Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

104<br />

Group Financial Statements<br />

Notes<br />

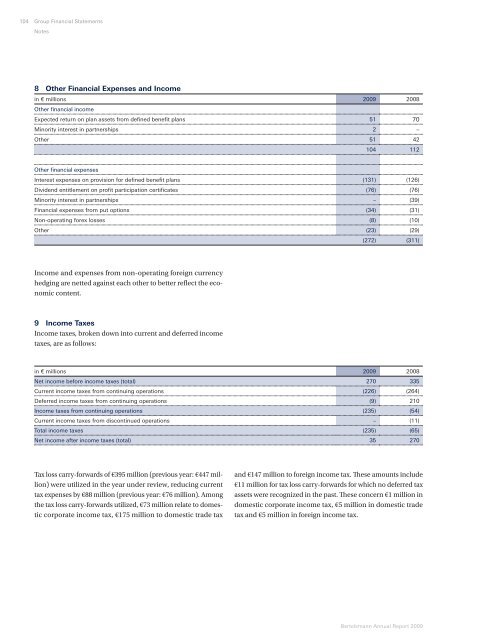

8 Other Financial Expenses and Income<br />

in € millions<br />

Other fi nancial income<br />

2009 2008<br />

Expected return on plan assets from defi ned benefi t plans 51 70<br />

Minority interest in partnerships 2 –<br />

Other 51 42<br />

104 112<br />

Other fi nancial expenses<br />

Interest expenses on provision for defi ned benefi t plans (131) (126)<br />

Dividend entitlement on profi t participation certifi cates (76) (76)<br />

Minority interest in partnerships – (39)<br />

Financial expenses from put options (34) (31)<br />

Non-operating forex losses (8) (10)<br />

Other (23) (29)<br />

(272) (311)<br />

Income and expenses from non-operating foreign currency<br />

hedging are netted against each other to better refl ect the economic<br />

content.<br />

9 Income Taxes<br />

Income taxes, broken down into current and deferred income<br />

taxes, are as follows:<br />

in € millions 2009 2008<br />

Net income before income taxes (total) 270 335<br />

Current income taxes from continuing operations (226) (264)<br />

Deferred income taxes from continuing operations (9) 210<br />

Income taxes from continuing operations (235) (54)<br />

Current income taxes from discontinued operations – (11)<br />

Total income taxes (235) (65)<br />

Net income after income taxes (total) 35 270<br />

Tax loss carry-forwards of €395 million (previous year: €447 million)<br />

were utilized in the year under review, reducing current<br />

tax expenses by €88 million (previous year: €76 million). Among<br />

the tax loss carry-forwards utilized, €73 million relate to domestic<br />

corporate income tax, €175 million to domestic trade tax<br />

and €147 million to foreign income tax. Th ese amounts include<br />

€11 million for tax loss carry-forwards for which no deferred tax<br />

assets were recognized in the past. Th ese concern €1 million in<br />

domestic corporate income tax, €5 million in domestic trade<br />

tax and €5 million in foreign income tax.<br />

Bertelsmann Annual Report 2009