Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

112<br />

Group Financial Statements<br />

Notes<br />

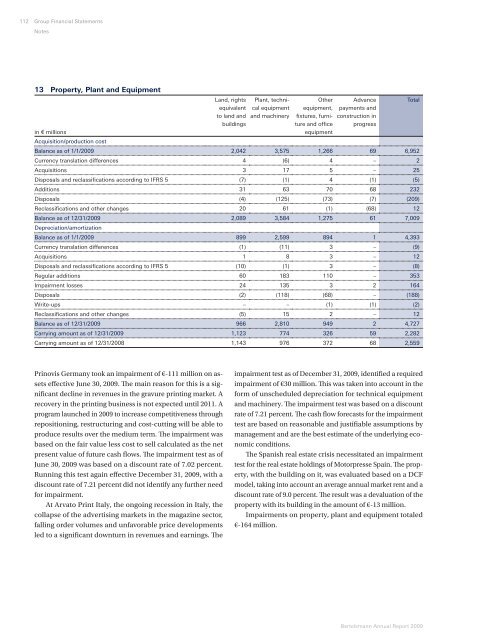

13 Property, Plant and Equipment<br />

Land, rights Plant, techni-<br />

Other Advance<br />

Total<br />

equivalent cal equipment equipment, payments and<br />

to land and and machinery fi xtures, furni- construction in<br />

buildings<br />

ture and offi ce progress<br />

in € millions<br />

Acquisition/production cost<br />

equipment<br />

Balance as of 1/1/2009 2,042 3,575 1,266 69 6,952<br />

Currency translation differences 4 (6) 4 – 2<br />

Acquisitions 3 17 5 – 25<br />

Disposals and reclassifi cations according to IFRS 5 (7) (1) 4 (1) (5)<br />

Additions 31 63 70 68 232<br />

Disposals (4) (125) (73) (7) (209)<br />

Reclassifi cations and other changes 20 61 (1) (68) 12<br />

Balance as of 12/31/2009<br />

Depreciation/amortization<br />

2,089 3,584 1,275 61 7,009<br />

Balance as of 1/1/2009 899 2,599 894 1 4,393<br />

Currency translation differences (1) (11) 3 – (9)<br />

Acquisitions 1 8 3 – 12<br />

Disposals and reclassifi cations according to IFRS 5 (10) (1) 3 – (8)<br />

Regular additions 60 183 110 – 353<br />

Impairment losses 24 135 3 2 164<br />

Disposals (2) (118) (68) – (188)<br />

Write-ups – – (1) (1) (2)<br />

Reclassifi cations and other changes (5) 15 2 – 12<br />

Balance as of 12/31/2009 966 2,810 949 2 4,727<br />

Carrying amount as of 12/31/2009 1,123 774 326 59 2,282<br />

Carrying amount as of 12/31/2008 1,143 976 372 68 2,559<br />

Prinovis Germany took an impairment of €-111 million on assets<br />

eff ective June 30, 2009. Th e main reason for this is a signifi<br />

cant decline in revenues in the gravure printing market. A<br />

recovery in the printing business is not expected until 2011. A<br />

program launched in 2009 to increase competitiveness through<br />

repositioning, restructuring and cost-cutting will be able to<br />

produce results over the medium term. Th e impairment was<br />

based on the fair value less cost to sell calculated as the net<br />

present value of future cash fl ows. Th e impairment test as of<br />

June 30, 2009 was based on a discount rate of 7.02 percent.<br />

Running this test again eff ective December 31, 2009, with a<br />

discount rate of 7.21 percent did not identify any further need<br />

for impairment.<br />

At Arvato Print Italy, the ongoing recession in Italy, the<br />

collapse of the advertising markets in the magazine sector,<br />

falling order volumes and unfavorable price developments<br />

led to a signifi cant downturn in revenues and earnings. Th e<br />

impairment test as of December 31, 2009, identifi ed a required<br />

impairment of €30 million. Th is was taken into account in the<br />

form of unscheduled depreciation for technical equipment<br />

and machinery. Th e impairment test was based on a discount<br />

rate of 7.21 percent. Th e cash fl ow forecasts for the impairment<br />

test are based on reasonable and justifi able assumptions by<br />

management and are the best estimate of the underlying economic<br />

conditions.<br />

Th e Spanish real estate crisis necessitated an impairment<br />

test for the real estate holdings of Motorpresse Spain. Th e property,<br />

with the building on it, was evaluated based on a DCF<br />

model, taking into account an average annual market rent and a<br />

discount rate of 9.0 percent. Th e result was a devaluation of the<br />

property with its building in the amount of €-13 million.<br />

Impairments on property, plant and equipment totaled<br />

€-164 million.<br />

Bertelsmann Annual Report 2009