Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company | Group Management Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

Income Statement<br />

Statement of Comprehensive Income<br />

Balance Sheet<br />

Cash Flow Statement<br />

Statement of Changes in Equity<br />

Notes<br />

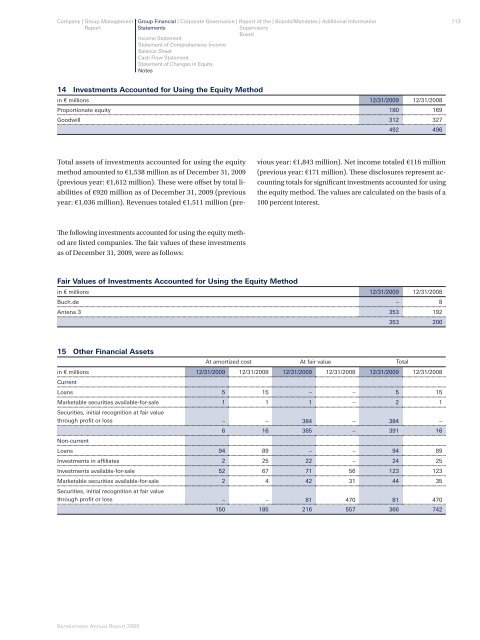

14 Investments Accounted for Using the Equity Method<br />

in € millions 12/31/2009 12/31/2008<br />

Proportionate equity 180 169<br />

Goodwill 312 327<br />

492 496<br />

Total assets of investments accounted for using the equity<br />

method amounted to €1,538 million as of December 31, 2009<br />

(previous year: €1,612 million). Th ese were off set by total liabilities<br />

of €920 million as of December 31, 2009 (previous<br />

year: €1,036 million). Revenues totaled €1,511 million (pre-<br />

Th e following investments accounted for using the equity method<br />

are listed companies. Th e fair values of these investments<br />

as of December 31, 2009, were as follows:<br />

Bertelsmann Annual Report 2009<br />

vious year: €1,843 million). Net income totaled €116 million<br />

(previous year: €171 million). Th ese disclosures represent accounting<br />

totals for signifi cant investments accounted for using<br />

the equity method. Th e values are calculated on the basis of a<br />

100 percent interest.<br />

Fair <strong>Values</strong> of Investments Accounted for Using the Equity Method<br />

in € millions 12/31/2009 12/31/2008<br />

Buch.de – 8<br />

Antena 3 353 192<br />

353 200<br />

15 Other Financial Assets<br />

At amortized cost At fair value Total<br />

in € millions<br />

Current<br />

12/31/2009 12/31/2008 12/31/2009 12/31/2008 12/31/2009 12/31/2008<br />

Loans 5 15 – – 5 15<br />

Marketable securities available-for-sale<br />

Securities, initial recognition at fair value<br />

1 1 1 – 2 1<br />

through profi t or loss – – 384 – 384 –<br />

Non-current<br />

6 16 385 – 391 16<br />

Loans 94 89 – – 94 89<br />

Investments in affi liates 2 25 22 – 24 25<br />

Investments available-for-sale 52 67 71 56 123 123<br />

Marketable securities available-for-sale<br />

Securities, initial recognition at fair value<br />

2 4 42 31 44 35<br />

through profi t or loss – – 81 470 81 470<br />

150 185 216 557 366 742<br />

113