Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

128<br />

Group Financial Statements<br />

Notes<br />

Th e documentation for the bond off ering by Bertelsmann U.S.<br />

Finance LLC and Bertelsmann AG in 2005 and 2009 is within<br />

the framework of a base documentation for debt issuance programs.<br />

Th e bonds issued by Bertelsmann AG in 2006 and 2007, the<br />

U.S. private placements and the promissory note loans were issued<br />

on the basis of separate documentation. Th e bonds have a<br />

rating of “BBB” (Standard & Poor’s) and “Baa2” (Moody’s).<br />

Th e debt issuance program which was launched in 2008<br />

was updated in April 2009. Th e framework documentation<br />

allows Bertelsmann AG and Bertelsmann U.S. Finance LLC<br />

to place bonds with a total volume of up to €4 billion on the<br />

capital market.<br />

Documented hedging relationships between bonds and<br />

interest rate swaps per IAS 39 were dissolved in the preceding<br />

years.<br />

Th e fair value of the bonds was last assessed when the hedging<br />

relationships were dissolved. Th e diff erence between the<br />

nominal volume and the latest fair value will be amortized over<br />

the residual term of the respective instruments. Amortization<br />

resulted in carrying amount increases of €8 million in the year<br />

under review (previous year: €8 million). Similarly, the transaction<br />

costs and discounts or premiums will also be reversed to<br />

interest income over the remaining term and change the carrying<br />

amount of the bonds. Transaction costs, discounts and<br />

premiums resulted in a diff erence to the nominal volume of<br />

€-14 million at year-end (previous year: €-18 million).<br />

Th e fair values of the issued bonds are generally determined<br />

on the basis of their quoted market price at the respective<br />

reporting dates. At December 31, 2009, the listed bonds<br />

had a cumulative fair value of €3,539 million (previous year:<br />

€3,288 million), a nominal volume of €3,425 million (previous<br />

year: €3,554 million) and a carrying amount of €3,414 million<br />

(previous year: €3,529 million). Th e quoted prices applied in<br />

determining the fair values are shown in the table below.<br />

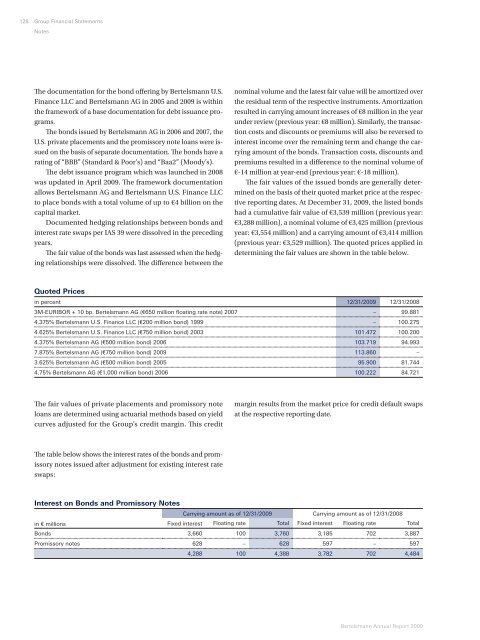

Quoted Prices<br />

in percent 12/31/2009 12/31/2008<br />

3M-EURIBOR + 10 bp. Bertelsmann AG (€650 million fl oating rate note) 2007 – 99.881<br />

4.375% Bertelsmann U.S. Finance LLC (€200 million bond) 1999 – 100.275<br />

4.625% Bertelsmann U.S. Finance LLC (€750 million bond) 2003 101.472 100.200<br />

4.375% Bertelsmann AG (€500 million bond) 2006 103.719 94.993<br />

7.875% Bertelsmann AG (€750 million bond) 2009 113.860 –<br />

3.625% Bertelsmann AG (€500 million bond) 2005 95.900 81.744<br />

4.75% Bertelsmann AG (€1,000 million bond) 2006 100.222 84.721<br />

Th e fair values of private placements and promissory note<br />

loans are determined using actuarial methods based on yield<br />

curves adjusted for the Group’s credit margin. Th is credit<br />

Th e table below shows the interest rates of the bonds and promissory<br />

notes issued after adjustment for existing interest rate<br />

swaps:<br />

margin results from the market price for credit default swaps<br />

at the respective reporting date.<br />

Interest on Bonds and Promissory Notes<br />

Carrying amount as of 12/31/2009 Carrying amount as of 12/31/2008<br />

in € millions Fixed interest Floating rate Total Fixed interest Floating rate Total<br />

Bonds 3,660 100 3,760 3,185 702 3,887<br />

Promissory notes 628 – 628 597 – 597<br />

4,288 100 4,388 3,782 702 4,484<br />

Bertelsmann Annual Report 2009