Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

138<br />

Group Financial Statements<br />

Notes<br />

Accounting of Derivative Financial Instruments<br />

and Hedges<br />

All derivatives are reported at their fair value. When a contract<br />

involving a derivative is entered into, it is determined whether<br />

that contract is intended to serve as a fair value hedge or as a<br />

cash fl ow hedge. Some derivatives do not meet the requirements<br />

for recognition as hedges, however, even though they<br />

function this way fi nancially.<br />

Bertelsmann documents all relationships between hedging<br />

instruments and hedged items as well as its risk management<br />

Financial Derivatives<br />

Bertelsmann uses standard market fi nancial derivatives, primarily<br />

unlisted (OTC) instruments, and in particular forward<br />

agreements, currency swaps, currency options, interest rate<br />

swaps and individual commodities forwards. Transactions are<br />

entered into solely with banks with an excellent credit rating.<br />

Transactions by the Corporate Treasury and Finance department<br />

are only conducted with banks approved by the Executive<br />

Board. Th e nominal volume is the total of all underlying buying<br />

and selling amounts.<br />

objectives and strategies in connection with the various hedges.<br />

Th is method includes linking all derivatives used for hedging<br />

purposes to the underlying assets, liabilities, fi rm commitments<br />

and forecasted transactions. Furthermore, the Bertelsmann<br />

Group assesses and documents the degree to which changes<br />

in the fair values or cash fl ows of hedged items are eff ectively<br />

off set by changes in the corresponding hedging instruments,<br />

both when the hedges are initiated and on an ongoing basis.<br />

Th e majority of the fi nancial derivatives at the balance sheet<br />

date are used to hedge against exchange rate risks from the<br />

Group’s internal fi nancing (54 percent). Financial derivatives<br />

used to hedge currency risks from operating business totaled<br />

€506 million (25 percent) on the balance sheet date. Financial<br />

derivatives are also used to hedge against interest rate risks<br />

from fi nancial debt. No fi nancial derivatives were purchased<br />

for speculative purposes.<br />

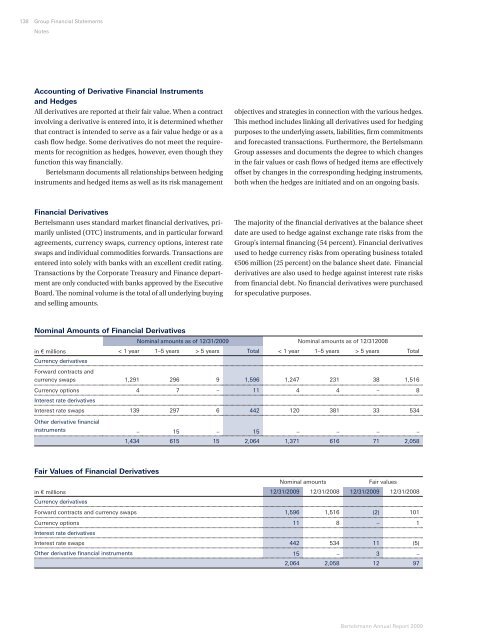

Nominal Amounts of Financial Derivatives<br />

Nominal amounts as of 12/31/2009 Nominal amounts as of 12/312008<br />

in € millions<br />

Currency derivatives<br />

Forward contracts and<br />

< 1 year 1–5 years > 5 years Total < 1 year 1–5 years > 5 years Total<br />

currency swaps 1,291 296 9 1,596 1,247 231 38 1,516<br />

Currency options<br />

Interest rate derivatives<br />

4 7 – 11 4 4 – 8<br />

Interest rate swaps 139 297 6 442 120 381 33 534<br />

Other derivative fi nancial<br />

instruments – 15 – 15 – – – –<br />

1,434 615 15 2,064 1,371 616 71 2,058<br />

Fair <strong>Values</strong> of Financial Derivatives<br />

Nominal amounts Fair values<br />

in € millions<br />

Currency derivatives<br />

12/31/2009 12/31/2008 12/31/2009 12/31/2008<br />

Forward contracts and currency swaps 1,596 1,516 (2) 101<br />

Currency options<br />

Interest rate derivatives<br />

11 8 – 1<br />

Interest rate swaps 442 534 11 (5)<br />

Other derivative fi nancial instruments 15 – 3 –<br />

2,064 2,058 12 97<br />

Bertelsmann Annual Report 2009