Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company | Group Management Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

Income Statement<br />

Statement of Comprehensive Income<br />

Balance Sheet<br />

Cash Flow Statement<br />

Statement of Changes in Equity<br />

Notes<br />

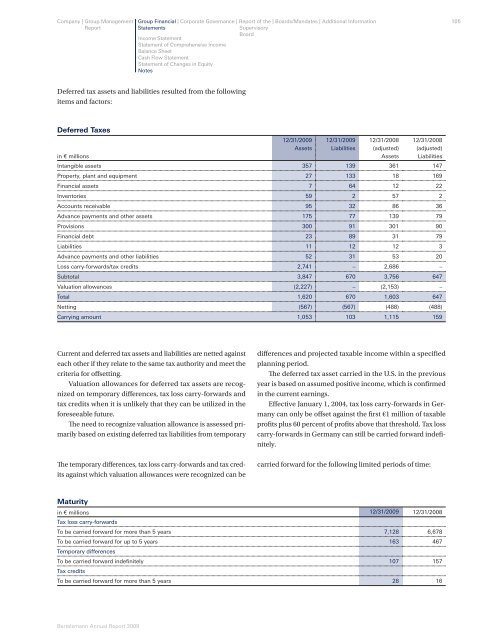

Deferred tax assets and liabilities resulted from the following<br />

items and factors:<br />

Deferred Taxes<br />

12/31/2009 12/31/2009 12/31/2008 12/31/2008<br />

Assets Liabilities (adjusted) (adjusted)<br />

in € millions<br />

Assets Liabilities<br />

Intangible assets 357 139 361 147<br />

Property, plant and equipment 27 133 18 169<br />

Financial assets 7 64 12 22<br />

Inventories 59 2 57 2<br />

Accounts receivable 95 32 86 36<br />

Advance payments and other assets 175 77 139 79<br />

Provisions 300 91 301 90<br />

Financial debt 23 89 31 79<br />

Liabilities 11 12 12 3<br />

Advance payments and other liabilities 52 31 53 20<br />

Loss carry-forwards/tax credits 2,741 – 2,686 –<br />

Subtotal 3,847 670 3,756 647<br />

Valuation allowances (2,227) – (2,153) –<br />

Total 1,620 670 1,603 647<br />

Netting (567) (567) (488) (488)<br />

Carrying amount 1,053 103 1,115 159<br />

Current and deferred tax assets and liabilities are netted against<br />

each other if they relate to the same tax authority and meet the<br />

criteria for off setting.<br />

Valuation allowances for deferred tax assets are recognized<br />

on temporary diff erences, tax loss carry-forwards and<br />

tax credits when it is unlikely that they can be utilized in the<br />

foreseeable future.<br />

Th e need to recognize valuation allowance is assessed primarily<br />

based on existing deferred tax liabilities from temporary<br />

Th e temporary diff erences, tax loss carry-forwards and tax credits<br />

against which valuation allowances were recognized can be<br />

Bertelsmann Annual Report 2009<br />

diff erences and projected taxable income within a specifi ed<br />

planning period.<br />

Th e deferred tax asset carried in the U.S. in the previous<br />

year is based on assumed positive income, which is confi rmed<br />

in the current earnings.<br />

Eff ective January 1, 2004, tax loss carry-forwards in Germany<br />

can only be off set against the fi rst €1 million of taxable<br />

profi ts plus 60 percent of profi ts above that threshold. Tax loss<br />

carry-forwards in Germany can still be carried forward indefi -<br />

nitely.<br />

carried forward for the following limited periods of time:<br />

Maturity<br />

in € millions<br />

Tax loss carry-forwards<br />

12/31/2009 12/31/2008<br />

To be carried forward for more than 5 years 7,128 6,678<br />

To be carried forward for up to 5 years<br />

Temporary differences<br />

163 467<br />

To be carried forward indefi nitely<br />

Tax credits<br />

107 157<br />

To be carried forward for more than 5 years 28 16<br />

105