Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

120<br />

Group Financial Statements<br />

Notes<br />

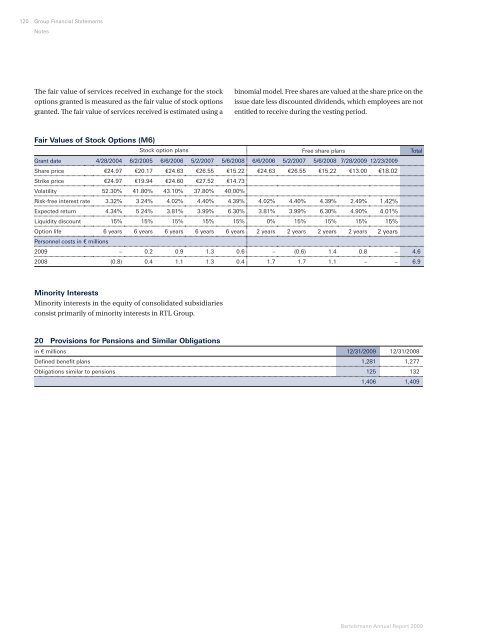

Th e fair value of services received in exchange for the stock<br />

options granted is measured as the fair value of stock options<br />

granted. Th e fair value of services received is estimated using a<br />

Fair <strong>Values</strong> of Stock Options (M6)<br />

Stock option plans Free share plans Total<br />

Grant date 4/28/2004 6/2/2005 6/6/2006 5/2/2007 5/6/2008 6/6/2006 5/2/2007 5/6/2008 7/28/2009 12/23/2009<br />

Share price €24.97 €20.17 €24.63 €26.55 €15.22 €24.63 €26.55 €15.22 €13.00 €18.02<br />

Strike price €24.97 €19.94 €24.60 €27.52 €14.73<br />

Volatility 52.30% 41.80% 43.10% 37.80% 40.00%<br />

Risk-free interest rate 3.32% 3.24% 4.02% 4.40% 4.39% 4.02% 4.40% 4.39% 2.49% 1.42%<br />

Expected return 4.34% 5.24% 3.81% 3.99% 6.30% 3.81% 3.99% 6.30% 4.90% 4.01%<br />

Liquidity discount 15% 15% 15% 15% 15% 0% 15% 15% 15% 15%<br />

Option life 6 years 6 years 6 years 6 years 6 years 2 years 2 years 2 years 2 years 2 years<br />

Personnel costs in € millions<br />

2009 – 0.2 0.9 1.3 0.6 – (0.6) 1.4 0.8 – 4.6<br />

2008 (0.8) 0.4 1.1 1.3 0.4 1.7 1.7 1.1 – – 6.9<br />

Minority Interests<br />

Minority interests in the equity of consolidated subsidiaries<br />

consist primarily of minority interests in RTL Group.<br />

binomial model. Free shares are valued at the share price on the<br />

issue date less discounted dividends, which employees are not<br />

entitled to receive during the vesting period.<br />

20 Provisions for Pensions and Similar Obligations<br />

in € millions 12/31/2009 12/31/2008<br />

Defi ned benefi t plans 1,281 1,277<br />

Obligations similar to pensions 125 132<br />

1,406 1,409<br />

Bertelsmann Annual Report 2009