Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company | Group Management Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

Income Statement<br />

Statement of Comprehensive Income<br />

Balance Sheet<br />

Cash Flow Statement<br />

Statement of Changes in Equity<br />

Notes<br />

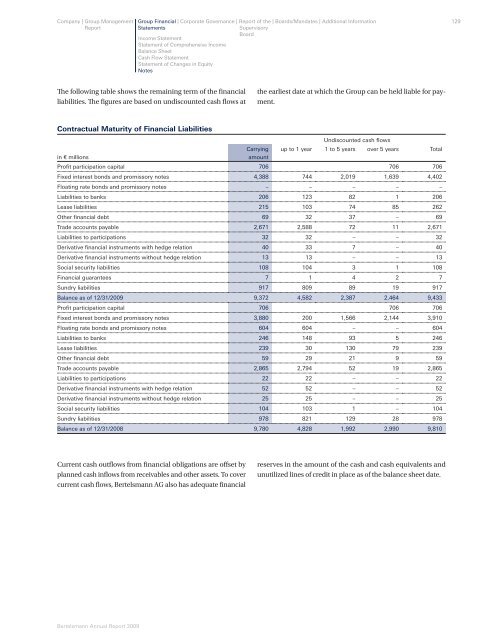

Th e following table shows the remaining term of the fi nancial<br />

liabilities. Th e fi gures are based on undiscounted cash fl ows at<br />

Contractual Maturity of Financial Liabilities<br />

Current cash outfl ows from fi nancial obligations are off set by<br />

planned cash infl ows from receivables and other assets. To cover<br />

current cash fl ows, Bertelsmann AG also has adequate fi nancial<br />

Bertelsmann Annual Report 2009<br />

the earliest date at which the Group can be held liable for payment.<br />

Undiscounted cash fl ows<br />

Carrying up to 1 year 1 to 5 years over 5 years Total<br />

in € millions<br />

amount<br />

Profi t participation capital 706 706 706<br />

Fixed interest bonds and promissory notes 4,388 744 2,019 1,639 4,402<br />

Floating rate bonds and promissory notes – – – – –<br />

Liabilities to banks 206 123 82 1 206<br />

Lease liabilities 215 103 74 85 262<br />

Other fi nancial debt 69 32 37 – 69<br />

Trade accounts payable 2,671 2,588 72 11 2,671<br />

Liabilities to participations 32 32 – – 32<br />

Derivative fi nancial instruments with hedge relation 40 33 7 – 40<br />

Derivative fi nancial instruments without hedge relation 13 13 – – 13<br />

Social security liabilities 108 104 3 1 108<br />

Financial guarantees 7 1 4 2 7<br />

Sundry liabilities 917 809 89 19 917<br />

Balance as of 12/31/2009 9,372 4,582 2,387 2,464 9,433<br />

Profi t participation capital 706 706 706<br />

Fixed interest bonds and promissory notes 3,880 200 1,566 2,144 3,910<br />

Floating rate bonds and promissory notes 604 604 – – 604<br />

Liabilities to banks 246 148 93 5 246<br />

Lease liabilities 239 30 130 79 239<br />

Other fi nancial debt 59 29 21 9 59<br />

Trade accounts payable 2,865 2,794 52 19 2,865<br />

Liabilities to participations 22 22 – – 22<br />

Derivative fi nancial instruments with hedge relation 52 52 – – 52<br />

Derivative fi nancial instruments without hedge relation 25 25 – – 25<br />

Social security liabilities 104 103 1 – 104<br />

Sundry liabilities 978 821 129 28 978<br />

Balance as of 12/31/2008 9,780 4,828 1,992 2,990 9,810<br />

reserves in the amount of the cash and cash equivalents and<br />

unutilized lines of credit in place as of the balance sheet date.<br />

129