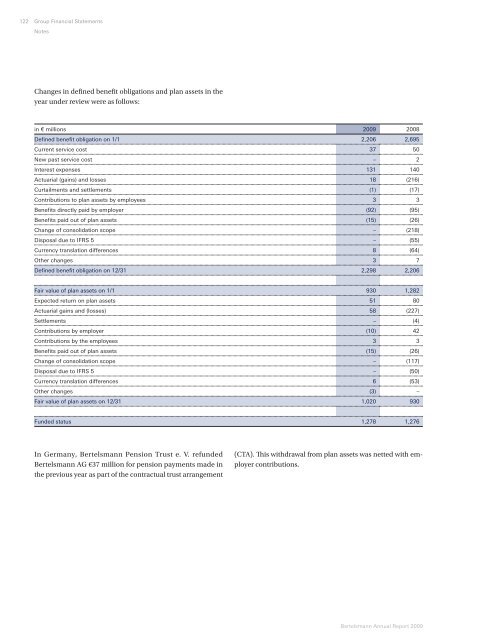

Changes in defi ned benefi t obligations and plan assets in the<br />

year under review were as follows:<br />

in € millions 2009 2008<br />

Defi ned benefi t obligation on 1/1 2,206 2,695<br />

Current service cost 37 50<br />

New past service cost – 2<br />

Interest expenses 131 140<br />

Actuarial (gains) and losses 18 (216)<br />

Curtailments and settlements (1) (17)<br />

Contributions to plan assets by employees 3 3<br />

Benefi ts directly paid by employer (92) (95)<br />

Benefi ts paid out of plan assets (15) (26)<br />

Change of consolidation scope – (218)<br />

Disposal due to IFRS 5 – (55)<br />

Currency translation differences 8 (64)<br />

Other changes 3 7<br />

Defi ned benefi t obligation on 12/31 2,298 2,206<br />

Fair value of plan assets on 1/1 930 1,282<br />

Expected return on plan assets 51 80<br />

Actuarial gains and (losses) 58 (227)<br />

Settlements – (4)<br />

Contributions by employer (10) 42<br />

Contributions by the employees 3 3<br />

Benefi ts paid out of plan assets (15) (26)<br />

Change of consolidation scope – (117)<br />

Disposal due to IFRS 5 – (50)<br />

Currency translation differences 6 (53)<br />

Other changes (3) –<br />

Fair value of plan assets on 12/31 1,020 930<br />

Funded status 1,278 1,276<br />

In Germany, Bertelsmann Pension Trust e. V. refunded<br />

Bertelsmann AG €37 million for pension payments made in<br />

the previous year as part of the contractual trust arrangement<br />

(CTA). Th is withdrawal from plan assets was netted with employer<br />

contributions.<br />

Bertelsmann Annual Report 2009