Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company | Group Management Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

Income Statement<br />

Statement of Comprehensive Income<br />

Balance Sheet<br />

Cash Flow Statement<br />

Statement of Changes in Equity<br />

Notes<br />

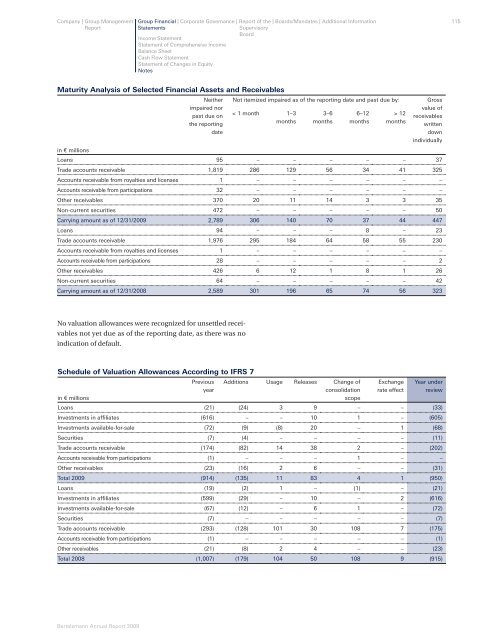

Maturity Analysis of Selected Financial Assets and Receivables<br />

Not itemized impaired as of the reporting date and past due by: Gross<br />

Neither<br />

impaired nor<br />

past due on<br />

the reporting<br />

< 1 month 1–3<br />

months<br />

3–6<br />

months<br />

6–12<br />

months<br />

> 12<br />

months<br />

value of<br />

receivables<br />

written<br />

date<br />

down<br />

individually<br />

in € millions<br />

Loans 95 – – – – – 37<br />

Trade accounts receivable 1,819 286 129 56 34 41 325<br />

Accounts receivable from royalties and licenses 1 – – – – – –<br />

Accounts receivable from participations 32 – – – – – –<br />

Other receivables 370 20 11 14 3 3 35<br />

Non-current securities 472 – – – – – 50<br />

Carrying amount as of 12/31/2009 2,789 306 140 70 37 44 447<br />

Loans 94 – – – 8 – 23<br />

Trade accounts receivable 1,976 295 184 64 58 55 230<br />

Accounts receivable from royalties and licenses 1 – – – – – –<br />

Accounts receivable from participations 28 – – – – – 2<br />

Other receivables 426 6 12 1 8 1 26<br />

Non-current securities 64 – – – – – 42<br />

Carrying amount as of 12/31/2008 2,589 301 196 65 74 56 323<br />

No valuation allowances were recognized for unsettled receivables<br />

not yet due as of the reporting date, as there was no<br />

indication of default.<br />

Schedule of Valuation Allowances According to IFRS 7<br />

Previous Additions Usage Releases Change of Exchange Year under<br />

year<br />

consolidation rate effect review<br />

in € millions<br />

scope<br />

Loans (21) (24) 3 9 – – (33)<br />

Investments in affi liates (616) – – 10 1 – (605)<br />

Investments available-for-sale (72) (9) (8) 20 – 1 (68)<br />

Securities (7) (4) – – – – (11)<br />

Trade accounts receivable (174) (82) 14 38 2 – (202)<br />

Accounts receivable from participations (1) – – – 1 – –<br />

Other receivables (23) (16) 2 6 – – (31)<br />

Total 2009 (914) (135) 11 83 4 1 (950)<br />

Loans (19) (2) 1 – (1) – (21)<br />

Investments in affi liates (599) (29) – 10 – 2 (616)<br />

Investments available-for-sale (67) (12) – 6 1 – (72)<br />

Securities (7) – – – – – (7)<br />

Trade accounts receivable (293) (128) 101 30 108 7 (175)<br />

Accounts receivable from participations (1) – – – – – (1)<br />

Other receivables (21) (8) 2 4 – – (23)<br />

Total 2008 (1,007) (179) 104 50 108 9 (915)<br />

Bertelsmann Annual Report 2009<br />

115