Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company | Group Management Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

Income Statement<br />

Statement of Comprehensive Income<br />

Balance Sheet<br />

Cash Flow Statement<br />

Statement of Changes in Equity<br />

Notes<br />

Phase 1: Th e fair value of the existing fi nancial derivatives is<br />

determined on the basis of stock exchange listings at the balance<br />

sheet date.<br />

Phase 2: To determine the fair values of unlisted derivatives,<br />

Bertelsmann uses various fi nancial methods refl ecting<br />

the prevailing market conditions and risks at the respective<br />

balance sheet date. Irrespective of the type of fi nancial instrument,<br />

future cash fl ows are discounted as of the balance sheet<br />

date based on the prevailing market interest rates and interest<br />

rate structure curves on the balance sheet date.<br />

Th e fair value of forward exchange transactions is calculated<br />

using the average spot prices as of the balance sheet date and<br />

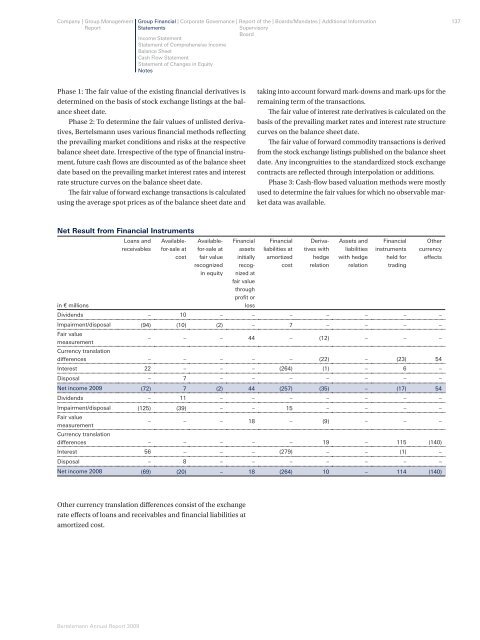

Net Result from Financial Instruments<br />

Loans and AvailableAvailable- Financial Financial Deriva- Assets and Financial Other<br />

receivables for-sale at for-sale at assets liabilities at tives with liabilities instruments currency<br />

cost fair value initially amortized hedge with hedge held for effects<br />

recognized recog- cost relation relation trading<br />

in equity nized at<br />

fair value<br />

through<br />

profit or<br />

in € millions<br />

loss<br />

Dividends – 10 – – – – – – –<br />

Impairment/disposal (94) (10) (2) – 7 – – – –<br />

Fair value<br />

measurement<br />

Currency translation<br />

– – – 44 – (12) – – –<br />

differences – – – – – (22) – (23) 54<br />

Interest 22 – – – (264) (1) – 6 –<br />

Disposal – 7 – – – – – – –<br />

Net income 2009 (72) 7 (2) 44 (257) (35) – (17) 54<br />

Dividends – 11 – – – – – – –<br />

Impairment/disposal (125) (39) – – 15 – – – –<br />

Fair value<br />

measurement<br />

Currency translation<br />

– – – 18 – (9) – – –<br />

differences – – – – – 19 – 115 (140)<br />

Interest 56 – – – (279) – – (1) –<br />

Disposal – 8 – – – – – – –<br />

Net income 2008 (69) (20) – 18 (264) 10 – 114 (140)<br />

Other currency translation diff erences consist of the exchange<br />

rate eff ects of loans and receivables and fi nancial liabilities at<br />

amortized cost.<br />

Bertelsmann Annual Report 2009<br />

taking into account forward mark-downs and mark-ups for the<br />

remaining term of the transactions.<br />

Th e fair value of interest rate derivatives is calculated on the<br />

basis of the prevailing market rates and interest rate structure<br />

curves on the balance sheet date.<br />

Th e fair value of forward commodity transactions is derived<br />

from the stock exchange listings published on the balance sheet<br />

date. Any incongruities to the standardized stock exchange<br />

contracts are refl ected through interpolation or additions.<br />

Phase 3: Cash-fl ow based valuation methods were mostly<br />

used to determine the fair values for which no observable market<br />

data was available.<br />

137