Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

102<br />

Group Financial Statements<br />

Notes<br />

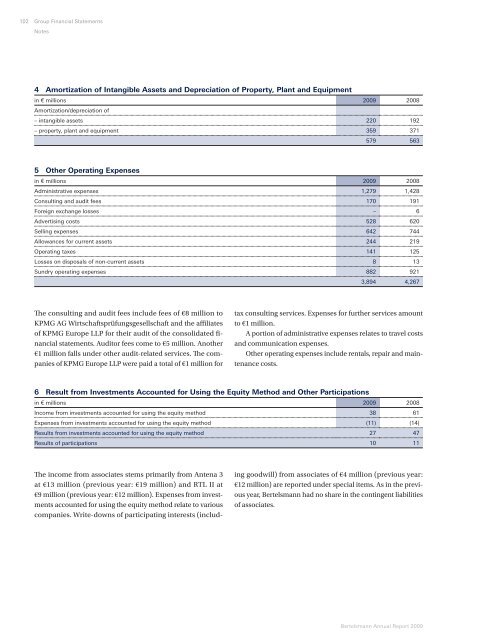

4 Amortization of Intangible Assets and Depreciation of Property, Plant and Equipment<br />

in € millions<br />

Amortization/depreciation of<br />

2009 2008<br />

– intangible assets 220 192<br />

– property, plant and equipment 359 371<br />

579 563<br />

5 Other Operating Expenses<br />

in € millions 2009 2008<br />

Administrative expenses 1,279 1,428<br />

Consulting and audit fees 170 191<br />

Foreign exchange losses – 6<br />

Advertising costs 528 620<br />

Selling expenses 642 744<br />

Allowances for current assets 244 219<br />

Operating taxes 141 125<br />

Losses on disposals of non-current assets 8 13<br />

Sundry operating expenses 882 921<br />

3,894 4,267<br />

Th e consulting and audit fees include fees of €8 million to<br />

KPMG AG Wirtschaftsprüfungsgesellschaft and the affi liates<br />

of KPMG Europe LLP for their audit of the consolidated fi -<br />

nancial statements. Auditor fees come to €5 million. Another<br />

€1 million falls under other audit-related services. Th e companies<br />

of KPMG Europe LLP were paid a total of €1 million for<br />

tax consulting services. Expenses for further services amount<br />

to €1 million.<br />

A portion of administrative expenses relates to travel costs<br />

and communication expenses.<br />

Other operating expenses include rentals, repair and maintenance<br />

costs.<br />

6 Result from Investments Accounted for Using the Equity Method and Other Participations<br />

in € millions 2009 2008<br />

Income from investments accounted for using the equity method 38 61<br />

Expenses from investments accounted for using the equity method (11) (14)<br />

Results from investments accounted for using the equity method 27 47<br />

Results of participations 10 11<br />

Th e income from associates stems primarily from Antena 3<br />

at €13 million (previous year: €19 million) and RTL II at<br />

€9 million (previous year: €12 million). Expenses from investments<br />

accounted for using the equity method relate to various<br />

companies. Write-downs of participating interests (includ-<br />

ing goodwill) from associates of €4 million (previous year:<br />

€12 million) are reported under special items. As in the previous<br />

year, Bertelsmann had no share in the contingent liabilities<br />

of associates.<br />

Bertelsmann Annual Report 2009